Physician'S Statement Verifying Eligibility For Disability Homestead Exemption Page 2

ADVERTISEMENT

Disability Homestead Exemption: Information and Requirements

In Texas, a disabled adult has a right to a special homestead exemption. If you qualify, this exemption can reduce your taxes

substantially. By law, school districts must provide a $10,000 disability exemption. Other taxing entities have the option to

offer disability exemptions of at least $3,000. If you qualify, you will receive this exemption in addition to the general

homestead exemption. However, you cannot receive both a disability exemption and an over-65 exemption.

Who is a disabled person for the purposes of this exemption?

The Texas Property Tax Code provides that you are entitled to the exemption if you meet the Social Security Administration's

tests for disability. In simplest terms:

1) You must have a medically determinable physical or mental impairment;

2) The impairment must prevent you from engaging in any substantial gainful activity; and

3) The impairment must be expected to last for at least 12 continuous months or to result in death.

Alternatively, you will qualify if you are 55 or older and blind and cannot engage in your previous work because of your

blindness.

Do I have to be receiving disability benefits to qualify?

You do not have to be receiving disability benefits, but you must meet the definition of disabled given above. If you receive

disability benefits under the Federal Old Age, Survivors, and Disability Insurance Program through the Social Security

Administration you will automatically qualify. Disability benefits from any other program do not automatically qualify you for

this exemption.

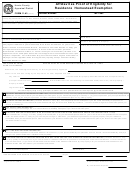

How do I claim the exemption?

To claim the exemption, you must file an application with the appraisal district. The application must include documentation of

your disability. The application form is entitled "Application for Residential Homestead Exemption." This form can be

obtained from our website or from the Information & Assistance Division of the Harris County Appraisal District. In it, you

should complete all applicable information. Be especially certain to mark the box that recognizes your claim for the disability

exemption. The most common reason for denial of this exemption is failure to provide adequate documentation.

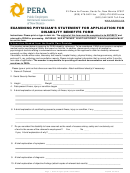

What kind of documents should I include?

The best form of documentation, if you are receiving Social Security Disability, is a copy of your disability determination letter

issued by the Social Security Administration. If you are not receiving Social Security Disability, then have your physician

complete and return HCAD's Verification of Disability Form or attach information from a recognized retirement system

verifying your permanent disability. It is very important that if you are submitting the Verification of Disability form, your

physician must mail it to the appraisal district. This form will not be accepted if simply attached to your application.

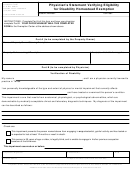

Where do I file my application?

Once you have completed the application and secured appropriate documentation, you need to file your application with the

chief appraiser. You may mail or file your request directly with the appraisal district at the address given on this form.

Action on your application usually will occur within four to six weeks from the date it is received. In the event the appraisal

district disagrees with your request, you will be notified and offered an opportunity to protest this decision.

For any questions or additional assistance, you are encouraged to call a HCAD representative at (713) 957-7800 between the

hours of 8:00 a.m. and 5:00 p.m., Monday through Friday.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2