Business Return Of Tangible Property And Machinery & Tools Spotsylvania County Form - 2007 (Expired) Page 2

ADVERTISEMENT

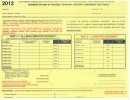

2007

BUSINESS RETURN OF TANGIBLE PROPERTY AND MACHINERY & TOOLS

SPOTSYLVANIA COUNTY

Office Use Only

COMMISSIONER OF THE REVENUE

Account # _____________

DEBORAH F WILILAMS

BPOL # _____________

PO BOX 175, SPOTSYLVANIA, VA 22553

MT # _____________

Phone: (540) 507-7051

Fax: (540) 582-3630

PLEASE FILE VEHICLE (S) AND/OR PROPERTY AS TITLED WITH DMV. THIS IS TO ENSURE PROPER BILLING FROM THE COUNTY.

Owner

___________________________________________

Trade

_________________________________________

Name:

(

Name:

If Corp, LLC etc – please list name as filed with the SCC)

Mailing

________________________________________

Physical

________________________________________

Address:

PO Box / Block / Street Name

Address:

Block/Street Name (no PO or Private Mail Box)

________________________________________

________________________________________

City

State

Zip

City

State

Zip

Phone

(______) _______ - ______________

ext _____________

Phone at Location:

(______) _______ - ___________

SSN #

_______-______-________

SSN #

_______-______-________

Federal Id #

_____ -_______________

Start Date of Business:

____/_____/____

Type of Business:

__ Individual

__ Partnership __ Corporation __ LLC

Description of Business

:

______________________________________________________________________________________________

Instructions:

Attach a copy of Depreciation & Amortization Form 4562.

Cost values to report: In reporting this form obtain cost values from capital depreciable assets as contained in your

books of account. Values to be reported are actual cost of the motor vehicles, furniture and fixtures, and machinery &

tools before allowance for depreciation. COST VALUES OF ITEMS FULLY DEPRECIATED, BUT STILL IN USE MUST

BE INCLUDED.

___________________________________________________________________________________________________________

SCHEDULE BELOW FOR BUSINESS PROFESSIONS, RENTALS, CABLE TV, ETC PROPERTY

Attach a list of all Equipment, Furniture, Fixtures, etc., used in your business. List name of item, date purchased and

cost of item.

If taxpayer is engaged in a manufacturing, mining, processing, or reprocessing, radio, television broadcasting, dairy,

dry cleaning, or laundry business or has leased property in their possession: Check here { } see page 2.

Cost of Property

Furniture, Fixtures & Equipment,

Year Purchased

For Office Use Only

Machinery & Tools, etc.

2002 & Prior

20%

2003

30%

2004

40%

2005

45%

2006

50%

TOTAL ACTUAL COST

OF PROPERTY OWNED

$

1/1/2007

HEAVY CONSTRUCTION MACHINERY (please attach list)

Date Acquired

Description

Cost

S

/

/

/

/

/

/

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4