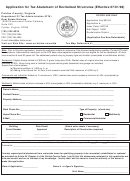

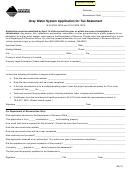

Application For Tax Abatement -Harris County, Texas Page 6

ADVERTISEMENT

Checklist

Contents of Complete Application Package

for Harris County Tax Abatement

Applicants and projects must meet the requirements established by the Guidelines and Criteria

for Granting Tax Abatement in a Reinvestment Zone Created in Harris County (“The

Guidelines”), facilities, eligible and ineligible improvements, terms and economic qualifications.

Conformance with all sections is the basis for determination of initial eligibility and for

favorable consideration by Commissioners Court. As detailed in The Guidelines, these

components comprise a “Completed Application.”

1. Harris County Application Form – Original signed by company officer.

2. Narrative – Completed in accordance with template at end of application.

3. Investment Budget – detailing components and costs of the real property

improvements and fixed-in-place improvements for which tax abatement is

requested, including type, number, economic life, and eligibility for a tax

exemption granted by the Texas Commission on Environmental Quality

(“TCEQ”) (if known).

4. Plat survey and metes & bounds description – Also “Key Map” reference

5. Project timeline – Schedule for constructing proposed improvements;

6. Ten-year environmental and worker safety compliance history – all facilities

located within the State of Texas and owned in whole or in part by applicants, per

The Guidelines, Section 2(k), “Environmental and Worker Safety Qualification”;

7. Evaluation of competing locations – per The Guidelines, Section 1(e),

“Competitively-Sited Project.”, including statement of reason(s) that requested

tax abatement is necessary to ensure that proposed project is built in Harris

County (i.e., documentation supporting assertion that “but for” a tax abatement,

the stated project could not be constructed in Harris County)

8. Quarterly report(s) filed with the Texas Workforce Commission – for the

immediately preceding quarter, documenting the current number of permanent

full-time employees (and full-time Contractor employees, if any).

9. Financial information –

• Publicly traded company (including wholly owned subsidiary or

operation division): most recent annual report to stockholders.

Checklist - Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7