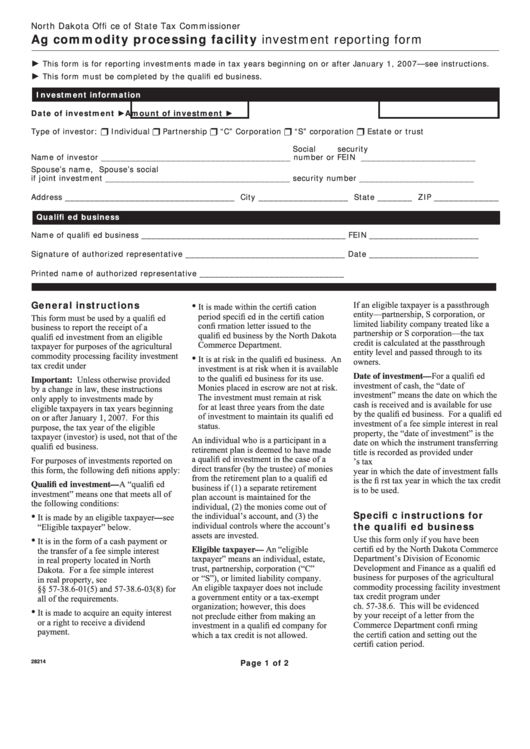

North Dakota Offi ce of State Tax Commissioner

Ag commodity processing facility investment reporting form

This form is for reporting investments made in tax years beginning on or after January 1, 2007—see instructions.

►

►

This form must be completed by the qualifi ed business.

Investment information

Date of investment ►

Amount of investment ►

Type of investor:

Individual

Partnership

“C” Corporation

“S” corporation

Estate or trust

Social security

Name of investor ______________________________________

number or FEIN _______________________

Spouse’s name,

Spouse’s social

if joint investment _____________________________________

security number _______________________

Address __________________________________ City __________________ State _______ ZIP _____________

Qualifi ed business

Name of qualifi ed business _________________________________________

FEIN ______________________

Signature of authorized representative ________________________________

Date ______________________

Printed name of authorized representative _____________________________

General instructions

•

If an eligible taxpayer is a passthrough

It is made within the certifi cation

entity—partnership, S corporation, or

period specifi ed in the certifi cation

This form must be used by a qualifi ed

limited liability company treated like a

confi rmation letter issued to the

business to report the receipt of a

partnership or S corporation—the tax

qualifi ed business by the North Dakota

qualifi ed investment from an eligible

credit is calculated at the passthrough

Commerce Department.

taxpayer for purposes of the agricultural

entity level and passed through to its

commodity processing facility investment

•

It is at risk in the qualifi ed business. An

owners.

tax credit under N.D.C.C. ch. 57-38.6.

investment is at risk when it is available

Date of investment—For a qualifi ed

to the qualifi ed business for its use.

Important: Unless otherwise provided

investment of cash, the “date of

Monies placed in escrow are not at risk.

by a change in law, these instructions

investment” means the date on which the

The investment must remain at risk

only apply to investments made by

cash is received and is available for use

for at least three years from the date

eligible taxpayers in tax years beginning

by the qualifi ed business. For a qualifi ed

of investment to maintain its qualifi ed

on or after January 1, 2007. For this

investment of a fee simple interest in real

status.

purpose, the tax year of the eligible

property, the “date of investment” is the

taxpayer (investor) is used, not that of the

An individual who is a participant in a

date on which the instrument transferring

qualifi ed business.

retirement plan is deemed to have made

title is recorded as provided under

a qualifi ed investment in the case of a

For purposes of investments reported on

N.D.C.C. ch. 47-19. The taxpayer’s tax

direct transfer (by the trustee) of monies

this form, the following defi nitions apply:

year in which the date of investment falls

from the retirement plan to a qualifi ed

is the fi rst tax year in which the tax credit

Qualifi ed investment—A “qualifi ed

business if (1) a separate retirement

is to be used.

investment” means one that meets all of

plan account is maintained for the

the following conditions:

individual, (2) the monies come out of

Specifi c instructions for

•

the individual’s account, and (3) the

It is made by an eligible taxpayer—see

individual controls where the account’s

the qualifi ed business

“Eligible taxpayer” below.

assets are invested.

•

Use this form only if you have been

It is in the form of a cash payment or

certifi ed by the North Dakota Commerce

Eligible taxpayer— An “eligible

the transfer of a fee simple interest

Department’s Division of Economic

taxpayer” means an individual, estate,

in real property located in North

Development and Finance as a qualifi ed

trust, partnership, corporation (“C”

Dakota. For a fee simple interest

business for purposes of the agricultural

or “S”), or limited liability company.

in real property, see N.D.C.C.

commodity processing facility investment

An eligible taxpayer does not include

§§ 57-38.6-01(5) and 57-38.6-03(8) for

tax credit program under N.D.C.C.

a government entity or a tax-exempt

all of the requirements.

ch. 57-38.6. This will be evidenced

organization; however, this does

•

It is made to acquire an equity interest

by your receipt of a letter from the

not preclude either from making an

or a right to receive a dividend

Commerce Department confi rming

investment in a qualifi ed company for

payment.

the certifi cation and setting out the

which a tax credit is not allowed.

certifi cation period.

Page 1 of 2

28214

1

1 2

2