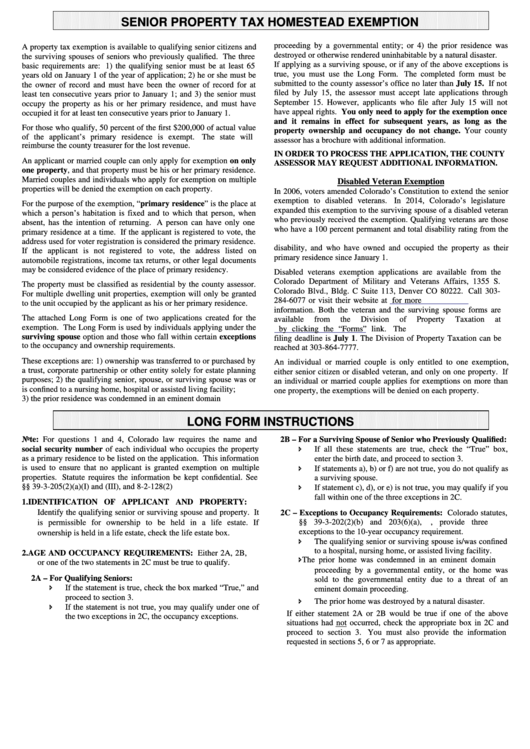

SENIOR PROPERTY TAX HOMESTEAD EXEMPTION

proceeding by a governmental entity; or 4) the prior residence was

A property tax exemption is available to qualifying senior citizens and

destroyed or otherwise rendered uninhabitable by a natural disaster.

the surviving spouses of seniors who previously qualified. The three

If applying as a surviving spouse, or if any of the above exceptions is

basic requirements are: 1) the qualifying senior must be at least 65

true, you must use the Long Form. The completed form must be

years old on January 1 of the year of application; 2) he or she must be

submitted to the county assessor’s office no later than July 15. If not

the owner of record and must have been the owner of record for at

filed by July 15, the assessor must accept late applications through

least ten consecutive years prior to January 1; and 3) the senior must

September 15. However, applicants who file after July 15 will not

occupy the property as his or her primary residence, and must have

have appeal rights. You only need to apply for the exemption once

occupied it for at least ten consecutive years prior to January 1.

and it remains in effect for subsequent years, as long as the

For those who qualify, 50 percent of the first $200,000 of actual value

property ownership and occupancy do not change. Your county

of the applicant’s primary residence is exempt.

The state will

assessor has a brochure with additional information.

reimburse the county treasurer for the lost revenue.

IN ORDER TO PROCESS THE APPLICATION, THE COUNTY

An applicant or married couple can only apply for exemption on only

ASSESSOR MAY REQUEST ADDITIONAL INFORMATION.

one property, and that property must be his or her primary residence.

Married couples and individuals who apply for exemption on multiple

Disabled Veteran Exemption

properties will be denied the exemption on each property.

In 2006, voters amended Colorado’s Constitution to extend the senior

exemption to disabled veterans.

In 2014, Colorado’s legislature

For the purpose of the exemption, “primary residence” is the place at

expanded this exemption to the surviving spouse of a disabled veteran

which a person’s habitation is fixed and to which that person, when

who previously received the exemption. Qualifying veterans are those

absent, has the intention of returning. A person can have only one

who have a 100 percent permanent and total disability rating from the

primary residence at a time. If the applicant is registered to vote, the

U.S. Department of Veterans Affairs as a result of a service-connected

address used for voter registration is considered the primary residence.

disability, and who have owned and occupied the property as their

If the applicant is not registered to vote, the address listed on

primary residence since January 1.

automobile registrations, income tax returns, or other legal documents

may be considered evidence of the place of primary residency.

Disabled veterans exemption applications are available from the

Colorado Department of Military and Veterans Affairs, 1355 S.

The property must be classified as residential by the county assessor.

Colorado Blvd., Bldg. C Suite 113, Denver CO 80222. Call 303-

For multiple dwelling unit properties, exemption will only be granted

284-6077 or visit their website at

for more

to the unit occupied by the applicant as his or her primary residence.

information. Both the veteran and the surviving spouse forms are

The attached Long Form is one of two applications created for the

available

from

the

Division

of

Property

Taxation

at

exemption. The Long Form is used by individuals applying under the

by clicking the “Forms” link.

The

surviving spouse option and those who fall within certain exceptions

filing deadline is July 1. The Division of Property Taxation can be

to the occupancy and ownership requirements.

reached at 303-864-7777.

These exceptions are: 1) ownership was transferred to or purchased by

An individual or married couple is only entitled to one exemption,

a trust, corporate partnership or other entity solely for estate planning

either senior citizen or disabled veteran, and only on one property. If

purposes; 2) the qualifying senior, spouse, or surviving spouse was or

an individual or married couple applies for exemptions on more than

is confined to a nursing home, hospital or assisted living facility;

one property, the exemptions will be denied on each property.

3) the prior residence was condemned in an eminent domain

LONG FORM INSTRUCTIONS

Note: For questions 1 and 4, Colorado law requires the name and

2B – For a Surviving Spouse of Senior who Previously Qualified:

social security number of each individual who occupies the property

If all these statements are true, check the “True” box,

as a primary residence to be listed on the application. This information

enter the birth date, and proceed to section 3.

is used to ensure that no applicant is granted exemption on multiple

If statements a), b) or f) are not true, you do not qualify as

properties. Statute requires the information be kept confidential. See

a surviving spouse.

§§ 39-3-205(2)(a)(I) and (III), and 8-2-128(2) C.R.S.

If statement c), d), or e) is not true, you may qualify if you

fall within one of the three exceptions in 2C.

1.

IDENTIFICATION OF APPLICANT AND PROPERTY:

Identify the qualifying senior or surviving spouse and property. It

2C – Exceptions to Occupancy Requirements: Colorado statutes,

§§ 39-3-202(2)(b) and 203(6)(a), C.R.S., provide three

is permissible for ownership to be held in a life estate. If

exceptions to the 10-year occupancy requirement.

ownership is held in a life estate, check the life estate box.

The qualifying senior or surviving spouse is/was confined

to a hospital, nursing home, or assisted living facility.

2.

AGE AND OCCUPANCY REQUIREMENTS: Either 2A, 2B,

The prior home was condemned in an eminent domain

or one of the two statements in 2C must be true to qualify.

proceeding by a governmental entity, or the home was

2A – For Qualifying Seniors:

sold to the governmental entity due to a threat of an

If the statement is true, check the box marked “True,” and

eminent domain proceeding.

proceed to section 3.

The prior home was destroyed by a natural disaster.

If the statement is not true, you may qualify under one of

If either statement 2A or 2B would be true if one of the above

the two exceptions in 2C, the occupancy exceptions.

situations had not occurred, check the appropriate box in 2C and

proceed to section 3. You must also provide the information

requested in sections 5, 6 or 7 as appropriate.

1

1 2

2 3

3 4

4