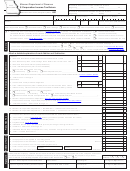

Form Sc 1120s - 'S' Corporation Income Tax Return 2007 Page 4

ADVERTISEMENT

SC1120S

Page 4

SCHEDULE H-3

COMPUTATION OF RATIO FOR PUBLIC SERVICE CORPORATIONS

Amount

Ratio

1. Total Within South Carolina

2. Total for System

:

%

3. Ratio (South Carolina

Total System)

SCHEDULE H-4

COMPUTATION OF SINGLE FACTOR APPORTIONMENT

SINGLE FACTOR APPORTIONMENT RATIO SCHEDULE

Amount

Ratio

1. Total Sales Within South Carolina

2. Total Sales Everywhere

:

3. Ratio (South Carolina

Everywhere)

Note: If there are no sales anywhere, enter 100% on Line 3, if South Carolina is the principal

place of business OR enter 0% on Line 3 if principal place of business is outside SC.

COMPUTATION OF SC NET INCOME SUBJECT TO TAX FOR MULTI-STATE CORPORATION

PART I

QUALIFYING FOR SINGLE FACTOR APPORTIONMENT

1. Enter amount from Sch G, Line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

%

2. Enter Ratio from Sch H-1, Line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. Multiply Line 2 by Line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

%

4. Enter Ratio from Line 3 of single factor apportionment schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. Multiply Line 1 by Line 4. If Line 3 is less than Line 5, STOP HERE and enter amount from Line 3 on

Schedule G,Line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Line 3 minus Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

7. For tax year 2007, multiply amount on Line 6 by 20% (.20). This is the amount of reduction in SC taxable

income allowed this year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Line 3 minus Line 7. Enter this amount on Sch G, Line 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

PART II

COMPUTATION OF LICENSE FEE - MULTI-STATE CORPORATION QUALIFYING

FOR SINGLE FACTOR APPORTIONMENT

1. Total Capital and Paid-in-Surplus at the end of the year. If $10,000 or less, STOP HERE and enter on

Schedule E, Line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

%

2. Enter the ratio from Sch H-1, Line 17. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. Multiply Line 1 by Line 2. If $10,000 or less, STOP HERE and enter on Schedule E, Line 2 . . . . . . . . . . . .

3.

%

4. Enter the ratio from Line 3 of single factor apportionment schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. Multiply Line 1 by Line 4. If Line 3 is less than Line 5, STOP HERE and enter amount from Line 3 on

Schedule E Line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Line 3 minus Line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

7. For tax year 2007, multiply the amount on Line 6 by 20% (.20). This is the amount of reduction of license

fee basis allowed this year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Line 3 minus Line 7. Enter here and on Schedule E, Line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5