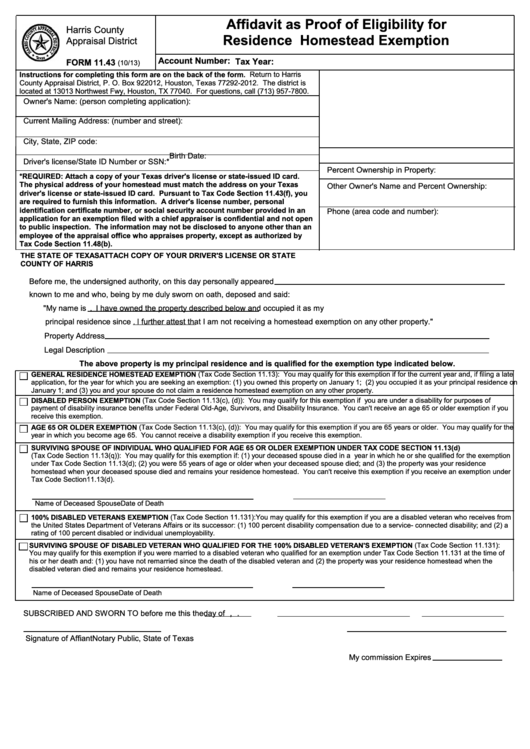

Affidavit as Proof of Eligibility for

Harris County

Residence Homestead Exemption

Appraisal District

Account Number:

Tax Year:

FORM 11.43

(10/13)

Instructions for completing this form are on the back of the form. Return to Harris

County Appraisal District, P. O. Box 922012, Houston, Texas 77292-2012. The district is

located at 13013 Northwest Fwy, Houston, TX 77040. For questions, call (713) 957-7800.

Owner's Name: (person completing application):

Current Mailing Address: (number and street):

City, State, ZIP code:

Birth Date:

Driver's license/State ID Number or SSN:*

Percent Ownership in Property:

*REQUIRED: Attach a copy of your Texas driver's license or state-issued ID card.

The physical address of your homestead must match the address on your Texas

Other Owner's Name and Percent Ownership:

driver's license or state-issued ID card. Pursuant to Tax Code Section 11.43(f), you

are required to furnish this information. A driver's license number, personal

identification certificate number, or social security account number provided in an

Phone (area code and number):

application for an exemption filed with a chief appraiser is confidential and not open

to public inspection. The information may not be disclosed to anyone other than an

employee of the appraisal office who appraises property, except as authorized by

Tax Code Section 11.48(b).

THE STATE OF TEXAS

ATTACH COPY OF YOUR DRIVER'S LICENSE OR STATE I.D. CARD

COUNTY OF HARRIS

Before me, the undersigned authority, on this day personally appeared

known to me and who, being by me duly sworn on oath, deposed and said:

"My name is

I have owned the property described below and occupied it as my

.

principal residence since

I further attest that I am not receiving a homestead exemption on any other property."

.

Property Address

Legal Description

The above property is my principal residence and is qualified for the exemption type indicated below.

GENERAL RESIDENCE HOMESTEAD EXEMPTION (Tax Code Section 11.13): You may qualify for this exemption if for the current year and, if filing a late

application, for the year for which you are seeking an exemption: (1) you owned this property on January 1; (2) you occupied it as your principal residence on

January 1; and (3) you and your spouse do not claim a residence homestead exemption on any other property.

DISABLED PERSON EXEMPTION (Tax Code Section 11.13(c), (d)): You may qualify for this exemption if you are under a disability for purposes of

payment of disability insurance benefits under Federal Old-Age, Survivors, and Disability Insurance. You can't receive an age 65 or older exemption if you

receive this exemption.

AGE 65 OR OLDER EXEMPTION (Tax Code Section 11.13(c), (d)): You may qualify for this exemption if you are 65 years or older. You may qualify for the

year in which you become age 65. You cannot receive a disability exemption if you receive this exemption.

SURVIVING SPOUSE OF INDIVIDUAL WHO QUALIFIED FOR AGE 65 OR OLDER EXEMPTION UNDER TAX CODE SECTION 11.13(d)

(Tax Code Section 11.13(q)): You may qualify for this exemption if: (1) your deceased spouse died in a year in which he or she qualified for the exemption

under Tax Code Section 11.13(d); (2) you were 55 years of age or older when your deceased spouse died; and (3) the property was your residence

homestead when your deceased spouse died and remains your residence homestead. You can't receive this exemption if you receive an exemption under

Tax Code Section11.13(d).

Name of Deceased Spouse

Date of Death

100% DISABLED VETERANS EXEMPTION (Tax Code Section 11.131): You may qualify for this exemption if you are a disabled veteran who receives from

the United States Department of Veterans Affairs or its successor: (1) 100 percent disability compensation due to a service- connected disability; and (2) a

rating of 100 percent disabled or individual unemployability.

SURVIVING SPOUSE OF DISABLED VETERAN WHO QUALIFIED FOR THE 100% DISABLED VETERAN'S EXEMPTION (Tax Code Section 11.131):

You may qualify for this exemption if you were married to a disabled veteran who qualified for an exemption under Tax Code Section 11.131 at the time of

his or her death and: (1) you have not remarried since the death of the disabled veteran and (2) the property was your residence homestead when the

disabled veteran died and remains your residence homestead.

Name of Deceased Spouse

Date of Death

,

.

SUBSCRIBED AND SWORN TO before me this the

day of

Signature of Affiant

Notary Public, State of Texas

My commission Expires

1

1 2

2 3

3 4

4