Long Form: Property Tax Exemption For Seniors

ADVERTISEMENT

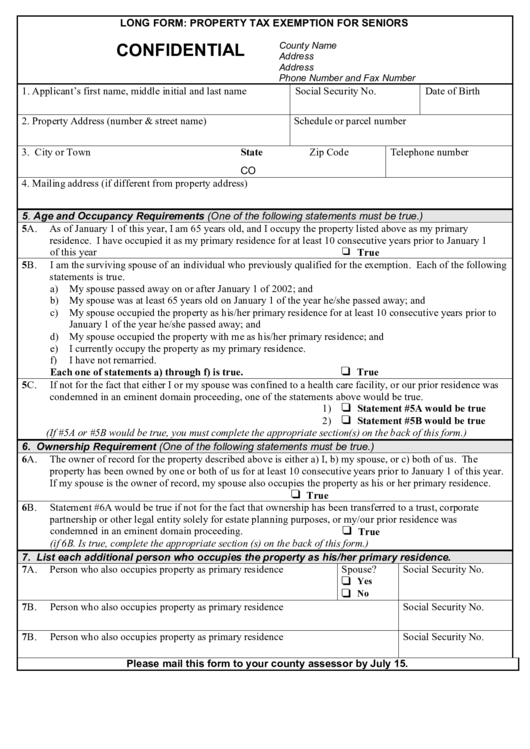

LONG FORM: PROPERTY TAX EXEMPTION FOR SENIORS

CONFIDENTIAL

County Name

Address

Address

Phone Number and Fax Number

1. Applicant’s first name, middle initial and last name

Social Security No.

Date of Birth

2. Property Address (number & street name)

Schedule or parcel number

3. City or Town

State

Zip Code

Telephone number

CO

4. Mailing address (if different from property address)

5. Age and Occupancy Requirements (One of the following statements must be true.)

5A.

As of January 1 of this year, I am 65 years old, and I occupy the property listed above as my primary

residence. I have occupied it as my primary residence for at least 10 consecutive years prior to January 1

of this year

True

5B.

I am the surviving spouse of an individual who previously qualified for the exemption. Each of the following

statements is true.

a)

My spouse passed away on or after January 1 of 2002; and

b) My spouse was at least 65 years old on January 1 of the year he/she passed away; and

c)

My spouse occupied the property as his/her primary residence for at least 10 consecutive years prior to

January 1 of the year he/she passed away; and

d) My spouse occupied the property with me as his/her primary residence; and

e)

I currently occupy the property as my primary residence.

f)

I have not remarried.

Each one of statements a) through f) is true.

True

5C.

If not for the fact that either I or my spouse was confined to a health care facility, or our prior residence was

condemned in an eminent domain proceeding, one of the statements above would be true.

1)

Statement #5A would be true

2)

Statement #5B would be true

(If #5A or #5B would be true, you must complete the appropriate section(s) on the back of this form.)

6. Ownership Requirement (One of the following statements must be true.)

6A.

The owner of record for the property described above is either a) I, b) my spouse, or c) both of us. The

property has been owned by one or both of us for at least 10 consecutive years prior to January 1 of this year.

If my spouse is the owner of record, my spouse also occupies the property as his or her primary residence.

True

6B.

Statement #6A would be true if not for the fact that ownership has been transferred to a trust, corporate

partnership or other legal entity solely for estate planning purposes, or my/our prior residence was

condemned in an eminent domain proceeding.

True

(if 6B. Is true, complete the appropriate section (s) on the back of this form.)

7. List each additional person who occupies the property as his/her primary residence.

7A.

Person who also occupies property as primary residence

Spouse?

Social Security No.

Yes

No

7B.

Person who also occupies property as primary residence

Social Security No.

7B.

Person who also occupies property as primary residence

Social Security No.

Please mail this form to your county assessor by July 15.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2