Instructions - Form 741 - Kentucky Fiduciary Income Tax Return - 2016

ADVERTISEMENT

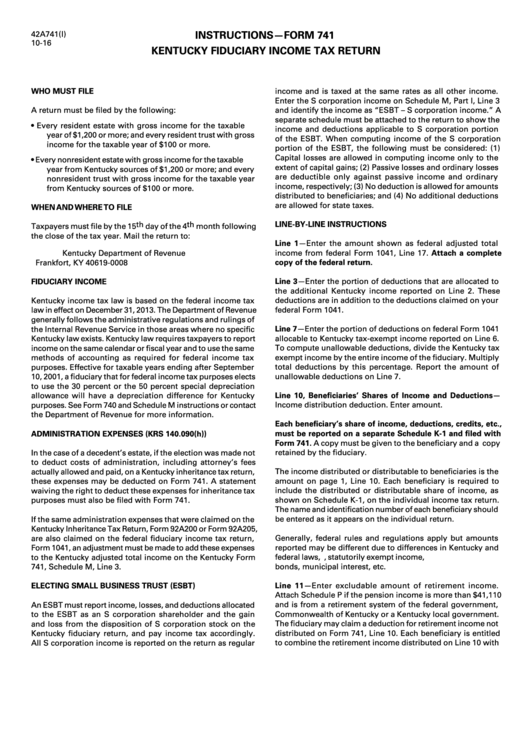

INSTRUCTIONS—FORM 741

42A741(I)

10-16

KENTUCKY FIDUCIARY INCOME TAX RETURN

income and is taxed at the same rates as all other income.

WHO MUST FILE

Enter the S corporation income on Schedule M, Part I, Line 3

A return must be filed by the following:

and identify the income as “ESBT – S corporation income. ” A

separate schedule must be attached to the return to show the

•

Every resident estate with gross income for the taxable

income and deductions applicable to S corporation portion

year of $1,200 or more; and every resident trust with gross

of the ESBT. When computing income of the S corporation

income for the taxable year of $100 or more.

portion of the ESBT, the following must be considered: (1)

Capital losses are allowed in computing income only to the

•

Every nonresident estate with gross income for the taxable

extent of capital gains; (2) Passive losses and ordinary losses

year from Kentucky sources of $1,200 or more; and every

are deductible only against passive income and ordinary

nonresident trust with gross income for the taxable year

income, respectively; (3) No deduction is allowed for amounts

from Kentucky sources of $100 or more.

distributed to beneficiaries; and (4) No additional deductions

are allowed for state taxes.

WHEN AND WHERE TO FILE

Taxpayers must file by the 15 th day of the 4 th month following

LINE-BY-LINE INSTRUCTIONS

the close of the tax year. Mail the return to:

Line 1—Enter the amount shown as federal adjusted total

Kentucky Department of Revenue

income from federal Form 1041, Line 17. Attach a complete

Frankfort, KY 40619-0008

copy of the federal return.

FIDUCIARY INCOME

Line 3—Enter the portion of deductions that are allocated to

the additional Kentucky income reported on Line 2. These

Kentucky income tax law is based on the federal income tax

deductions are in addition to the deductions claimed on your

federal Form 1041.

law in effect on December 31, 2013. The Department of Revenue

generally follows the administrative regulations and rulings of

Line 7—Enter the portion of deductions on federal Form 1041

the Internal Revenue Service in those areas where no specific

allocable to Kentucky tax-exempt income reported on Line 6.

Kentucky law exists. Kentucky law requires taxpayers to report

To compute unallowable deductions, divide the Kentucky tax

income on the same calendar or fiscal year and to use the same

exempt income by the entire income of the fiduciary. Multiply

methods of accounting as required for federal income tax

total deductions by this percentage. Report the amount of

purposes. Effective for taxable years ending after September

unallowable deductions on Line 7.

10, 2001, a fiduciary that for federal income tax purposes elects

to use the 30 percent or the 50 percent special depreciation

Line 10, Beneficiaries’ Shares of Income and Deductions—

allowance will have a depreciation difference for Kentucky

Income distribution deduction. Enter amount.

purposes. See Form 740 and Schedule M instructions or contact

the Department of Revenue for more information.

Each beneficiary’s share of income, deductions, credits, etc.,

must be reported on a separate Schedule K-1 and filed with

ADMINISTRATION EXPENSES (KRS 140.090(h))

Form 741. A copy must be given to the beneficiary and a copy

retained by the fiduciary.

In the case of a decedent’s estate, if the election was made not

to deduct costs of administration, including attorney’s fees

actually allowed and paid, on a Kentucky inheritance tax return,

The income distributed or distributable to beneficiaries is the

these expenses may be deducted on Form 741. A statement

amount on page 1, Line 10. Each beneficiary is required to

waiving the right to deduct these expenses for inheritance tax

include the distributed or distributable share of income, as

purposes must also be filed with Form 741.

shown on Schedule K-1, on the individual income tax return.

The name and identification number of each beneficiary should

If the same administration expenses that were claimed on the

be entered as it appears on the individual return.

Kentucky Inheritance Tax Return, Form 92A200 or Form 92A205,

are also claimed on the federal fiduciary income tax return,

Generally, federal rules and regulations apply but amounts

Form 1041, an adjustment must be made to add these expenses

reported may be different due to differences in Kentucky and

to the Kentucky adjusted total income on the Kentucky Form

federal laws, e.g., statutorily exempt income, U.S. government

741, Schedule M, Line 3.

bonds, municipal interest, etc.

ELECTING SMALL BUSINESS TRUST (ESBT)

Line 11—Enter excludable amount of retirement income.

Attach Schedule P if the pension income is more than $41,110

An ESBT must report income, losses, and deductions allocated

and is from a retirement system of the federal government,

Commonwealth of Kentucky or a Kentucky local government.

to the ESBT as an S corporation shareholder and the gain

The fiduciary may claim a deduction for retirement income not

and loss from the disposition of S corporation stock on the

distributed on Form 741, Line 10. Each beneficiary is entitled

Kentucky fiduciary return, and pay income tax accordingly.

to combine the retirement income distributed on Line 10 with

All S corporation income is reported on the return as regular

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4