Tax Organizer Template - 2012

Download a blank fillable Tax Organizer Template - 2012 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Tax Organizer Template - 2012 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Y / N

Y

N

Y / N

Y

N

Y / N

Y

N

Y / N

Y

N

Yes / No If yes, date of move: _________________

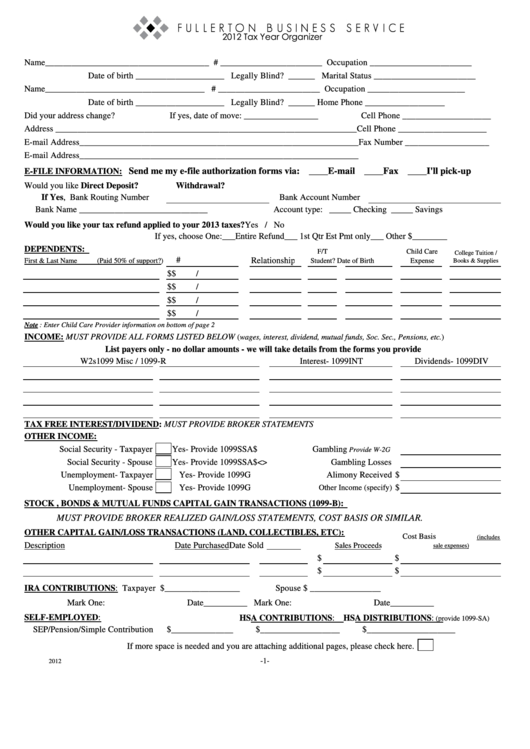

2012 Tax Year Organizer

Name_____________________________________ S.S.# _______________________ Occupation _______________________

Date of birth ____________________ Legally Blind? ______ Marital Status _______________________

Name____________________________________ S.S.# _______________________ Occupation ______________________

Date of birth ____________________ Legally Blind? ______

Home Phone __________________

Did your address change?

Cell Phone ____________________

Address ____________________________________________________________________

Cell Phone ____________________

E-mail Address_______________________________________________________________ Fax Number ___________________

E-mail Address_______________________________________________________________

Send me my e-file authorization forms via: ____E-mail ____Fax ____I'll pick-up

E-FILE INFORMATION:

Would you like Direct Deposit? Yes / No

Withdrawal? Yes / No

If Yes, Bank Routing Number

Bank Account Number

Bank Name _____________________________

Account type: _____ Checking _____ Savings

Would you like your tax refund applied to your 2013 taxes?

Yes / No

If yes, choose One:

___Entire Refund ___ 1st Qtr Est Pmt only

___ Other $________

DEPENDENTS:

F/T

Child Care

College Tuition /

S.S. #

Relationship

First & Last Name

(Paid 50% of support?)

Student?

Date of Birth

Expense

Books & Supplies

$

$

/

$

$

/

$

$

/

$

$

/

Note : Enter Child Care Provider information on bottom of page 2

INCOME: MUST PROVIDE ALL FORMS LISTED BELOW

(wages, interest, dividend, mutual funds, Soc. Sec., Pensions, etc. )

List payers only - no dollar amounts - we will take details from the forms you provide

W2s

1099 Misc / 1099-R

Interest- 1099INT

Dividends- 1099DIV

TAX FREE INTEREST/DIVIDEND: MUST PROVIDE BROKER STATEMENTS

OTHER INCOME:

Social Security - Taxpayer

Yes- Provide 1099SSA

Gambling

$

Provide W-2G

Social Security - Spouse

Yes- Provide 1099SSA

Gambling Losses

$ <

>

Unemployment- Taxpayer

Yes- Provide 1099G

Alimony Received

$

Unemployment- Spouse

Yes- Provide 1099G

$

Other Income (specify)

STOCK , BONDS & MUTUAL FUNDS CAPITAL GAIN TRANSACTIONS (1099-B):

MUST PROVIDE BROKER REALIZED GAIN/LOSS STATEMENTS, COST BASIS OR SIMILAR.

OTHER CAPITAL GAIN/LOSS TRANSACTIONS (LAND, COLLECTIBLES, ETC):

Cost Basis

(includes

Description

Date Purchased

Date Sold

Sales Proceeds

sale expenses)

$

$

$

$

IRA CONTRIBUTIONS: Taxpayer $_________________

Spouse $ ________________

Mark One: Roth / Traditional

Date__________

Mark One: Roth / Traditional

Date__________

SELF-EMPLOYED:

HSA CONTRIBUTIONS: HSA DISTRIBUTIONS:

(provide 1099-SA)

SEP/Pension/Simple Contribution

$______________

$__________________

$____________________

If more space is needed and you are attaching additional pages, please check here.

-1-

2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3