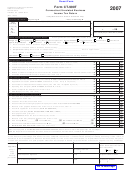

Schedule A

–– Unrelated Business Income Apportionment: See instructions.

Complete this schedule if the taxpayer’s unrelated trade or business is conducted at a regular place of business outside Connecticut.

Column C

Column A

Column B

Divide Column A by Column B.

Factor

Item

Connecticut

Everywhere

Carry to six places

1. (a) Inventories

00

00

(b) Tangible property

00

00

Property

(c) Real property

00

00

(Average value)

(d) Capitalized rent

00

00

1.

Total

00

00

0.

2. (a) Sales of tangibles

00

00

(b) Services

00

00

(c) Rentals

00

00

Receipts

00

00

(d) Other

00

00

2.

Total

0.

Wages, salaries,

and other

3.

Total

00

00

0.

compensation

0.

4. Total: Add Lines 1, 2, and 3 in Column C.

5. Apportionment fraction: Divide Line 4 by number of factors used. Enter here;

0.

on Schedule C, Line 4; and also on front page, Computation of Tax, Line 2. ................

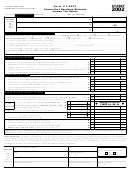

Schedule B

–– Connecticut Apportioned Operating Loss Carryover

1. 2000 Connecticut net operating loss available for use in 2008 ................................................................. 1

00

00

2. 2001 Connecticut net operating loss available for use in 2008 ................................................................. 2

3. 2002 Connecticut net operating loss available for use in 2008 ................................................................. 3

00

00

4. 2003 Connecticut net operating loss available for use in 2008 ................................................................. 4

5. 2004 Connecticut net operating loss available for use in 2008 ................................................................. 5

00

00

6. 2005 Connecticut net operating loss available for use in 2008 ................................................................. 6

7.

2006 Connecticut net operating loss available for use in 2008 ................................................................. 7

00

8. 2007 Connecticut net operating loss available for use in 2008 ................................................................. 8

00

9. Total: Add Lines 1 through 8. Enter here and on Computation of Tax, Line 4. ......................................... 9

00

Schedule C

–– Computation of Net Operating Loss Carryforward

00

1. Enter amount from Computation of Income, Line 6, if less than zero. ...................................................... 1

00

2. Add back specifi c deduction from 2008 federal Form 990-T, Part II, Line 33 ............................................ 2

3. Subtotal: Add Line 1 and Line 2. ............................................................................................................... 3

00

4. Apportionment fraction from Schedule A, Line 5 ....................................................................................... 4

0.

00

5. 2008 Connecticut net operating loss available for carryforward: Multiply Line 3 by Line 4. ...................... 5

Form CT-990T Back (Rev. 12/08)

1

1 2

2