Form Ptax-203-B - Illinois Real Estate Transfer Declaration Supplemental Form B

ADVERTISEMENT

Do not write in this area.

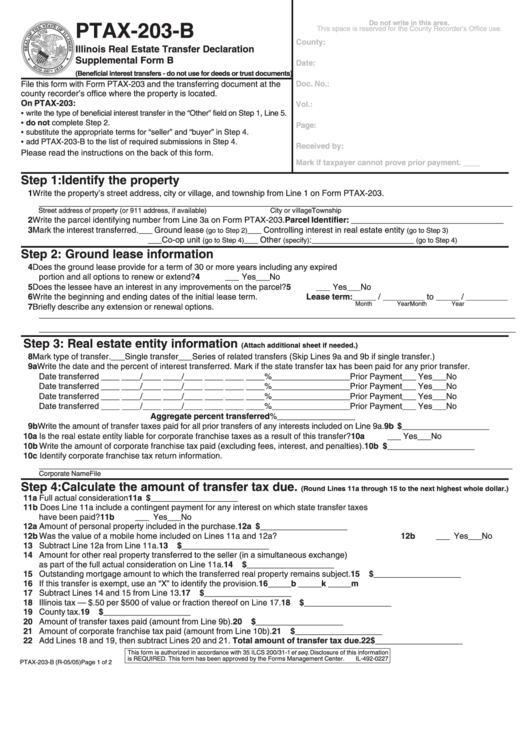

PTAX-203-B

This space is reserved for the County Recorder’s Office use.

County:

Illinois Real Estate Transfer Declaration

Supplemental Form B

Date:

(Beneficial interest transfers - do not use for deeds or trust documents)

File this form with Form PTAX-203 and the transferring document at the

Doc. No.:

county recorder’s office where the property is located.

On PTAX-203:

Vol.:

• write the type of beneficial interest transfer in the “Other” field on Step 1, Line 5.

• do not complete Step 2.

Page:

• substitute the appropriate terms for “seller” and “buyer” in Step 4.

• add PTAX-203-B to the list of required submissions in Step 4.

Received by:

Please read the instructions on the back of this form.

Mark if taxpayer cannot prove prior payment. ____

Step 1:Identify the property

1 Write the property’s street address, city or village, and township from Line 1 on Form PTAX-203.

_______________________________________________________________________________________________________

Street address of property (or 911 address, if available)

City or village

Township

2 Write the parcel identifying number from Line 3a on Form PTAX-203. Parcel Identifier: _________________________________

3 Mark the interest transferred. ___ Ground lease

___ Controlling interest in real estate entity

(go to Step 2)

(go to Step 3)

___ Co-op unit

___ Other

:______________________

(go to Step 4)

(specify)

(go to Step 4)

Step 2: Ground lease information

4 Does the ground lease provide for a term of 30 or more years including any expired

portion and all options to renew or extend?

4

___ Yes

___ No

5 Does the lessee have an interest in any improvements on the parcel?

5

___ Yes

___ No

6 Write the beginning and ending dates of the initial lease term.

Lease term:_____ / _________ to _____ / _________

Month

Year

Month

Year

7 Briefly describe any extension or renewal options.

________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________

Step 3: Real estate entity information

(Attach additional sheet if needed.)

8 Mark type of transfer.

___ Single transfer

___ Series of related transfers (Skip Lines 9a and 9b if single transfer.)

9a Write the date and the percent of interest transferred. Mark if the state transfer tax has been paid for any prior transfer.

Date transferred ____ ____/____ ____/____ ____ ____ ____ %_________________

Prior Payment ___ Yes

___ No

Date transferred ____ ____/____ ____/____ ____ ____ ____ %_________________

Prior Payment ___ Yes

___ No

Date transferred ____ ____/____ ____/____ ____ ____ ____ %_________________

Prior Payment ___ Yes

___ No

Date transferred ____ ____/____ ____/____ ____ ____ ____ %_________________

Prior Payment ___ Yes

___ No

Aggregate percent transferred %_________________

9b Write the amount of transfer taxes paid for all prior transfers of any interests included on Line 9a.

9b $___________________

10a Is the real estate entity liable for corporate franchise taxes as a result of this transfer?

10a

___ Yes

___ No

10b Write the amount of corporate franchise tax paid (excluding fees, interest, and penalties).

10b $___________________

10c Identify corporate franchise tax return information.

_______________________________________________________________________________________________________

Corporate Name

File No.

BCA Form No.

Date paid

Step 4:Calculate the amount of transfer tax due.

(Round Lines 11a through 15 to the next highest whole dollar.)

11a Full actual consideration

11a $___________________

11b Does Line 11a include a contingent payment for any interest on which state transfer taxes

have been paid?

11b

___ Yes

___ No

12a Amount of personal property included in the purchase.

12a $___________________

12b Was the value of a mobile home included on Lines 11a and 12a?

12b

___ Yes

___ No

13 Subtract Line 12a from Line 11a.

13

$___________________

14 Amount for other real property transferred to the seller (in a simultaneous exchange)

as part of the full actual consideration on Line 11a.

14

$___________________

15 Outstanding mortgage amount to which the transferred real property remains subject.

15

$___________________

16 If this transfer is exempt, use an “X” to identify the provision.

16

_____b _____k _____m

17 Subtract Lines 14 and 15 from Line 13.

17

$___________________

18 Illinois tax — $.50 per $500 of value or fraction thereof on Line 17.

18

$___________________

19 County tax.

19

$___________________

20 Amount of transfer taxes paid (amount from Line 9b).

20

$___________________

21 Amount of corporate franchise tax paid (amount from Line 10b).

21

$___________________

22 Add Lines 18 and 19, then subtract Lines 20 and 21. Total amount of transfer tax due.

22

$___________________

This form is authorized in accordance with 35 ILCS 200/31-1 et seq. Disclosure of this information

is REQUIRED. This form has been approved by the Forms Management Center.

IL-492-0227

PTAX-203-B (R-05/05)

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1