AB CD

PRINT FORM

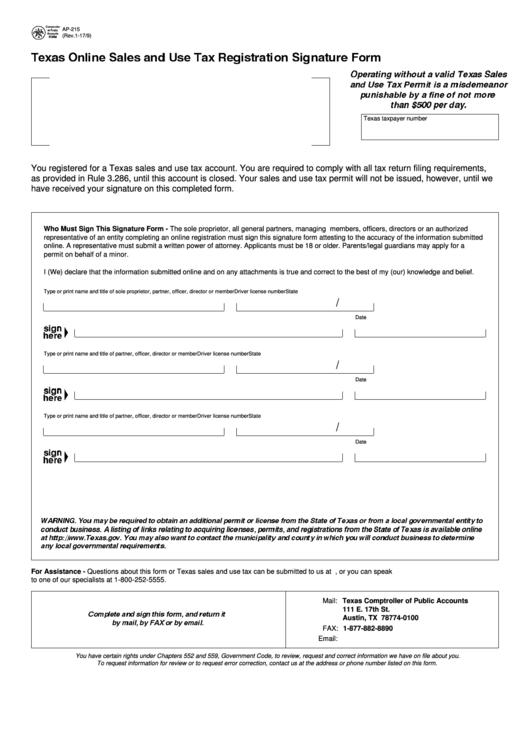

AP-215

(Rev.1-17/9)

Texas Online Sales and Use Tax Registration Signature Form

Operating without a valid Texas Sales

and Use Tax Permit is a misdemeanor

punishable by a fine of not more

than $500 per day.

Texas taxpayer number

You registered for a Texas sales and use tax account. You are required to comply with all tax return filing requirements,

as provided in Rule 3.286, until this account is closed. Your sales and use tax permit will not be issued, however, until we

have received your signature on this completed form.

Who Must Sign This Signature Form - The sole proprietor, all general partners, managing members, officers, directors or an authorized

representative of an entity completing an online registration must sign this signature form attesting to the accuracy of the information submitted

online. A representative must submit a written power of attorney. Applicants must be 18 or older. Parents/legal guardians may apply for a

permit on behalf of a minor.

I (We) declare that the information submitted online and on any attachments is true and correct to the best of my (our) knowledge and belief.

AB

Type or print name and title of sole proprietor, partner, officer, director or member

Driver license number

State

/

Date

AB

Type or print name and title of partner, officer, director or member

Driver license number

State

/

Date

AB

Type or print name and title of partner, officer, director or member

Driver license number

State

/

Date

WARNING. You may be required to obtain an additional permit or license from the State of Texas or from a local governmental entity to

conduct business. A listing of links relating to acquiring licenses, permits, and registrations from the State of Texas is available online

at You may also want to contact the municipality and county in which you will conduct business to determine

any local governmental requirements.

For Assistance - Questions about this form or Texas sales and use tax can be submitted to us at , or you can speak

to one of our specialists at 1-800-252-5555.

Mail: Texas Comptroller of Public Accounts

111 E. 17th St.

Complete and sign this form, and return it

Austin, TX 78774-0100

by mail, by FAX or by email.

FAX: 1-877-882-8890

Email: sales.applications@cpa.texas.gov

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct information we have on file about you.

To request information for review or to request error correction, contact us at the address or phone number listed on this form.

1

1