Instructions For Form 2441 - 2016

ADVERTISEMENT

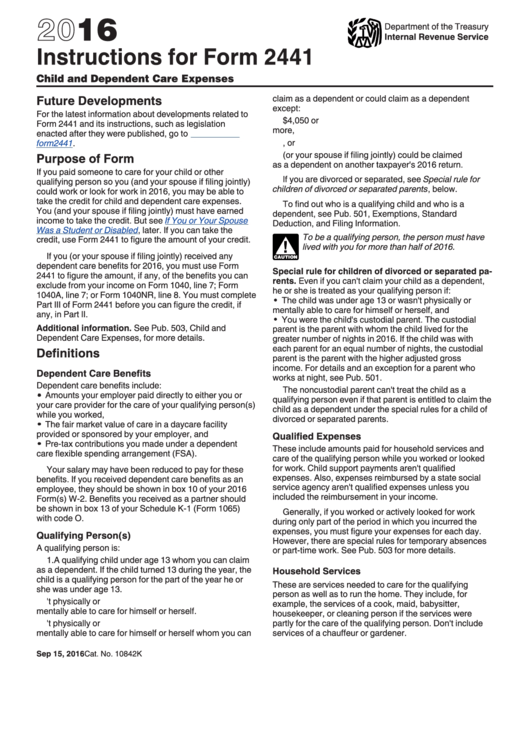

2016

Department of the Treasury

Internal Revenue Service

Instructions for Form 2441

Child and Dependent Care Expenses

Future Developments

claim as a dependent or could claim as a dependent

except:

For the latest information about developments related to

a. The disabled person had gross income of $4,050 or

Form 2441 and its instructions, such as legislation

more,

enacted after they were published, go to

b. The disabled person filed a joint return, or

form2441.

c. You (or your spouse if filing jointly) could be claimed

Purpose of Form

as a dependent on another taxpayer's 2016 return.

If you paid someone to care for your child or other

If you are divorced or separated, see Special rule for

qualifying person so you (and your spouse if filing jointly)

children of divorced or separated parents, below.

could work or look for work in 2016, you may be able to

take the credit for child and dependent care expenses.

To find out who is a qualifying child and who is a

You (and your spouse if filing jointly) must have earned

dependent, see Pub. 501, Exemptions, Standard

income to take the credit. But see

If You or Your Spouse

Deduction, and Filing Information.

Was a Student or

Disabled, later. If you can take the

To be a qualifying person, the person must have

credit, use Form 2441 to figure the amount of your credit.

lived with you for more than half of 2016.

!

If you (or your spouse if filing jointly) received any

CAUTION

dependent care benefits for 2016, you must use Form

Special rule for children of divorced or separated pa

2441 to figure the amount, if any, of the benefits you can

rents. Even if you can't claim your child as a dependent,

exclude from your income on Form 1040, line 7; Form

he or she is treated as your qualifying person if:

1040A, line 7; or Form 1040NR, line 8. You must complete

The child was under age 13 or wasn't physically or

Part III of Form 2441 before you can figure the credit, if

mentally able to care for himself or herself, and

any, in Part II.

You were the child's custodial parent. The custodial

Additional information. See Pub. 503, Child and

parent is the parent with whom the child lived for the

Dependent Care Expenses, for more details.

greater number of nights in 2016. If the child was with

each parent for an equal number of nights, the custodial

Definitions

parent is the parent with the higher adjusted gross

income. For details and an exception for a parent who

Dependent Care Benefits

works at night, see Pub. 501.

Dependent care benefits include:

The noncustodial parent can't treat the child as a

Amounts your employer paid directly to either you or

qualifying person even if that parent is entitled to claim the

your care provider for the care of your qualifying person(s)

child as a dependent under the special rules for a child of

while you worked,

divorced or separated parents.

The fair market value of care in a daycare facility

provided or sponsored by your employer, and

Qualified Expenses

Pre-tax contributions you made under a dependent

These include amounts paid for household services and

care flexible spending arrangement (FSA).

care of the qualifying person while you worked or looked

for work. Child support payments aren't qualified

Your salary may have been reduced to pay for these

expenses. Also, expenses reimbursed by a state social

benefits. If you received dependent care benefits as an

service agency aren't qualified expenses unless you

employee, they should be shown in box 10 of your 2016

included the reimbursement in your income.

Form(s) W-2. Benefits you received as a partner should

be shown in box 13 of your Schedule K-1 (Form 1065)

Generally, if you worked or actively looked for work

with code O.

during only part of the period in which you incurred the

expenses, you must figure your expenses for each day.

Qualifying Person(s)

However, there are special rules for temporary absences

A qualifying person is:

or part-time work. See Pub. 503 for more details.

1. A qualifying child under age 13 whom you can claim

as a dependent. If the child turned 13 during the year, the

Household Services

child is a qualifying person for the part of the year he or

These are services needed to care for the qualifying

she was under age 13.

person as well as to run the home. They include, for

2. Your disabled spouse who wasn't physically or

example, the services of a cook, maid, babysitter,

mentally able to care for himself or herself.

housekeeper, or cleaning person if the services were

3. Any disabled person who wasn't physically or

partly for the care of the qualifying person. Don't include

mentally able to care for himself or herself whom you can

services of a chauffeur or gardener.

Sep 15, 2016

Cat. No. 10842K

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6