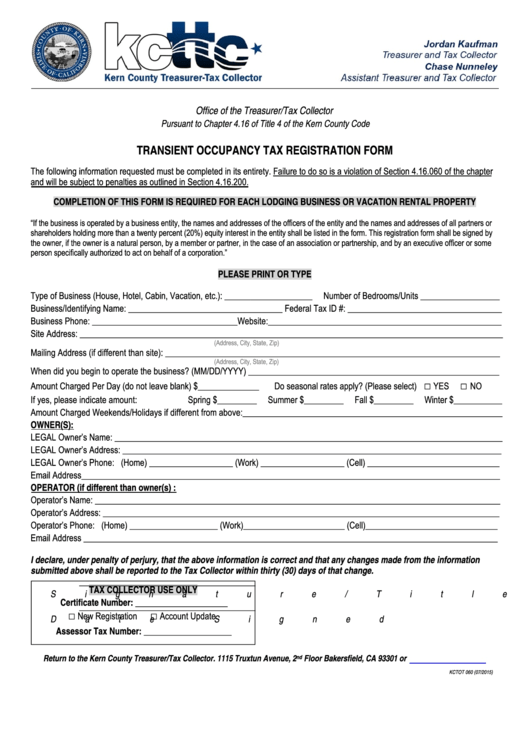

Office of the Treasurer/Tax Collector

Pursuant to Chapter 4.16 of Title 4 of the Kern County Code

TRANSIENT OCCUPANCY TAX REGISTRATION FORM

The following information requested must be completed in its entirety. Failure to do so is a violation of Section 4.16.060 of the chapter

and will be subject to penalties as outlined in Section 4.16.200.

COMPLETION OF THIS FORM IS REQUIRED FOR EACH LODGING BUSINESS OR VACATION RENTAL PROPERTY

“If the business is operated by a business entity, the names and addresses of the officers of the entity and the names and addresses of all partners or

shareholders holding more than a twenty percent (20%) equity interest in the entity shall be listed in the form. This registration form shall be signed by

the owner, if the owner is a natural person, by a member or partner, in the case of an association or partnership, and by an executive officer or some

person specifically authorized to act on behalf of a corporation.”

PLEASE PRINT OR TYPE

Type of Business (House, Hotel, Cabin, Vacation, etc.): ____________________

Number of Bedrooms/Units __________________

Business/Identifying Name: ___________________________________ Federal Tax ID #: ___________________________________

Business Phone: _________________________________Website:_____________________________________________________

Site Address: ________________________________________________________________________________________________

(Address, City, State, Zip)

Mailing Address (if different than site): ____________________________________________________________________________

(Address, City, State, Zip)

When did you begin to operate the business? (MM/DD/YYYY) _________________________________________________________

□

□

Amount Charged Per Day (do not leave blank) $______________

Do seasonal rates apply? (Please select)

YES

NO

If yes, please indicate amount:

Spring $_________

Summer $_________

Fall $_________

Winter $___________

Amount Charged Weekends/Holidays if different from above:___________________________________________________________

OWNER(S):

LEGAL Owner’s Name: ________________________________________________________________________________________

LEGAL Owner’s Address: ______________________________________________________________________________________

LEGAL Owner’s Phone: (Home) ___________________ (Work) ___________________ (Cell) ______________________________

Email Address_______________________________________________________________________________________________

OPERATOR (if different than owner(s) :

Operator’s Name: ____________________________________________________________________________________________

Operator’s Address: __________________________________________________________________________________________

Operator’s Phone: (Home) ____________________ (Work)_______________________ (Cell)______________________________

Email Address ______________________________________________________________________________________________

I declare, under penalty of perjury, that the above information is correct and that any changes made from the information

submitted above shall be reported to the Tax Collector within thirty (30) days of that change.

________________________________________

TAX COLLECTOR USE ONLY

Signature/Title

Certificate Number: _____________________

________________________________________

□

□

New Registration

Account Update

Date Signed

Assessor Tax Number: ____________________

Return to the Kern County Treasurer/Tax Collector. 1115 Truxtun Avenue, 2

Floor Bakersfield, CA 93301 or

kerntot@co.kern.ca.us

nd

KCTOT 060 (07/2015)

1

1