Dd Form 2656 Instructions - Data For Payment Of Retired Personnel - April 2009 Page 3

ADVERTISEMENT

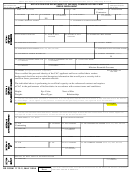

DATA FOR PAYMENT OF RETIRED PERSONNEL

(Please read Instructions and Privacy Act Statement before completing form.)

SECTION I - PAY IDENTIFICATION

5. DATE OF

3. RETIREMENT/

1. NAME

2. SSN

4. RANK/PAY GRADE/

(LAST, First, Middle Initial)

TRANSFER DATE

BIRTH

BRANCH OF SERVICE

(YYYYMMDD)

(YYYYMMDD)

6. CORRESPONDENCE ADDRESS

(Ensure DFAS - Cleveland Center is advised whenever your correspondence address changes.)

a. STREET (Include apartment number)

b. CITY

c. STATE d. ZIP CODE

e. TELEPHONE (Incl. area code)

SECTION II - DIRECT DEPOSIT/ELECTRONIC FUND TRANSFER (DD/EFT) INFORMATION (See Instructions)

7. ROUTING NUMBER

8. TYPE OF ACCOUNT

9. ACCOUNT NUMBER

(See Instructions)

(Savings (S) or

(See Instructions)

Checking (C))

10. FINANCIAL INSTITUTION

a. NAME

b. STREET ADDRESS

c. CITY

d. STATE e. ZIP CODE

SECTION III - SEPARATION PAYMENT INFORMATION

11. Complete if you have received any one of the payment types listed in 11.a.

a. DID YOU RECEIVE SEVERANCE PAY (SE), READJUSTMENT PAY (RP), SEPARATION PAY (SP),

b. TYPE OF PAYMENT

c. GROSS AMOUNT

VOLUNTARY SEPARATION INCENTIVE (VSI), OR SPECIAL SEPARATION BONUS (SSB)?

(X one. If "Yes," attach a copy of the orders which authorized the payment, and a copy of

the DD Form 214.)

YES

NO

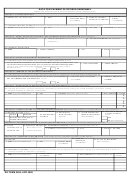

SECTION IV - MEMBER OF THE RESERVE COMPONENT

12. Complete only if a member or former member of the reserve component not on active duty retiring at age 60.

a. DO YOU RECEIVE OR WERE YOU RECEIVING ON THE DATE OF RETIREMENT

b. EFFECTIVE DATE OF PAYMENT

c. MONTHLY AMOUNT OF

ANY VA COMPENSATION FOR DISABILITY? (X one)

(YYYYMMDD)

PAYMENT

YES

NO

SECTION V - DESIGNATION OF BENEFICIARIES FOR UNPAID RETIRED PAY (See INSTRUCTIONS)

13. Complete this section if you wish to designate a beneficiary or beneficiaries to receive any unpaid retired pay you are due at death.

(Continue in Section X, "Remarks," if necessary.)

a. NAME (Last, First, Middle Initial)

b. SSN

c. ADDRESS (Street, City, State, ZIP Code)

d. RELATIONSHIP e. SHARE

%

%

%

%

%

SECTION VI - FEDERAL INCOME TAX WITHHOLDING INFORMATION

(Submit information in Items 14 - 17 in lieu of IRS Form W-4 for tax purposes.)

18. ARE YOU A UNITED

15. TOTAL NUMBER

16. ADDITIONAL

17. I CLAIM EXEMPTION

14. MARITAL STATUS

(X one)

STATES CITIZEN?

OF EXEMPTIONS

WITHHOLDING

FROM WITHHOLDING

SINGLE

MARRIED

(X one)

CLAIMED

(Optional)

(Enter "EXEMPT")

YES

MARRIED BUT WITHHOLD AT

HIGHER SINGLE RATE

NO (See Instructions)

SECTION VII - VOLUNTARY STATE TAX WITHHOLDING INFORMATION (Complete only if monthly withholding is desired.)

19. STATE

20. MONTHLY AMOUNT

21. RESIDENCE ADDRESS

(If different from address listed in Item 6)

DESIGNATED TO

(Whole dollar amount

a. STREET (Include apartment number)

b. CITY

c. STATE d. ZIP CODE

RECEIVE TAX

not less than $10.00)

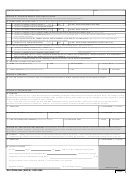

SECTION VIII - DEPENDENCY INFORMATION (This section must be completed regardless of SBP Election.)

23. DATE OF

24. PLACE OF MARRIAGE

22. SPOUSE

MARRIAGE

c. DATE OF BIRTH

(See Instructions)

a. NAME (Last, First, Middle Initial)

b. SSN

(YYYYMMDD)

(YYYYMMDD)

25. DEPENDENT CHILDREN (Indicate which child(ren) resulted from marriage to former spouse by entering (FS) after relationship in column d.

Continue in Section X, "Remarks," if necessary.)

b. DATE OF BIRTH

e. DISABLED?

d. RELATIONSHIP (Son, daughter,stepson, etc.)

a. NAME (Last, First, Middle Initial)

c. SSN

(YYYYMMDD)

(Yes/No)

DD FORM 2656, APR 2009

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4