Form Sc 1120s - 'S' Corporation Income Tax Return 2007 Page 3

ADVERTISEMENT

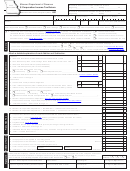

SC1120S

Page 3

SCHEDULES E, F, G, AND H ARE TO BE COMPLETED BY MULTI-STATE CORPORATIONS

SCHEDULE E

COMPUTATION FOR LICENSE FEE - MULTI-STATE CORPORATIONS

1. Total Capital and Paid-in-Surplus at end of Year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

2. SC PROPORTION: (line 1 X ratio from Schedule H-1, H-2 or H-3, as appropriate) OR enter amount from Schedule

H-4, Part II. Also enter on line 14, Part II . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

SCHEDULE F

INCOME SUBJECT TO DIRECT ALLOCATION

(B) Gross

(C) Related

(D) Net Amounts

(E) Net Amounts

(A) Allocated Income

Amounts

Expenses

(Column B minus Column (C)

Allocated Directly to SC

1. Total Allocated Income (Enter the total of Column D here)

2. Total Income Allocated to SC (Enter the total of Column E)

Attach an explanation of each type of income listed above that is not allocated to South Carolina.

SCHEDULE G

COMPUTATION OF TAXABLE INCOME FOR CORPORATIONS CLAIMING MULTI-STATE OPERATIONS

1. Total net income as reconciled. Enter amount from line 3, Page 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2. Less: Income subject to direct allocation to SC and other states from Schedule F, line 1. . . . . . . . . . . . . . . .

2.

3. Total net income subject to apportionment (line 1 less line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. Multiply amount on line 3 by appropriate ratio from Schedule H-1, H-2, or H-3 and enter result here OR

enter amount from Schedule H-4, Part I . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. Add: Income subject to direct allocation to SC from Schedule F, line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Total S.C. Net Income (sum of lines 4 and 5 above) also enter on line 4, Part 1 of Page 1 . . . . . . . . . . . . . .

6.

COMPUTATION OF FOUR FACTOR APPORTIONMENT RATIO

SCHEDULE H-1

1. Property Within South Carolina

2. Total Property Everywhere

(a) Beginning Period

(b) Ending Period

(a) Beginning Period

(b) Ending Period

1. Land

2. Buildings

3. Machinery and Equipment

4. Inventories

5. Other Property

<

> <

>

<

>

<

>

6. Exclusions

7. TOTAL (add lines 1 - 5; subtract line 6)

1. Within SC

2. Total Everywhere

3. Ratio

8.

Avg. of Beginning and Ending Period (add line 7a and b and divide by 2)

9. Rental or Lease Value

:

%

10. TOTAL

Property Add lines 8 and 9. (Col. 1

Col. 2 and enter ratio in Col. 3)

11. GROSS Payroll

<

>

<

>

12. Less: Officers Compensation and Exclusions

:

%

13. TOTAL Payroll (Col. 1

Col. 2 and enter ratio in Col. 3)

:

%

14. TOTAL Sales (Col. 1

Col. 2 and enter ratio in Col. 3)

%

15. TOTAL Sales (same as line 14)

%

16. TOTAL of Ratios (add Column 3 - lines 10,13, 14 and 15)

%

17. Arithmetical Average of Ratios

SCHEDULE H - 2

COMPUTATION OF GROSS RECEIPTS RATIO

1. In SC

2. Total Everywhere

3. Ratio

1. Total Gross Receipts

<

> <

>

2. Less: Exclusion (see instructions)

3. Gross Receipts (for ratio)

:

4. Ratio of Gross Receipts (line 3, Col. 1

line 3, Col. 2)

%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5