Business Return Of Tangible Property And Machinery & Tools Spotsylvania County Form - 2007 (Expired) Page 3

ADVERTISEMENT

2006

2007

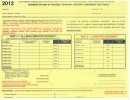

BUSINESS RETURN OF TANGIBLE PROPERTY AND MACHINERY & TOOLS

SPOTSYLVANIA COUNTY

Office Use Only

Page 2 of 3

Account # ______________

MACHINERY AND TOOLS USED IN a manufacturing,

mining, processing or reprocessing, radio or television

broadcasting, dairy, dry cleaning or laundry business.

All machinery and tools used in above captioned businesses are segregated by Section 58.1-3507, Code of V

irginia,

as amended, for local taxation exclusively; and each county, city and town is required to make a separate

classification for all such machinery and tools. 58.1-3518 requires that the original total capitalized cost of all

machinery and tools be listed or the cost that woul

d have been capitalized if IRC Section 179 had not been taken.

Cost of Property

Year Purchased

Furniture, Fixtures & Equipment,

For Office Use Only

Machinery & Tools, etc.

2002 & Prior

20%

2003

30%

2004

40%

2005

45%

2006

50%

TOTAL ACTUAL COST

OF PROPERTY OWNED

$

1/1/2007

MACHIN ERY AND TOOLS USED IN a semiconductor manufacturing or food processing – Code of Virginia 58.1-

3508.1

Cost of Property

Year Purchased

Furniture, Fixtures & Equipment,

For Office Use Only

Machinery & Tools, etc.

2002 & Prior

20%

2003

30%

2004

40%

2005

45%

2006

50%

TOTAL ACTUAL COST

OF PROPERTY OWNED

$

1/1/2007

LIST BELOW ALL TANGIBLE PROPERTY LEASED OR RENTED FROM OTHERS AS REQUIRED

BY THE CODE OF VIRGINIA 58.1-35

18

Name & Address of

Date Lease began and Description of Item

Amount of

Length of

Actual Owner

(Including Vehicle License Plate Number)

Monthly Lease

Lease

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4