Form Ptax-203 - Instructions For Completing Form Ptax-203, Illinois Real Estate Transfer Declaration

ADVERTISEMENT

Instructions for Completing Form PTAX-203,

Illinois Real Estate Transfer Declaration

General Information

(m) A deed or trust document related to the purchase of a principal

residence by a participant in the program authorized by the

The information requested on this form is required by the Real Estate

Home Ownership Made Easy Act, except that those deeds and

Transfer Tax Law (35 ILCS 200/31-1 et seq. ). All parties involved in

trust documents shall not be exempt from filing the declaration.

the transaction must answer each question completely and truthfully.

Can criminal penalties be imposed?

What is the purpose of this form?

Anyone who willfully falsifies or omits any required information on

County offices and the Illinois Department of Revenue use this form

Form PTAX-203 is guilty of a Class B misdemeanor for the first

to collect sales data and to determine if a sale can be used in

offense and a Class A misdemeanor for subsequent offenses.

assessment ratio studies. This information is used to compute

Anyone who knowingly submits a false statement concerning the

equalization factors. Equalization factors are used to help achieve a

identity of a grantee of property in Cook County is guilty of a Class C

state-wide uniform valuation of properties based on their fair market

misdemeanor for the first offense and a Class A misdemeanor for

value.

subsequent offenses. The penalties that could be imposed for each

type of misdemeanor are listed below (35 ILCS 200/31-50 and

Must I file Form PTAX-203?

730 ILCS 5/5-8-3 and 5/5-9-1).

You must file either (1) Form PTAX-203 and any required documents

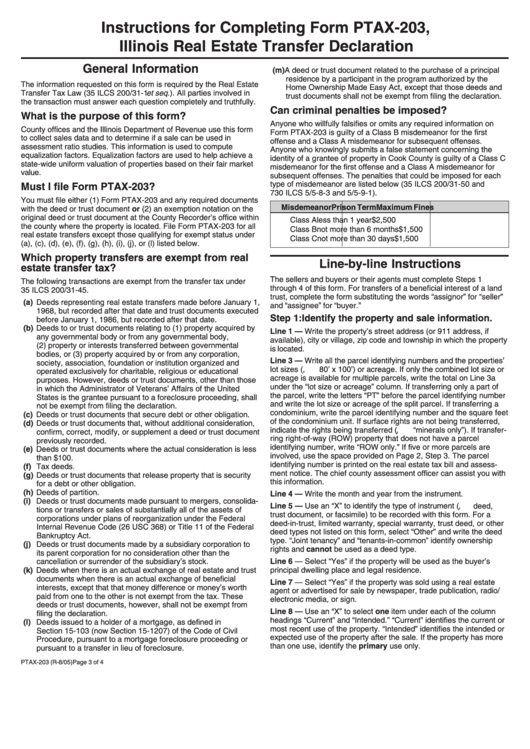

Misdemeanor

Prison Term

Maximum Fines

with the deed or trust document or (2) an exemption notation on the

original deed or trust document at the County Recorder’s office within

Class A

less than 1 year

$2,500

the county where the property is located. File Form PTAX-203 for all

Class B

not more than 6 months

$1,500

real estate transfers except those qualifying for exempt status under

Class C

not more than 30 days

$1,500

(a), (c), (d), (e), (f), (g), (h), (i), (j), or (l) listed below.

Which property transfers are exempt from real

Line-by-line Instructions

estate transfer tax?

The sellers and buyers or their agents must complete Steps 1

The following transactions are exempt from the transfer tax under

through 4 of this form. For transfers of a beneficial interest of a land

35 ILCS 200/31-45.

trust, complete the form substituting the words “assignor” for “seller”

(a) Deeds representing real estate transfers made before January 1,

and “assignee” for “buyer.”

1968, but recorded after that date and trust documents executed

Step 1:

Identify the property and sale information.

before January 1, 1986, but recorded after that date.

(b) Deeds to or trust documents relating to (1) property acquired by

Line 1 — Write the property’s street address (or 911 address, if

any governmental body or from any governmental body,

available), city or village, zip code and township in which the property

(2) property or interests transferred between governmental

is located.

bodies, or (3) property acquired by or from any corporation,

Line 3 — Write all the parcel identifying numbers and the properties’

society, association, foundation or institution organized and

lot sizes ( e.g., 80’ x 100’) or acreage. If only the combined lot size or

operated exclusively for charitable, religious or educational

acreage is available for multiple parcels, write the total on Line 3a

purposes. However, deeds or trust documents, other than those

under the “lot size or acreage” column. If transferring only a part of

in which the Administrator of Veterans’ Affairs of the United

the parcel, write the letters “PT” before the parcel identifying number

States is the grantee pursuant to a foreclosure proceeding, shall

and write the lot size or acreage of the split parcel. If transferring a

not be exempt from filing the declaration.

condominium, write the parcel identifying number and the square feet

(c) Deeds or trust documents that secure debt or other obligation.

of the condominium unit. If surface rights are not being transferred,

(d) Deeds or trust documents that, without additional consideration,

indicate the rights being transferred ( e.g., “minerals only”). If transfer-

confirm, correct, modify, or supplement a deed or trust document

ring right-of-way (ROW) property that does not have a parcel

previously recorded.

identifying number, write “ROW only.” If five or more parcels are

(e) Deeds or trust documents where the actual consideration is less

involved, use the space provided on Page 2, Step 3. The parcel

than $100.

identifying number is printed on the real estate tax bill and assess-

(f) Tax deeds.

ment notice. The chief county assessment officer can assist you with

(g) Deeds or trust documents that release property that is security

this information.

for a debt or other obligation.

(h) Deeds of partition.

Line 4 — Write the month and year from the instrument.

(i) Deeds or trust documents made pursuant to mergers, consolida-

Line 5 — Use an “X” to identify the type of instrument ( i.e., deed,

tions or transfers or sales of substantially all of the assets of

trust document, or facsimile) to be recorded with this form. For a

corporations under plans of reorganization under the Federal

deed-in-trust, limited warranty, special warranty, trust deed, or other

Internal Revenue Code (26 USC 368) or Title 11 of the Federal

deed types not listed on this form, select “Other” and write the deed

Bankruptcy Act.

type. “Joint tenancy” and “tenants-in-common” identify ownership

(j) Deeds or trust documents made by a subsidiary corporation to

rights and cannot be used as a deed type.

its parent corporation for no consideration other than the

Line 6 — Select “Yes” if the property will be used as the buyer’s

cancellation or surrender of the subsidiary’s stock.

(k) Deeds when there is an actual exchange of real estate and trust

principal dwelling place and legal residence.

documents when there is an actual exchange of beneficial

Line 7 — Select “Yes” if the property was sold using a real estate

interests, except that that money difference or money’s worth

agent or advertised for sale by newspaper, trade publication, radio/

paid from one to the other is not exempt from the tax. These

electronic media, or sign.

deeds or trust documents, however, shall not be exempt from

Line 8 — Use an “X” to select one item under each of the column

filing the declaration.

headings “Current” and “Intended.” “Current” identifies the current or

(l) Deeds issued to a holder of a mortgage, as defined in

most recent use of the property. “Intended” identifies the intended or

Section 15-103 (now Section 15-1207) of the Code of Civil

expected use of the property after the sale. If the property has more

Procedure, pursuant to a mortgage foreclosure proceeding or

than one use, identify the primary use only.

pursuant to a transfer in lieu of foreclosure.

PTAX-203 (R-8/05)

Page 3 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2