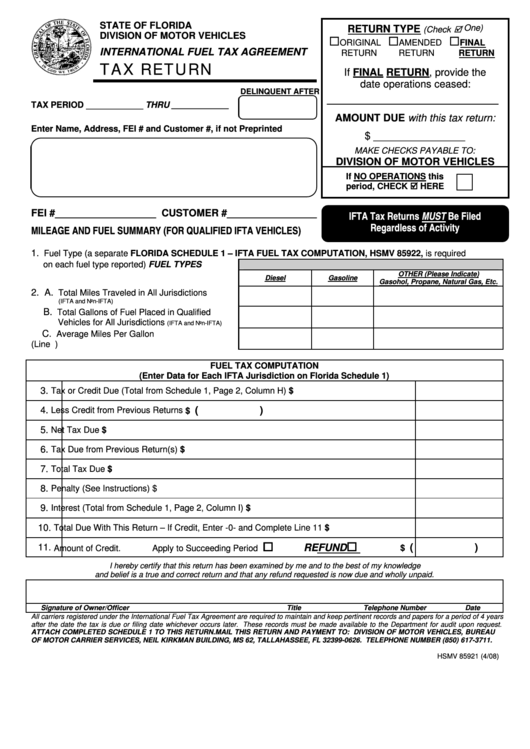

STATE OF FLORIDA

RETURN TYPE

(Check

One)

DIVISION OF MOTOR VEHICLES

ORIGINAL

AMENDED

FINAL

INTERNATIONAL FUEL TAX AGREEMENT

RETURN

RETURN

RETURN

TAX RETURN

If FINAL RETURN, provide the

date operations ceased:

DELINQUENT AFTER

TAX PERIOD ____________ THRU ____________

AMOUNT DUE with this tax return:

Enter Name, Address, FEI # and Customer #, if not Preprinted

$ ________________

MAKE CHECKS PAYABLE TO:

DIVISION OF MOTOR VEHICLES

If NO OPERATIONS this

period, CHECK

HERE

FEI #__________________ CUSTOMER #________________

IFTA Tax Returns MUST Be Filed

Regardless of Activity

MILEAGE AND FUEL SUMMARY (FOR QUALIFIED IFTA VEHICLES)

1.

Fuel Type (a separate FLORIDA SCHEDULE 1 – IFTA FUEL TAX COMPUTATION, HSMV 85922, is required

on each fuel type reported)

FUEL TYPES

OTHER (Please Indicate)

Diesel

Gasoline

Gasohol, Propane, Natural Gas, Etc.

2. A.

Total Miles Traveled in All Jurisdictions

(IFTA and Non-IFTA)

B.

Total Gallons of Fuel Placed in Qualified

Vehicles for All Jurisdictions

(IFTA and Non-IFTA)

C.

Average Miles Per Gallon

(Line 2.A. / Line 2.B.)

FUEL TAX COMPUTATION

(Enter Data for Each IFTA Jurisdiction on Florida Schedule 1)

3.

Tax or Credit Due (Total from Schedule 1, Page 2, Column H)

$

4.

(

)

Less Credit from Previous Returns

$

5.

Net Tax Due

$

6.

Tax Due from Previous Return(s)

$

7.

Total Tax Due

$

8.

Penalty (See Instructions)

$

9.

Interest (Total from Schedule 1, Page 2, Column I)

$

10.

Total Due With This Return – If Credit, Enter -0- and Complete Line 11

$

(

)

11.

REFUND

Amount of Credit.

Apply to Succeeding Period

$

I hereby certify that this return has been examined by me and to the best of my knowledge

and belief is a true and correct return and that any refund requested is now due and wholly unpaid.

Signature of Owner/Officer

Title

Telephone Number

Date

All carriers registered under the International Fuel Tax Agreement are required to maintain and keep pertinent records and papers for a period of 4 years

after the date the tax is due or filing date whichever occurs later. These records must be made available to the Department for audit upon request.

ATTACH COMPLETED SCHEDULE 1 TO THIS RETURN. MAIL THIS RETURN AND PAYMENT TO: DIVISION OF MOTOR VEHICLES, BUREAU

OF MOTOR CARRIER SERVICES, NEIL KIRKMAN BUILDING, MS 62, TALLAHASSEE, FL 32399-0626. TELEPHONE NUMBER (850) 617-3711.

HSMV 85921 (4/08)

1

1 2

2 3

3