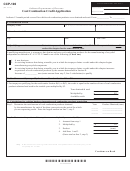

Instructions for Biodiesel Tax Credits (BD-100)

• Indiana Code (IC) 6-3.1-27 provides biodiesel credits to Indiana producers,

Note: You may not use the credit to offset or reduce the Indiana Gross Retail

Sales Tax you collected from your customers.

blenders, and retailers. Biodiesel is defined as a renewable, biodegradable,

mono alkylester combustible liquid fuel derived from agricultural plant oils

Section E - Signature

or animal fats that meets American Society for Testing and Material

specification D6751-03a Standard Specification for biodiesel fuel (B100)

This claim must be signed by the taxpayer or an authorized agent. If necessary,

blend stock for distillate fuels.

a properly executed Power of Attorney form must accompany the application.

• The biodiesel production credit and blended biodiesel credits are each

limited to a maximum of $3 million per taxpayer for all taxable years but

How Soon Will I Receive My Tax Credit Approval?

may be increased to $5 million for the biodiesel production credit with prior

approval from the Indiana Economic Development Corporation (IEDC).

The credit claims will be reviewed in the order in which they are received.

The total of credits allowed for biodiesel production, biodiesel blending, and

Processing time will vary depending on the number of credit applications

ethanol production (allowed under IC 6-3.1-1-28) is capped at $50 million

received. Incomplete credit applications will be delayed until we are able to

for all taxable years, of which at least $4 million is provided for each type of

production.

obtain the required information from you. Inquiries regarding processing

procedures or the status of your claim may be directed to the Compliance

Who May File for This Credit?

Division at (317) 232-2339.

A producer (certified by the IEDC) who is producing biodiesel at an Indiana

Where Do I Send My Biodiesel Tax Credit Application Claim?

facility that will be used to produce blended biodiesel; and/or

Form BD-100 can be faxed to: (317) 615-2697

A blender (certified by the IEDC) who purchases biodiesel produced at an

-or-

Indiana facility and produces blended biodiesel at an Indiana facility.

Mail form to: Indiana Department of Revenue

Tax Administration

How Often Can I File a Tax Credit Application Claim?

P.O. Box 6197

Indianapolis, IN 46204

A claim for credit can be filed monthly, quarterly, semiannually, or annually.

Credits will be approved by the Department until the maximum amount of

Where Can I Claim This Credit?

credit for each category has been reached.

The Biodiesel Credits can be applied as a credit against the taxpayer’s sales/use tax

(IC 6-2.5), adjusted gross income tax (IC 6-3-1 to 6-3-7), financial institution tax

Section A - Taxpayer Information

(IC 6-5.5), and insurance premium tax (IC 27-1-18-2). A copy of the approved

1. Type or print name and location address.

BD-100 must be attached to the return; otherwise, the credit will be disallowed.

2. Enter Indiana taxpayer ID number (TID).

The credit amount approved on the BD-100 is to be taken as a credit against your

3. Enter federal ID number (FID).

tax liability on the return of your choice. Please see your tax returns’ instructions

to determine where the credit should be entered on the various tax forms.

Section B - Biodiesel Production Credit

What If I Do Not Use All of My Credit?

Note: Attach certification from the IEDC.

Any unused credit can be carried forward for up to six years or until all credits

1. Enter total gallons of biodiesel produced at an Indiana location.

have been used. You can claim the credit on more than one return up to the

2. Enter total gallons of biodiesel sold to biodiesel blenders.

maximum credit approved on the BD-100.

3. Multiply the number of gallons from line 2 by $1. Enter the total

amount of Indiana credit for biodiesel production.

Note: A taxpayer is not entitled to a carryback or refund of any unused credit.

4. Create and attach a schedule to include the name, address, TID, and

number of gallons sold to each Indiana blender.

What If I Am an Entity Exempt from Adjusted Gross Income Tax?

Section C - Blended Biodiesel Credit

Entities exempt from adjusted gross income tax under IC 6-3-2-2.8(2) may “pass

Note: Only blended biodiesel produced from Indiana biodiesel is eligible for

through” the credit to shareholders, partners, or members of the pass-through

the credit. Attach certification from the IEDC.

entity. A pass-through entity means an S corporation, partnership, limited

1. Enter the total gallons of biodiesel purchased from all sources.

liability company, or limited liability partnership. Each member’s tax credit is

2. Enter the total gallons of biodiesel purchased from Indiana producers.

calculated by multiplying the total credit available by the percentage of the entity’s

3. Enter the total gallons of blended biodiesel generated from the gallons

distributive income to which the shareholder, partner, or member is entitled.

shown on line 2 and blended in an Indiana facility.

4. Multiply the number of gallons from line 3 by $.02. Enter the total

The pro rata share of the approved credit is reported by the entity on each unit

amount of Indiana credit for blended biodiesel.

holder’s Schedule IN K-1. Enclose with the return a copy of Form BD-100 or

IN K-1 when claiming your share of the credit. See Income Tax Information

Section D - Application of Tax Liability Credits

Bulletin #91 for more information.

Please indicate how you anticipate using this credit by checking the appropriate

box(es). Combine the amount of credits from sections B and D to be applied

against the tax selected.

*24100000000*

24100000000

1

1 2

2