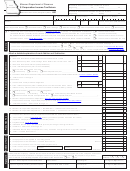

Form Sc 1120s - 'S' Corporation Income Tax Return 2007 Page 5

ADVERTISEMENT

Form SC1120S

Page 5

SCHEDULE SC-K WORKSHEET

* Enter amounts from corresponding lines on your federal Schedule K in Column B.

(A)

(B) *

(C)

(D)

(E)

(F)

Description

Amounts From

Plus or Minus

Federal Schedule K

Col. (D) Amounts Not

Col. (D) Amounts

Federal Schedule K

South Carolina

Amounts After SC

Apportioned or Allocated

Apportioned or

Adjustments

Adjustments

to SC

Allocated to SC

Ordinary Business

1

Income (loss)

Net Real Estate

2

Rents (loss)

3

Other Net Rents (loss)

4

Interest Income

5a

Ordinary dividends

5b

Qualified dividends

6

Royalties

Net Short Term

7

Cap. Gain (loss)

Net Long Term

8

Cap. Gain (loss)

S S

9

Net 1231 Gain (loss)

10

Other Income (loss)

S S

11

179 Deduction

12a

Contributions

Investment

12b

Interest Expense

S S

59 (e)(2) Expenditures

12c

Other Deductions

12d

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Non-Refundable Tax Credits: Enter Total Credits from SC1120-TC, line 43.

SC1120-TC must be attached to return.

If Qualified Subchapter S Subsidiary Election (QSSS), please list South Carolina subsidiaries only.

Attach schedule, if more space is needed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5