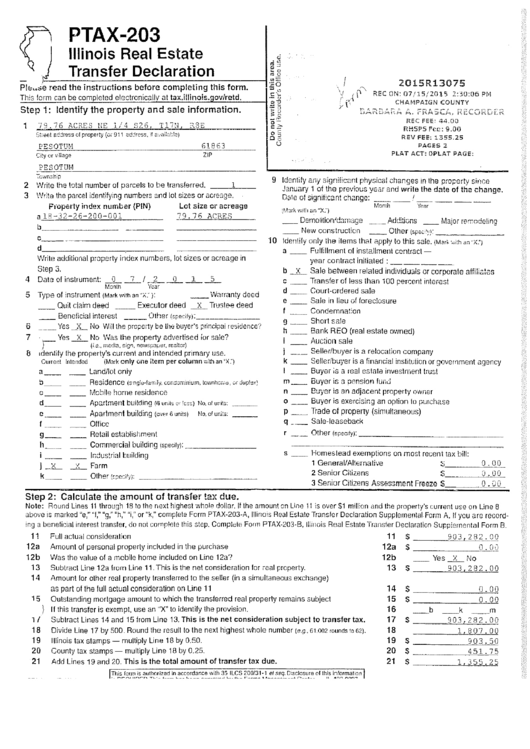

Illinois Real Estate Transfer Declaration

ADVERTISEMENT

/T':

PTAX-203

\ j

Illinois Real Estate

ci

P!:u$~

read

!~:~r:!t:~s ~~:~:~~~!!i~g~his

form.

IU

1015R13075

T .. hc::i s :_:f:::.;o

r"-'m;_:c~a'-'n ;::be::.:c::::o~m~p

l c : : _ e tc::_ed:::..c:' e !c:;ec::::tr::::o

nc::ic::::a:e.ll~..:a::::t_,tae.::x:::..

il:::.li!.!:n o:::.L:::• ·zo::..:v:::.lr::;:et,d'-.

--I.E

·a

-

cvu

Step

1:

Identify the property and sale information.

·~ ~

f' '\.

y

REC ON: 07/15/2015 2:30:06 PM

CHAMPA!GN COUNTY

1

79.76 ACRES NE l/4 S26

Tl f:.J

St,<;e\ e::!:iress of property (ur 91 i adciress, if a·_,aiie:ble)

PE?OTut-1

Ci!y

or v;IIG\;le

PESOTUt-1

To·.r;;r.shp

?.3E

61853

ZIP

2

Write the tatal number of parcels to be transferred. ___ 1

3

VIJrlte the parcel identifying numbers and Jot sizes or acreage.

Property index number {PIN)

Lot size cr acreage

a lR-32-26-200-00l

]9. 76

ACRES

b _ _ _ _ _ _ _

c _ _ _ _ _ _ _ _ _ _ _ _ _

d _ _ _ _ _ _ _ _ _ _ ___

VVrite additional prcperty index numbers, lot sizes or acreage in

Step 3.

4

Date of instrument:

0

7

I

2

0

1

5

Month - -

YC3f - - - - - -

5

Type of instrument

{Mark

with an";.::·}:

_ _ Wnrranty deed

Quit ciaim deed _ _ Executor deed

......L

Trustee

deed

__ BenGfid31 interest ___

Other

(s~ecify):

____________ _

6

~--Yes

_li._

No Wiil the property be lht: buyer's principal residence?

7

· __

Yes

_x_

No V.Jas

the

property advertised

lor

sale?

}

(i.e.,

media,

sig11,

newspa!Jer, realtor)

8

1dentify

the property's

current and intended

primary

use.

Currer.t 1nlended

(Mark only one item per column ·.·.-ith an "X."")

a__

__ Land/lot only

b _ _

_ _

Residence

(s·ngiu·fa;nily, ccnGcm!n!um, townhcr:.c. vr

dup!ec-:1

c__ __

Mcbile home residence

d___

_ __ Apmtment building

{6

uniis

{Y

rc:o:o)

No.

of

units:

c

_ _

Apartment building

(ovRr 6 um!s)

No. of unit:;:

Office

g__

__ Retail establishment

h

_ _ Commercial building

(speCify): _ _ _ _ _ _ _ _ _

_ _ lr.dus!rial building

j __

_x_

__6_

Farm

k

__ Other

(spcsify;:

Step

2:

Calculate the amount of transfer tax due.

o:!:

cZ'

0~

ooe

u

:.~;zu.:.r,;,:,

;.,

rrtt.·;c:,,

tit:coxr,-r;~K

REC FEE:: 44.GO

RHSPS Fcc: 9.00

REV FEE: 1355.25

PAGES 2

PLAT ACT: OPLAT PAGE:

9 Identify any significant

physical

changes In the

pro;:erty

since

January 1 of the

previous

year and write the date of the change.

Dale of significant change: _ _ _ _ ' _ _ _ _ _ _ _ _

~~-~::!rh ·::~~!1

an "X.")

Month

w~ar

__ Demolition/C.::uno.ge

~--

Add;tivns __ Major

rerr;ode!ing

New

constructlon

__ Other

(spt:.:.·';•::

10 Identify only the items

thc;_t apply

to this

sale.

(MRrh .,..,;han "X."J

a __ Fulfillment of installment contract-

year

contract initiated:-------·

b

_x_

Sale between related

individuals

or

corporate affiliates

c _ _

Transfer

of less

than 100

percent inteiest

d

Court-ordered sale

e

Saie in

lieu of

foreclosure

Condemnat:on

9 __

Short

sa1e

h __ Bank REO (real estate owned)

i __ Auction

sale

j ____

Seller/buyer

is a

relocation company

k _ _

Seller/buyer

is a financial institution

or

government agency

I __ Buyer is a real estate investment trust

m __

Buyer

is a pension

tur~~::J

n __ Buyer

is an adjacent property owner

o __ Buyer is

exercising an option to purchase

p __

Trade of property (simultaneous)

q __ Sale-leaseback

r __ Other

(spee>ly): - - - - - - - - - - - - - - - -

s _ _

Homestead

exemptions on most

recent

tax bill:

1 Generai/AIIernative

~

0. 0 0

2

Senior Citizens

S

0 . 0 0

3 Senior Citizens Assessment Freeze

$

__

0 • 0 G

Note: Round Lines 11 through 18 to the next

highest

·::hole

dollar.

If

the

amount an Line 11 is over S1 million and the property's current use on Une 8

above is marked "e,"

"!," "g," "h," "i," or ';k," complete Fcrm PTAX-203-A, l!lino's Real Estate Transfer Declaration Supplemental Form A. If you are record-

:ng a beneficial interest transfer, do not cornr!ete this step.

Comp!t::TP.

Fon11 PTAX-203-B, liiinois Real Estate Transfer Declaration

Supplemental

Form B.

11

Fullactualconsideration

11

$

903 ?R2.00

12a

Amount of personal property included in the purchase

12a

$

0 . 0

Q

12b

Was the value of a mobile home included on Line 12a

7

12b

__

Yes

_x__

No

13

Subtract Line 12a

I

rom Line 11. This is the net consideration for real property.

13

S

9 0 3 2 8 2 . 0 0

14

Amount for other real property transferred to the seller (in a simultaneous exchange)

as part of the full actual consideration on Line 11

15

Outstanding mortgage amount to which

the transferred real

property remains subject

} If

this transfer is

exempt,

use an "X"

to

identify the provision.

1/

Subtract

Lines

14 and 15 from Line 13. This is the net

consideration subject

to

transfer

tax.

18

Divide Line 17

by

500. Round the result to the next highest whole number

{e.g. 61.002

rounds to

62).

19

Illinois tax slamps- multiply Line 18 by 0.50.

20

County tax stamps- multiply Line 1 8

by

0.25.

21

Add Lines 19 and 20.

This is

the total amount oftransfer tax due.

~·

-'

,

__

1-t_''~.-';:,r,i::~:..-~u~'~'-'!L.'::'~ '._"_'-_'-i:~':':.n::~~~~~._~~~~ ~~-~,0~-:~_:!..S.~_fJ.:_~:~.c;?:~.r-e_

of !h},S

i~!~r~~!'~n

I

14

15

16

17

18

19

20

21

$

0.00

s

0.00

b

k

m

---

- -

- -

s

903 282.0Q

1 807.00

s

903.50

$

451.75

$

1.355.25

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2