Notification Of Dissolution Or Surrender Form D5

ADVERTISEMENT

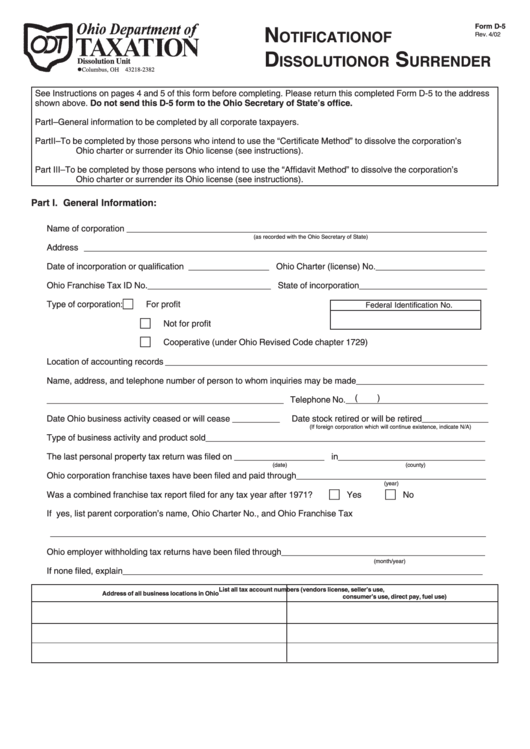

Form D-5

N

OTIFICATION OF

Rev. 4/02

D

S

ISSOLUTION OR

URRENDER

Dissolution Unit

P.O. Box 182382

Columbus, OH 43218-2382

See Instructions on pages 4 and 5 of this form before completing. Please return this completed Form D-5 to the address

shown above. Do not send this D-5 form to the Ohio Secretary of State’s office.

Part I – General information to be completed by all corporate taxpayers.

Part II – To be completed by those persons who intend to use the “Certificate Method” to dissolve the corporation’s

Ohio charter or surrender its Ohio license (see instructions).

Part III – To be completed by those persons who intend to use the “Affidavit Method” to dissolve the corporation’s

Ohio charter or surrender its Ohio license (see instructions).

Part I. General Information:

Name of corporation ____________________________________________________________________________

(as recorded with the Ohio Secretary of State)

Address _____________________________________________________________________________________

Date of incorporation or qualification _________________ Ohio Charter (license) No. _______________________

Ohio Franchise Tax ID No.__________________________ State of incorporation ___________________________

Type of corporation:

For profit

Federal Identification No.

Not for profit

Cooperative (under Ohio Revised Code chapter 1729)

Location of accounting records ____________________________________________________________________

Name, address, and telephone number of person to whom inquiries may be made ___________________________

(

)

__________________________________________________ Telephone No. ______________________________

Date Ohio business activity ceased or will cease __________

Date stock retired or will be retired ______________

(If foreign corporation which will continue existence, indicate N/A)

Type of business activity and product sold ___________________________________________________________

The last personal property tax return was filed on ___________________ in _______________________________

(date)

(county)

Ohio corporation franchise taxes have been filed and paid through ________________________________________

(year)

Was a combined franchise tax report filed for any tax year after 1971?

Yes

No

If yes, list parent corporation’s name, Ohio Charter No., and Ohio Franchise Tax I.D. No. ______________________

____________________________________________________________________________________________

Ohio employer withholding tax returns have been filed through ___________________________________________

(month/year)

If none filed, explain ____________________________________________________________________________

List all tax account numbers (vendors license, seller’s use,

Address of all business locations in Ohio

consumer’s use, direct pay, fuel use)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5