Instructions For Form 741 - Kentucky Fiduciary Income Tax Return

ADVERTISEMENT

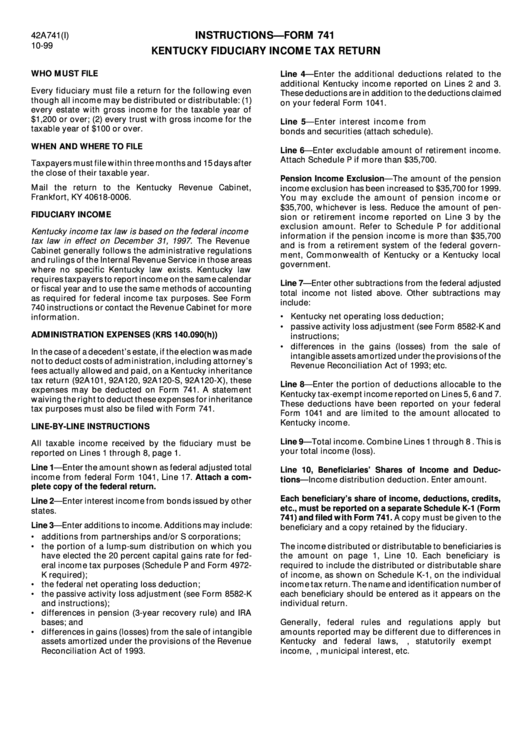

INSTRUCTIONS—FORM 741

42A741(I)

10-99

KENTUCKY FIDUCIARY INCOME TAX RETURN

WHO MUST FILE

Line 4—Enter the additional deductions related to the

additional Kentucky income reported on Lines 2 and 3.

Every fiduciary must file a return for the following even

These deductions are in addition to the deductions claimed

though all income may be distributed or distributable: (1)

on your federal Form 1041.

every estate with gross income for the taxable year of

$1,200 or over; (2) every trust with gross income for the

Line 5—Enter interest income from U.S. government

taxable year of $100 or over.

bonds and securities (attach schedule).

WHEN AND WHERE TO FILE

Line 6—Enter excludable amount of retirement income.

Attach Schedule P if more than $35,700.

Taxpayers must file within three months and 15 days after

the close of their taxable year.

Pension Income Exclusion—The amount of the pension

Mail the return to the Kentucky Revenue Cabinet,

income exclusion has been increased to $35,700 for 1999.

Frankfort, KY 40618-0006.

You may exclude the amount of pension income or

$35,700, whichever is less. Reduce the amount of pen-

FIDUCIARY INCOME

sion or retirement income reported on Line 3 by the

exclusion amount. Refer to Schedule P for additional

Kentucky income tax law is based on the federal income

information if the pension income is more than $35,700

tax law in effect on December 31, 1997. The Revenue

and is from a retirement system of the federal govern-

Cabinet generally follows the administrative regulations

ment, Commonwealth of Kentucky or a Kentucky local

and rulings of the Internal Revenue Service in those areas

government.

where no specific Kentucky law exists. Kentucky law

requires taxpayers to report income on the same calendar

Line 7—Enter other subtractions from the federal adjusted

or fiscal year and to use the same methods of accounting

total income not listed above. Other subtractions may

as required for federal income tax purposes. See Form

include:

740 instructions or contact the Revenue Cabinet for more

Kentucky net operating loss deduction;

information.

passive activity loss adjustment (see Form 8582-K and

ADMINISTRATION EXPENSES (KRS 140.090(h))

instructions;

differences in the gains (losses) from the sale of

In the case of a decedent’s estate, if the election was made

intangible assets amortized under the provisions of the

not to deduct costs of administration, including attorney’s

Revenue Reconciliation Act of 1993; etc.

fees actually allowed and paid, on a Kentucky inheritance

tax return (92A101, 92A120, 92A120-S, 92A120-X), these

Line 8—Enter the portion of deductions allocable to the

expenses may be deducted on Form 741. A statement

Kentucky tax-exempt income reported on Lines 5, 6 and 7.

waiving the right to deduct these expenses for inheritance

These deductions have been reported on your federal

tax purposes must also be filed with Form 741.

Form 1041 and are limited to the amount allocated to

Kentucky income.

LINE-BY-LINE INSTRUCTIONS

Line 9—Total income. Combine Lines 1 through 8 . This is

All taxable income received by the fiduciary must be

your total income (loss).

reported on Lines 1 through 8, page 1.

Line 1—Enter the amount shown as federal adjusted total

Line 10, Beneficiaries’ Shares of Income and Deduc-

income from federal Form 1041, Line 17. Attach a com-

tions—Income distribution deduction. Enter amount.

plete copy of the federal return.

Each beneficiary’s share of income, deductions, credits,

Line 2—Enter interest income from bonds issued by other

etc., must be reported on a separate Schedule K-1 (Form

states.

741) and filed with Form 741. A copy must be given to the

Line 3—Enter additions to income. Additions may include:

beneficiary and a copy retained by the fiduciary.

additions from partnerships and/or S corporations;

the portion of a lump-sum distribution on which you

The income distributed or distributable to beneficiaries is

have elected the 20 percent capital gains rate for fed-

the amount on page 1, Line 10. Each beneficiary is

eral income tax purposes (Schedule P and Form 4972-

required to include the distributed or distributable share

K required);

of income, as shown on Schedule K-1, on the individual

the federal net operating loss deduction;

income tax return. The name and identification number of

the passive activity loss adjustment (see Form 8582-K

each beneficiary should be entered as it appears on the

and instructions);

individual return.

differences in pension (3-year recovery rule) and IRA

bases; and

Generally, federal rules and regulations apply but

differences in gains (losses) from the sale of intangible

amounts reported may be different due to differences in

assets amortized under the provisions of the Revenue

Kentucky and federal laws, i.e., statutorily exempt

Reconciliation Act of 1993.

income, U.S. government bonds, municipal interest, etc.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2