Transient Occupancy Tax Return

Download a blank fillable Transient Occupancy Tax Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Transient Occupancy Tax Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

County of Santa Barbara

Mailing Address:

Treasurer-Tax Collector

PO Box 579

105 E. Anapamu St # 109

Santa Barbara, CA 93102

Santa Barbara, CA 93101

(805) 568-2927

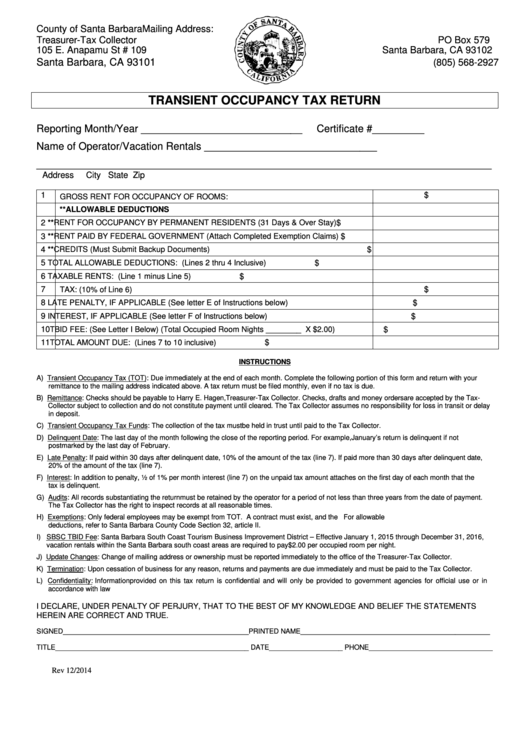

TRANSIENT OCCUPANCY TAX RETURN

Reporting Month/Year ____________________________

Certificate #_________

Name of Operator/Vacation Rentals ______________________________

_______________________________________________________________________________

Address

City

State

Zip

1

$

GROSS RENT FOR OCCUPANCY OF ROOMS:

**ALLOWABLE DEDUCTIONS

**RENT FOR OCCUPANCY BY PERMANENT RESIDENTS (31 Days & Over Stay)

2

$

3

**RENT PAID BY FEDERAL GOVERNMENT (Attach Completed Exemption Claims)

$

4

**CREDITS (Must Submit Backup Documents)

$

5

TOTAL ALLOWABLE DEDUCTIONS: (Lines 2 thru 4 Inclusive)

$

6

TAXABLE RENTS: (Line 1 minus Line 5)

$

7

TAX: (10% of Line 6)

$

8

$

LATE PENALTY, IF APPLICABLE (See letter E of Instructions below)

9

INTEREST, IF APPLICABLE (See letter F of Instructions below)

$

10

TBID FEE: (See Letter I Below) (Total Occupied Room Nights ________ X $2.00)

$

11

$

TOTAL AMOUNT DUE: (Lines 7 to 10 inclusive)

INSTRUCTIONS

A) Transient Occupancy Tax (TOT): Due immediately at the end of each month. Complete the following portion of this form and return with your

remittance to the mailing address indicated above. A tax return must be filed monthly, even if no tax is due.

B) Remittance: Checks should be payable to Harry E. Hagen, Treasurer-Tax Collector. Checks, drafts and money orders are accepted by the Tax-

Collector subject to collection and do not constitute payment until cleared. The Tax Collector assumes no responsibility for loss in transit or delay

in deposit.

C) Transient Occupancy Tax Funds: The collection of the tax must be held in trust until paid to the Tax Collector.

D) Delinquent Date: The last day of the month following the close of the reporting period. For example, January’s return is delinquent if not

postmarked by the last day of February.

E) Late Penalty: If paid within 30 days after delinquent date, 10% of the amount of the tax (line 7). If paid more than 30 days after delinquent date,

20% of the amount of the tax (line 7).

F) Interest: In addition to penalty, ½ of 1% per month interest (line 7) on the unpaid tax amount attaches on the first day of each month that the

tax is delinquent.

G) Audits: All records substantiating the return must be retained by the operator for a period of not less than three years from the date of payment.

The Tax Collector has the right to inspect records at all reasonable times.

H) Exemptions: Only federal employees may be exempt from TOT. A contract must exist, and the U.S. Government must pay directly. For allowable

deductions, refer to Santa Barbara County Code Section 32, article II.

I) SBSC TBID Fee: Santa Barbara South Coast Tourism Business Improvement District – Effective January 1, 2015 through December 31, 2016,

vacation rentals within the Santa Barbara south coast areas are required to pay $2.00 per occupied room per night.

J) Update Changes: Change of mailing address or ownership must be reported immediately to the office of the Treasurer-Tax Collector.

K) Termination: Upon cessation of business for any reason, returns and payments are due immediately and must be paid to the Tax Collector.

L) Confidentiality: Information provided on this tax return is confidential and will only be provided to government agencies for official use or in

accordance with law

I DECLARE, UNDER PENALTY OF PERJURY, THAT TO THE BEST OF MY KNOWLEDGE AND BELIEF THE STATEMENTS

HEREIN ARE CORRECT AND TRUE.

SIGNED________________________________________________ PRINTED NAME_________________________________________________

TITLE__________________________________________________ DATE___________________ PHONE________________________________

Rev 12/2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1