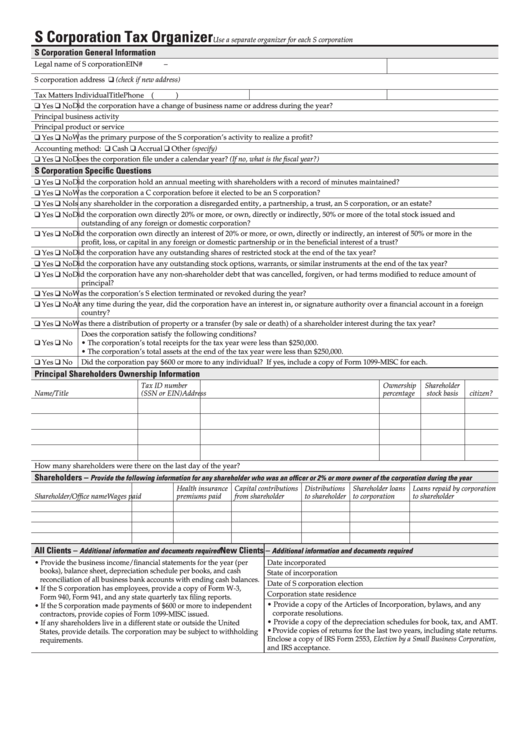

S Corporation Tax Organizer

Use a separate organizer for each S corporation

S Corporation General Information

Legal name of S corporation

EIN#

–

S corporation address ❑ (check if new address)

Tax Matters Individual

Title

Phone (

)

❑ Yes ❑ No Did the corporation have a change of business name or address during the year?

Principal business activity

Principal product or service

❑ Yes ❑ No Was the primary purpose of the S corporation’s activity to realize a profit?

Accounting method: ❑ Cash ❑ Accrual ❑ Other (specify)

❑ Yes ❑ No Does the corporation file under a calendar year? (If no, what is the fiscal year?)

S Corporation Specific Questions

❑ Yes ❑ No Did the corporation hold an annual meeting with shareholders with a record of minutes maintained?

❑ Yes ❑ No Was the corporation a C corporation before it elected to be an S corporation?

❑ Yes ❑ No Is any shareholder in the corporation a disregarded entity, a partnership, a trust, an S corporation, or an estate?

❑ Yes ❑ No Did the corporation own directly 20% or more, or own, directly or indirectly, 50% or more of the total stock issued and

outstanding of any foreign or domestic corporation?

❑ Yes ❑ No Did the corporation own directly an interest of 20% or more, or own, directly or indirectly, an interest of 50% or more in the

profit, loss, or capital in any foreign or domestic partnership or in the beneficial interest of a trust?

❑ Yes ❑ No Did the corporation have any outstanding shares of restricted stock at the end of the tax year?

❑ Yes ❑ No Did the corporation have any outstanding stock options, warrants, or similar instruments at the end of the tax year?

❑ Yes ❑ No Did the corporation have any non-shareholder debt that was cancelled, forgiven, or had terms modified to reduce amount of

principal?

❑ Yes ❑ No Was the corporation’s S election terminated or revoked during the year?

❑ Yes ❑ No At any time during the year, did the corporation have an interest in, or signature authority over a financial account in a foreign

country?

❑ Yes ❑ No Was there a distribution of property or a transfer (by sale or death) of a shareholder interest during the tax year?

Does the corporation satisfy the following conditions?

❑ Yes ❑ No

• The corporation’s total receipts for the tax year were less than $250,000.

• The corporation’s total assets at the end of the tax year were less than $250,000.

❑ Yes ❑ No Did the corporation pay $600 or more to any individual? If yes, include a copy of Form 1099-MISC for each.

Principal Shareholders Ownership Information

Tax ID number

Ownership

Shareholder

U.S.

Name/ Title

(SSN or EIN)

Address

percentage

stock basis

citizen?

How many shareholders were there on the last day of the year?

Shareholders –

Provide the following information for any shareholder who was an officer or 2% or more owner of the corporation during the year

Health insurance

Capital contributions

Distributions

Shareholder loans

Loans repaid by corporation

Shareholder/Office name

Wages paid

premiums paid

from shareholder

to shareholder

to corporation

to shareholder

All Clients –

New Clients –

Additional information and documents required

Additional information and documents required

• Provide the business income/financial statements for the year (per

Date incorporated

books), balance sheet, depreciation schedule per books, and cash

State of incorporation

reconciliation of all business bank accounts with ending cash balances.

Date of S corporation election

• If the S corporation has employees, provide a copy of Form W-3,

Corporation state residence

Form 940, Form 941, and any state quarterly tax filing reports.

• Provide a copy of the Articles of Incorporation, bylaws, and any

• If the S corporation made payments of $600 or more to independent

corporate resolutions.

contractors, provide copies of Form 1099-MISC issued.

• Provide a copy of the depreciation schedules for book, tax, and AMT.

• If any shareholders live in a different state or outside the United

• Provide copies of returns for the last two years, including state returns.

States, provide details. The corporation may be subject to withholding

Enclose a copy of IRS Form 2553, Election by a Small Business Corporation,

requirements.

and IRS acceptance.

1

1 2

2