Ira Recharacterization Form (External)

ADVERTISEMENT

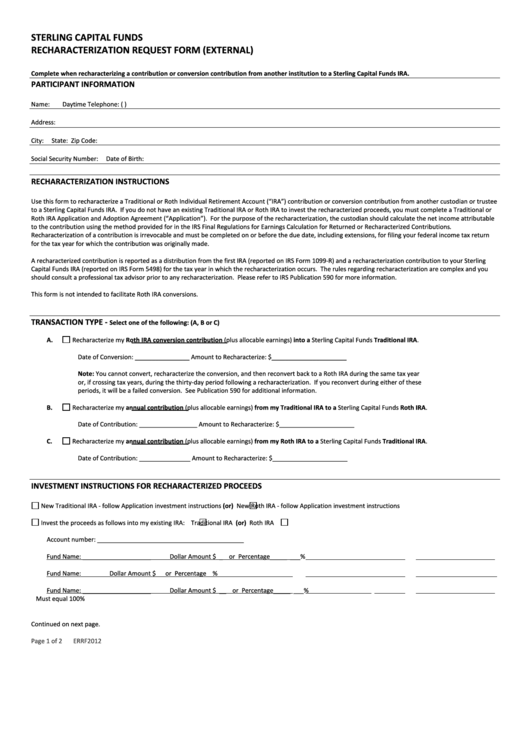

STERLING CAPITAL FUNDS

RECHARACTERIZATION REQUEST FORM (EXTERNAL)

Complete when recharacterizing a contribution or conversion contribution from another institution to a Sterling Capital Funds IRA.

PARTICIPANT INFORMATION

Name:

Daytime Telephone: (

)

Address:

City:

State:

Zip Code:

Social Security Number:

Date of Birth:

RECHARACTERIZATION INSTRUCTIONS

Use this form to recharacterize a Traditional or Roth Individual Retirement Account (“IRA”) contribution or conversion contribution from another custodian or trustee

to a Sterling Capital Funds IRA. If you do not have an existing Traditional IRA or Roth IRA to invest the recharacterized proceeds, you must complete a Traditional or

Roth IRA Application and Adoption Agreement (“Application”). For the purpose of the recharacterization, the custodian should calculate the net income attributable

to the contribution using the method provided for in the IRS Final Regulations for Earnings Calculation for Returned or Recharacterized Contributions.

Recharacterization of a contribution is irrevocable and must be completed on or before the due date, including extensions, for filing your federal income tax return

for the tax year for which the contribution was originally made.

A recharacterized contribution is reported as a distribution from the first IRA (reported on IRS Form 1099-R) and a recharacterization contribution to your Sterling

Capital Funds IRA (reported on IRS Form 5498) for the tax year in which the recharacterization occurs. The rules regarding recharacterization are complex and you

should consult a professional tax advisor prior to any recharacterization. Please refer to IRS Publication 590 for more information.

This form is not intended to facilitate Roth IRA conversions.

TRANSACTION TYPE -

Select one of the following: (A, B or C)

A.

Recharacterize my Roth IRA conversion contribution (plus allocable earnings) into a Sterling Capital Funds Traditional IRA.

Date of Conversion: ________________

Amount to Recharacterize: $______________________

Note: You cannot convert, recharacterize the conversion, and then reconvert back to a Roth IRA during the same tax year

or, if crossing tax years, during the thirty-day period following a recharacterization. If you reconvert during either of these

periods, it will be a failed conversion. See Publication 590 for additional information.

B.

Recharacterize my annual contribution (plus allocable earnings) from my Traditional IRA to a Sterling Capital Funds Roth IRA.

Date of Contribution: _________________

Amount to Recharacterize: $______________________

C.

Recharacterize my annual contribution (plus allocable earnings) from my Roth IRA to a Sterling Capital Funds Traditional IRA.

Date of Contribution: _______________

Amount to Recharacterize: $______________________

INVESTMENT INSTRUCTIONS FOR RECHARACTERIZED PROCEEDS

New Traditional IRA - follow Application investment instructions (or)

New Roth IRA - follow Application investment instructions

Invest the proceeds as follows into my existing IRA:

Traditional IRA

(or)

Roth IRA

Account number: ___________________________________________

Fund Name:

____________________

Dollar Amount $

_

or Percentage_____

___%

Fund Name:

Dollar Amount $

or Percentage

%

Fund Name:

____________________

Dollar Amount $

__

or Percentage_____

___%

Must equal 100%

Continued on next page.

Page 1 of 2

ERRF2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2