Tax Organizer For Corporations, S Corporations, Partnerships & Limited Liability Corporations (Or Partnerships) Page 3

ADVERTISEMENT

**NOTE: If Intuit QuickBooks software is used, we prefer to receive a backup version of the

current fiscal year end. Please note that the bank and credit card accounts should be reconciled

using the reconciliation function in QuickBooks prior to us receiving the backup.

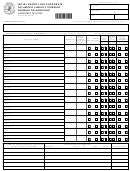

Schedule of federal estimated tax payments:

Payment

Date Paid

Amount Paid

First Quarter Estimated

Second Quarter Estimated

Third Quarter Estimated

Fourth Quarter Estimated

Extension

Additional Payment(s)

Additional Payment(s)

INCOME AND DEDUCTIONS

Please provide the following information:

Done

N/A

1. Form 1099s filed (please let us know if 1099’s have NOT been filed)

2. Form 1099s or Schedule K-1s received

3. Schedule of LIFO and/or UNICAP inventory calculations, if applicable.

4. Depreciation schedules (federal asset depreciation report) for book, tax, AMT, ACE, and

state purposes, including a rollforward of additions and disposals and a calculation of

current-year expense.

5. For property acquired: description of property, date of acquisition, purchase price, and

trade-in allowances. The property invoice, or purchase document is acceptable.

6. For property disposed of: description of property; calculation of book, tax, AMT, ACE, and

state gain (loss); date of acquisition and disposition; cost and sales proceeds;

accumulated depreciation; and trade-in allowance.

7. For domestic production activities deduction: domestic production gross receipts,

qualified production activities income, and qualified W-2 wages, including amounts from

Schedule K-1s received.

8. For multi-state business operations; provide state allocations for income, salaries/wages,

and fixed assets.

9. Foreign income, expenses, and foreign taxes paid.

10. Fringe benefits provided or paid to partners or more than 2% S corporation shareholders,

including amounts treated as guaranteed payments or wages. These include, but are not

limited to, health insurance premiums, life insurance premiums, housing/auto allowances,

and pension schemes.

11. Indicate whether fringe benefits provided or paid to partners or more than 2% S

Corporation shareholders were included in W2 wages, if applicable.

Charitable contributions using the following format: please use blank document for further space

Tax Organizer

(Cont)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4