Instructions For Schedule 500c - 2016

ADVERTISEMENT

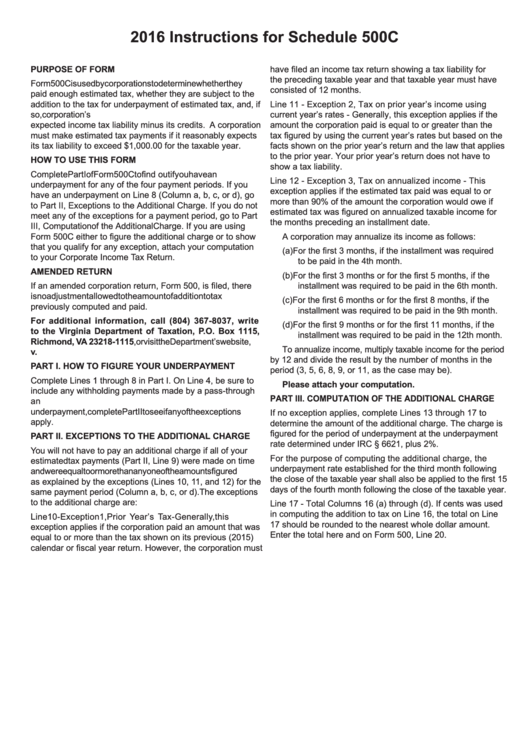

2016 Instructions for Schedule 500C

PURPOSE OF FORM

have filed an income tax return showing a tax liability for

the preceding taxable year and that taxable year must have

Form 500C is used by corporations to determine whether they

consisted of 12 months.

paid enough estimated tax, whether they are subject to the

addition to the tax for underpayment of estimated tax, and, if

Line 11 - Exception 2, Tax on prior year’s income using

so, the amount of the addition. Estimated tax is a corporation’s

current year’s rates - Generally, this exception applies if the

expected income tax liability minus its credits. A corporation

amount the corporation paid is equal to or greater than the

must make estimated tax payments if it reasonably expects

tax figured by using the current year’s rates but based on the

its tax liability to exceed $1,000.00 for the taxable year.

facts shown on the prior year’s return and the law that applies

to the prior year. Your prior year’s return does not have to

HOW TO USE THIS FORM

show a tax liability.

Complete Part I of Form 500C to find out if you have an

Line 12 - Exception 3, Tax on annualized income - This

underpayment for any of the four payment periods. If you

exception applies if the estimated tax paid was equal to or

have an underpayment on Line 8 (Column a, b,

c,

or d), go

more than 90% of the amount the corporation would owe if

to Part II, Exceptions to the Additional Charge. If you do not

estimated tax was figured on annualized taxable income for

meet any of the exceptions for a payment period, go to Part

the months preceding an installment date.

III, Computation of the Additional Charge. If you are using

Form 500C either to figure the additional charge or to show

A corporation may annualize its income as follows:

that you qualify for any exception, attach your computation

(a) For the first 3 months, if the installment was required

to your Corporate Income Tax Return.

to be paid in the 4th month.

AMENDED RETURN

(b) For the first 3 months or for the first 5 months, if the

If an amended corporation return, Form 500, is filed, there

installment was required to be paid in the 6th month.

is no adjustment allowed to the amount of addition to tax

(c) For the first 6 months or for the first 8 months, if the

previously computed and paid.

installment was required to be paid in the 9th month.

For additional information, call (804) 367-8037, write

(d) For the first 9 months or for the first 11 months, if the

to the Virginia Department of Taxation, P.O. Box 1115,

installment was required to be paid in the 12th month.

Richmond, VA 23218-1115, or visit the Department’s website,

To annualize income, multiply taxable income for the period

by 12 and divide the result by the number of months in the

PART I. HOW TO FIGURE YOUR UNDERPAYMENT

period (3, 5, 6, 8, 9, or 11, as the case may be).

Complete Lines 1 through 8 in Part I. On Line 4, be sure to

Please attach your computation.

include any withholding payments made by a pass-through

PART III. COMPUTATION OF THE ADDITIONAL CHARGE

entity on behalf of the corporation. If Line 8 shows an

underpayment, complete Part II to see if any of the exceptions

If no exception applies, complete Lines 13 through 17 to

apply.

determine the amount of the additional charge. The charge is

figured for the period of underpayment at the underpayment

PART II. EXCEPTIONS TO THE ADDITIONAL CHARGE

rate determined under IRC § 6621, plus 2%.

You will not have to pay an additional charge if all of your

For the purpose of computing the additional charge, the

estimated tax payments (Part II, Line 9) were made on time

underpayment rate established for the third month following

and were equal to or more than any one of the amounts figured

the close of the taxable year shall also be applied to the first 15

as explained by the exceptions (Lines 10, 11, and 12) for the

days of the fourth month following the close of the taxable year.

same payment period (Column a, b, c, or d).The exceptions

to the additional charge are:

Line 17 - Total Columns 16 (a) through (d). If cents was used

in computing the addition to tax on Line 16, the total on Line

Line 10 - Exception 1, Prior Year’s Tax - Generally, this

17 should be rounded to the nearest whole dollar amount.

exception applies if the corporation paid an amount that was

Enter the total here and on Form 500, Line 20.

equal to or more than the tax shown on its previous (2015)

calendar or fiscal year return. However, the corporation must

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1