Instructions For Form 8853 - 2016

ADVERTISEMENT

2016

Department of the Treasury

Internal Revenue Service

Instructions for Form 8853

Archer MSAs and Long-Term Care Insurance Contracts

Section references are to the Internal Revenue Code

accelerated death benefits from a life insurance

Instructions for Schedule A (Form 1040),

unless otherwise noted.

policy on a per diem or other periodic basis in

Itemized Deductions and Pub. 502, Medical

2016. See the instructions for Section C, later.

and Dental Expenses. Qualified medical

Future Developments

You (or your spouse, if filing jointly) received

expenses are those incurred by the account

Archer MSA or Medicare Advantage MSA

holder or the account holder's spouse or

For the latest information about developments

distributions in 2016.

dependent(s). Only prescribed medicines or

related to Form 8853 and its instructions, such

drugs (including over-the-counter medicines

If you (or your spouse, if filing jointly)

as legislation enacted after they were

and drugs that are prescribed) and insulin (even

received Archer MSA or Medicare

published, go to

!

if purchased without a prescription) for the

Advantage MSA distributions in

CAUTION

General Instructions

account holder or the account holder's spouse

2016, you must file Form 8853 with Form 1040

or dependent(s), are qualified medical

even if you have no taxable income or any other

expenses. See the instructions for line 7, later.

reason for filing Form 1040.

After December 31, 2007,

You can't treat insurance premiums as qualified

contributions can't be made to an

!

medical expenses unless the premiums are for:

Archer MSA for you, unless:

Specific Instructions

CAUTION

Long-term care (LTC) insurance,

You were an active Archer MSA participant

Health care continuation coverage, or

for any tax year ending before January 1, 2008,

Name and social security number (SSN).

Health care coverage while receiving

or

Enter your name(s) and SSN as shown on your

unemployment compensation under federal or

You became an active Archer MSA

tax return. If filing jointly and both you and your

state law.

participant for a tax year ending after December

spouse each have an Archer MSA or each have

31, 2007, because of coverage under a high

a Medicare Advantage MSA, enter the SSN

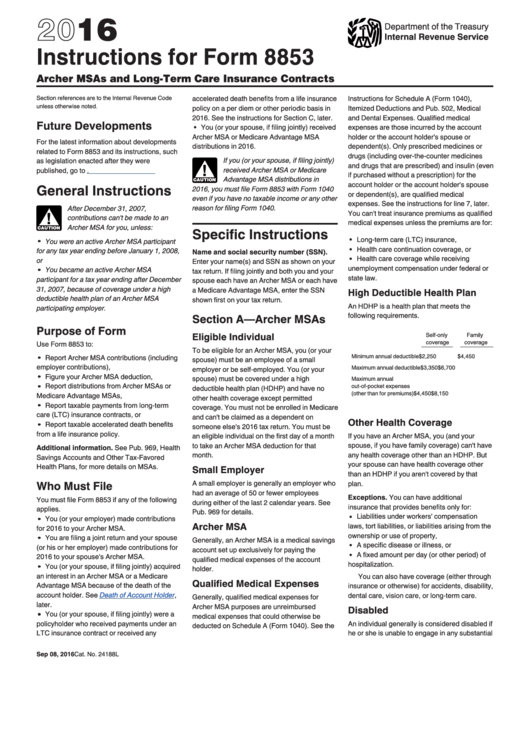

High Deductible Health Plan

deductible health plan of an Archer MSA

shown first on your tax return.

An HDHP is a health plan that meets the

participating employer.

Section A—Archer MSAs

following requirements.

Purpose of Form

Eligible Individual

Self-only

Family

coverage

coverage

Use Form 8853 to:

To be eligible for an Archer MSA, you (or your

Minimum annual deductible

Report Archer MSA contributions (including

$2,250

$4,450

spouse) must be an employee of a small

employer contributions),

Maximum annual deductible

$3,350

$6,700

employer or be self-employed. You (or your

Figure your Archer MSA deduction,

spouse) must be covered under a high

Maximum annual

Report distributions from Archer MSAs or

out-of-pocket expenses

deductible health plan (HDHP) and have no

(other than for premiums)

$4,450

$8,150

Medicare Advantage MSAs,

other health coverage except permitted

Report taxable payments from long-term

coverage. You must not be enrolled in Medicare

care (LTC) insurance contracts, or

and can't be claimed as a dependent on

Other Health Coverage

Report taxable accelerated death benefits

someone else's 2016 tax return. You must be

from a life insurance policy.

If you have an Archer MSA, you (and your

an eligible individual on the first day of a month

to take an Archer MSA deduction for that

spouse, if you have family coverage) can't have

Additional information. See Pub. 969, Health

month.

any health coverage other than an HDHP. But

Savings Accounts and Other Tax-Favored

your spouse can have health coverage other

Health Plans, for more details on MSAs.

Small Employer

than an HDHP if you aren't covered by that

Who Must File

A small employer is generally an employer who

plan.

had an average of 50 or fewer employees

Exceptions. You can have additional

You must file Form 8853 if any of the following

during either of the last 2 calendar years. See

insurance that provides benefits only for:

applies.

Pub. 969 for details.

Liabilities under workers' compensation

You (or your employer) made contributions

Archer MSA

laws, tort liabilities, or liabilities arising from the

for 2016 to your Archer MSA.

ownership or use of property,

You are filing a joint return and your spouse

Generally, an Archer MSA is a medical savings

A specific disease or illness, or

(or his or her employer) made contributions for

account set up exclusively for paying the

A fixed amount per day (or other period) of

2016 to your spouse's Archer MSA.

qualified medical expenses of the account

hospitalization.

You (or your spouse, if filing jointly) acquired

holder.

an interest in an Archer MSA or a Medicare

You can also have coverage (either through

Qualified Medical Expenses

Advantage MSA because of the death of the

insurance or otherwise) for accidents, disability,

account holder. See

Death of Account

Holder,

dental care, vision care, or long-term care.

Generally, qualified medical expenses for

later.

Archer MSA purposes are unreimbursed

Disabled

You (or your spouse, if filing jointly) were a

medical expenses that could otherwise be

policyholder who received payments under an

An individual generally is considered disabled if

deducted on Schedule A (Form 1040). See the

LTC insurance contract or received any

he or she is unable to engage in any substantial

Sep 08, 2016

Cat. No. 24188L

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8