Nyce Ira Deposit Form

ADVERTISEMENT

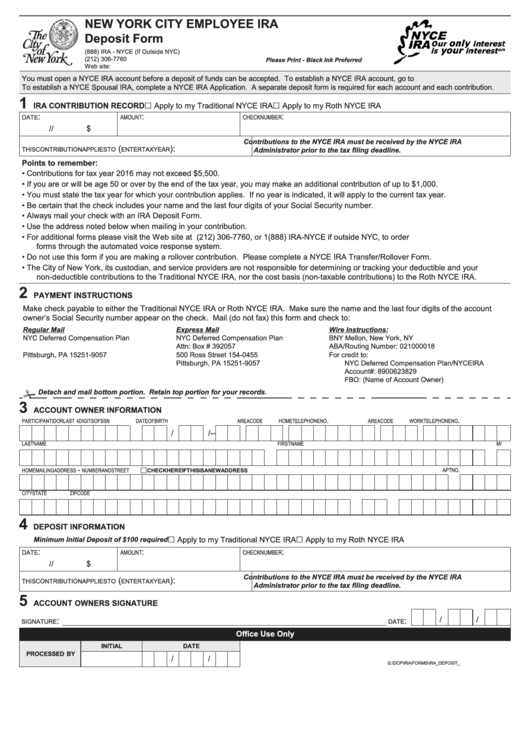

NEW YORK CITY EMPLOYEE IRA

Deposit Form

(888) IRA - NYCE (If Outside NYC)

(212) 306-7760

Please Print - Black Ink Preferred

Web site:

You must open a NYCE IRA account before a deposit of funds can be accepted. To establish a NYCE IRA account, go to .

To establish a NYCE Spousal IRA, complete a NYCE IRA Application. A separate deposit form is required for each account and each contribution.

1

IRA CONTRIBUTION RECORD

£ Apply to my Traditional NYCE IRA

£ Apply to my Roth NYCE IRA

:

:

:

amount

check number

date

/

/

$

Contributions to the NYCE IRA must be received by the NYCE IRA

(

):

this contribution applies to

enter tax year

Administrator prior to the tax filing deadline.

Points to remember:

•

Contributions for tax year 2016 may not exceed $5,500.

•

If you are or will be age 50 or over by the end of the tax year, you may make an additional contribution of up to $1,000.

•

You must state the tax year for which your contribution applies. If no year is indicated, it will apply to the current tax year.

•

Be certain that the check includes your name and the last four digits of your Social Security number.

•

Always mail your check with an IRA Deposit Form.

•

Use the address noted below when mailing in your contribution.

•

For additional forms please visit the Web site at nyc.gov/nyceira or call (212) 306-7760, or 1(888) IRA-NYCE if outside NYC, to order

forms through the automated voice response system.

•

Do not use this form if you are making a rollover contribution. Please complete a NYCE IRA Transfer/Rollover Form.

•

The City of New York, its custodian, and service providers are not responsible for determining or tracking your deductible and your

non-deductible contributions to the Traditional NYCE IRA, nor the cost basis (non-taxable contributions) to the Roth NYCE IRA.

2

PAYMENT INSTRUCTIONS

Make check payable to either the Traditional NYCE IRA or Roth NYCE IRA. Make sure the name and the last four digits of the account

owner’s Social Security number appear on the check. Mail (do not fax) this form and check to:

Regular Mail

Express Mail

Wire Instructions:

NYC Deferred Compensation Plan

NYC Deferred Compensation Plan

BNY Mellon, New York, NY

P.O. Box 392057

Attn: Box # 392057

ABA/Routing Number: 021000018

Pittsburgh, PA 15251-9057

500 Ross Street 154-0455

For credit to:

Pittsburgh, PA 15251-9057

NYC Deferred Compensation Plan/NYCEIRA

Account#: 8900623829

FBO: (Name of Account Owner)

Detach and mail bottom portion. Retain top portion for your records.

3

ACCOUNT OWNER INFORMATION

.

.

participant id or last 4 digits of ssn

date of birth

area code

home telephone no

area code

work telephone no

/

/

-

-

last name

first name

mi

-

.

apt no

home mailing address

number and street

£

check here if this is a new address

city

state

zip code

4

DEPOSIT INFORMATION

£ Apply to my Traditional NYCE IRA

£ Apply to my Roth NYCE IRA

Minimum Initial Deposit of $100 required

:

:

:

amount

check number

date

/

/

$

Contributions to the NYCE IRA must be received by the NYCE IRA

(

):

this contribution applies to

enter tax year

Administrator prior to the tax filing deadline.

5

ACCOUNT OWNERS SIGNATURE

/

/

:

:

signature

date

Office Use Only

initial

date

processed by

/

/

G:\DCP\IRA\FORMS\IRA_DEPOSIT_FORM.INDD 5K 6/2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2