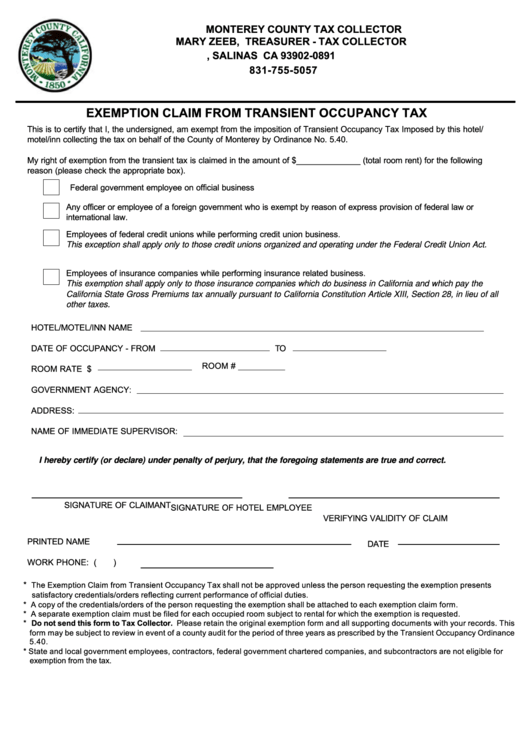

MONTEREY COUNTY TAX COLLECTOR

MARY ZEEB, TREASURER - TAX COLLECTOR

P.O. BOX 891, SALINAS CA 93902-0891

831-755-5057

EXEMPTION CLAIM FROM TRANSIENT OCCUPANCY TAX

This is to certify that I, the undersigned, am exempt from the imposition of Transient Occupancy Tax Imposed by this hotel/

motel/inn collecting the tax on behalf of the County of Monterey by Ordinance No. 5.40.

My right of exemption from the transient tax is claimed in the amount of $______________ (total room rent) for the following

reason (please check the appropriate box).

Federal government employee on official business

Any officer or employee of a foreign government who is exempt by reason of express provision of federal law or

international law.

Employees of federal credit unions while performing credit union business.

This exception shall apply only to those credit unions organized and operating under the Federal Credit Union Act.

Employees of insurance companies while performing insurance related business.

This exemption shall apply only to those insurance companies which do business in California and which pay the

California State Gross Premiums tax annually pursuant to California Constitution Article XIII, Section 28, in lieu of all

other taxes.

HOTEL/MOTEL/INN NAME

DATE OF OCCUPANCY - FROM

TO

ROOM #

ROOM RATE $

GOVERNMENT AGENCY:

ADDRESS:

NAME OF IMMEDIATE SUPERVISOR:

I hereby certify (or declare) under penalty of perjury, that the foregoing statements are true and correct.

SIGNATURE OF CLAIMANT

SIGNATURE OF HOTEL EMPLOYEE

VERIFYING VALIDITY OF CLAIM

PRINTED NAME

DATE

WORK PHONE: (

)

*

The Exemption Claim from Transient Occupancy Tax shall not be approved unless the person requesting the exemption presents

satisfactory credentials/orders reflecting current performance of official duties.

* A copy of the credentials/orders of the person requesting the exemption shall be attached to each exemption claim form.

* A separate exemption claim must be filed for each occupied room subject to rental for which the exemption is requested.

* Do not send this form to Tax Collector. Please retain the original exemption form and all supporting documents with your records. This

form may be subject to review in event of a county audit for the period of three years as prescribed by the Transient Occupancy Ordinance

5.40.

* State and local government employees, contractors, federal government chartered companies, and subcontractors are not eligible for

exemption from the tax.

1

1