Wood County Hotel/motel Occupancy Tax Reporting Form

ADVERTISEMENT

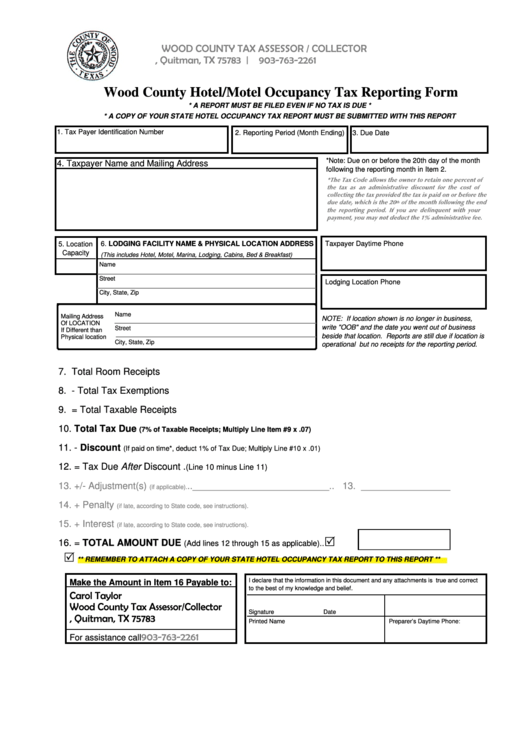

WOOD COUNTY TAX ASSESSOR / COLLECTOR

P.O. Box 1919, Quitman, TX 75783 | 903-763-2261

Wood County Hotel/Motel Occupancy Tax Reporting Form

* A REPORT MUST BE FILED EVEN IF NO TAX IS DUE *

* A COPY OF YOUR STATE HOTEL OCCUPANCY TAX REPORT MUST BE SUBMITTED WITH THIS REPORT

1. Tax Payer Identification Number

2. Reporting Period (Month Ending)

3. Due Date

*Note: Due on or before the 20th day of the month

4. Taxpayer Name and Mailing Address

following the reporting month in Item 2.

Taxpayer Daytime Phone

5. Location

6. LODGING FACILITY NAME & PHYSICAL LOCATION ADDRESS

Capacity

(This includes Hotel, Motel, Marina, Lodging, Cabins, Bed & Breakfast)

Name

Street

Lodging Location Phone

City, State, Zip

Name

Mailing Address

NOTE: If location shown is no longer in business,

Of LOCATION

write "OOB" and the date you went out of business

Street

If Different than

beside that location. Reports are still due if location is

Physical location

City, State, Zip

operational but no receipts for the reporting period.

7. Total Room Receipts ...............................................................

7. _________________

8. - Total Tax Exemptions ............................................................

8. _________________

9. = Total Taxable Receipts .........................................................

9. _________________

10. Total Tax Due

......... 10. _________________

(7% of Taxable Receipts; Multiply Line Item #9 x .07)

11. - Discount

.... 11. _________________

(If paid on time*, deduct 1% of Tax Due; Multiply Line #10 x .01)

12. = Tax Due After Discount .

......................... 12. _________________

(Line 10 minus Line 11)

13. +/- Adjustment(s)

..__________________________.. 13. _________________

(if applicable).

14. + Penalty

................................. 14. _________________

(if late, according to State code, see instructions).

15. + Interest

................................. 15. _________________

(if late, according to State code, see instructions).

R

16. = TOTAL AMOUNT DUE

.......16. _________________

(Add lines 12 through 15 as applicable)..

R

** REMEMBER TO ATTACH A COPY OF YOUR STATE HOTEL OCCUPANCY TAX REPORT TO THIS REPORT **

I declare that the information in this document and any attachments is true and correct

Make the Amount in Item 16 Payable to:

to the best of my knowledge and belief.

Carol Taylor

Wood County Tax Assessor/Collector

Signature

Date

P.O. Box 1919, Quitman, TX 75783

Printed Name

Preparer’s Daytime Phone:

903-763-2261

For assistance call

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2