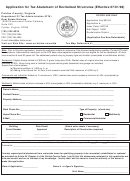

Application For Tax Abatement -Harris County, Texas Page 7

ADVERTISEMENT

• Privately-owned company: most recent audited financial statements,

documentation of the date and location of incorporation, bank references

(including officer name and telephone number), and accountant and

attorney references (names of firms and contact telephone numbers).

• New venture: Business plan and financing commitment from lender

and/or venture capitalist; plus bank references (including officer name and

telephone number), accountant and attorney references (firms and contact

telephone numbers).

10. Certification by Harris County Tax Assessor-Collector that all tax accounts

within Harris County are paid on a current basis.

11. Lease Agreement, if applicable. For a facility to be leased the applicant shall provide

with the application the name and address of the lessor and a draft copy of the proposed

lease, or option contract. In the event a lease or option contract has already been executed

with owner of site, the document must include a provision whereby abatement applicant

may terminate such contract without penalty or loss of earnest money, in the event that

Harris County does not grant a tax abatement.

Page 2 of 2 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7