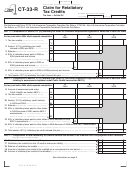

Form It-272, 2014, Claim For College Tuition Credit Page 2

ADVERTISEMENT

IT-272 (2014) (back)

Part 2 –

Complete Part 2 if your total qualified college tuition expenses on line 3 are less than $5,000.

4 Credit limitation ($200)..................................................................................................................................

4

200 00

5 Enter the lesser of line 3 or line 4. This is your college tuition credit ........................................................

5

00

• If you did not itemize your deductions on your federal return, enter the line 5 amount

on Form IT-201, line 68.

• If you itemized your deductions on your federal return, continue with Part 4.

Part 3 –

Complete Part 3 if your total qualified college tuition expenses on line 3 are $5,000 or more.

6 Enter the amount from line 3 ........................................................................................................................

6

00

7 Multiply line 6 by 4% (.04). This is your college tuition credit ...................................................................

7

00

• If you did not itemize your deductions on your federal return, enter the line 7 amount

on Form IT-201, line 68.

• If you itemized your deductions on your federal return, continue with Part 4.

Part 4 – College tuition itemized deduction election

If you itemized your deductions on your federal return, you may elect to claim the college tuition itemized

deduction instead of the college tuition credit. To compute your college tuition itemized deduction,

complete Worksheet 1 in the instructions for this form. To determine if you will receive a greater tax benefit

from the itemized deduction or credit, complete Worksheet 2 in the instructions for this form.

8 Mark an X in this box only if you elect to claim the college tuition itemized deduction .........................................................

8

• If you marked an X in the box at line 8, enter the amount from Worksheet 1, line 5 (in the instructions for this

form), on your itemized deduction schedule. Do not enter the college tuition credit from line 5 or 7 above on

Form IT-201. You are entitled to claim either the deduction or the credit, but not both.

• If you did not mark an X in the box at line 8 and you elect to claim the college tuition credit instead of the

college tuition itemized deduction, enter the line 5 or line 7 amount on Form IT-201, line 68.

Important: If you are claiming the college tuition credit or the college tuition itemized deduction, you must submit Form IT-272 with

your return.

272002140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2