INSTRUCTIONS FOR FORM OS-3105G, OS-3105AF, and OS-3105MW

GENERAL INFORMATION: This tax return is used to report and pay tax on the gross revenues of all business activities except as follows:

NOTE: If you are engaged in Hotel/Motel operations and or the sale of sale of alcoholic beverages, you are required to also file a monthly hotel

occupancy tax return (Form OS-3305) and/or bar tax return (Form OS-3900). If you operate a gaming establishment (poker machines) you are also

required a monthly Form 3705G and pay the tax thereon.

A.1. Enter the name of the owner for sole proprietorship, or partnership, or corporation/association name.

A.2. Enter the name(s) under which the taxpayer operates as; e.g. “John Doe’s Restaurant”.

B.

Enter the complete mailing address, including post office box, if any.

C.1. Enter your taxpayer I.D. Number. If you do not have one, please apply at the Division of Revenue and Taxation for use only in reporting CNMI Taxes.

C.2. Enter your Employer I.D. Number used in previous quarter.

D.

Enter the quarter ended for which you are filing this return.

E.

Enter your telephone number(s).

If this is a final return, place a check mark (

)in the box provided and indicate the date when the business was closed or dissolved.

F.

Pursuant to Revenue and Taxation Regulations, a penalty will be imposed for failure to comply with this requirement.

G.

Indicate the form of your business by checking the applicable box.

H.

Indicate the location of your business. Please ensure you enter the name of the village on the space provided.

I.

Indicate the code and the type(s) of business activity you are engaged in and the gross revenue derived from that activity for the quarter. See activity

code listing on the back of Form OS-3105G.

J1. Enter the gross revenue from all activities during the period January 1 - March 31.

J2. Enter the gross revenue from all activities during the period April 1 - June 30.

J3. Enter the gross revenue from all activities during the period July 1 - September 30.

J4. Enter the gross revenue from all activities during the period October 1 - December 31.

J5. Add lines 1 through 4.

J6. Enter the amount of revenue which is exempted from tax (cumulative to this quarter). Attach a separate sheet explaining in

detail the amount and type of exemption. CLAIM WILL BE DISALLOWED IF STATEMENT IS NOT ATTACHED.

J7. Subtract line 6 from line 5 and enter the difference here.

J8. To compute the tax for line 7, multiply the gross revenue on line 7 by the rate (based on the gross revenue level)

shown in the appropriate quarterly tax table below, and enter the tax on this line.

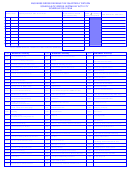

TABLE I. Use this table for Form OS-3105G (General)

1st QUARTER

2nd QUARTER

3rd QUARTER

4th QUARTER

FROM

TO

RATE

FROM

TO

RATE

FROM

TO

RATE

FROM

TO

RATE

0

1,250.00

0

0

2,500.00

3,750.00

0

0

0

5,000.00

0

0

1,250.01

12,500.00

25,000.00

3,750.01

37,500.00

2,500.01

1.5%

1.5%

1.5%

5,000.01

50,000.00

1.5%

12,500.01

25,000.00

25,000.01

50,000.00

37,500.01

75,000.00

2%

2%

2%

50,000.01

100,000.00

2%

25,000.01

62,500.00

75,000.01

50,000.01

125,000.00

187,500.00

2.5%

2.5%

2.5%

100,000.01

250,000.00

2.5%

62,500.01

125,000.00

125,000.01

250,000.00

187,500.01

375,000.00

3%

3%

3%

250,000.01

500,000.00

3%

125,000.01

187,500.00

250,000.01

375,000.00

375,000.01

562,500.00

4%

4%

500,000.01

750,000.00

4%

4%

187,500.01

And Over

And Over

562,500.01

And Over

375,000.01

5%

5%

5%

750,000.01

And Over

5%

TABLE II. Use this table for Form OS-3105AF (Agricutural and Fisheries)

2nd QUARTER

3rd QUARTER

4th QUARTER

1st QUARTER

1% of amount over 20,000.00

1% of amount over 5,000.00

1% of amount over 10,000.00

1% of amount over 15,000.00

(Line 7)

(Line 7)

(Line 7)

(Line 7)

TABLE III. Use this table for Form OS-3105MW (Manufacturing and Wholesaling)

1st QUARTER

2nd QUARTER

3rd QUARTER

4th QUARTER

FROM

TO

RATE

FROM

TO

RATE

FROM

TO

RATE

FROM

TO

RATE

0

1,250.00

0

0

2,500.00

0

3,750.00

0

0

5,000.00

0

0

1,250.01

12,500.01

25,000.00

3,750.01

37,500.00

5,000.01

50,000.00

1.5%

1.5%

2,500.01

1.5%

1.5%

12,500.01

And Over

2%

25,000.01

And Over

37,500.01

And Over

2%

50,000.01

And Over

2%

2%

9.

Enter the tax allocated to previous quarters as shown on line 8 of the preceding quarter’s return. (Current year only).

10. Subtract line 9 from line 8. If less than zero, enter zero. This is the tax allocated to this quarter.

11a. Enter the cumulative amount, if any, of cash contributions made during the taxable year but not more than $5,000 to a

qualified educational institution or other tax exempt educational institution located in the CNMI. (The maximum educational

credit allowable in any one year is the lesser of $5,000 or your accumulated wage and salary tax, earnings tax, and business gross

revenue tax liability.) Attach Schedule ETC.

11b. Enter cumulative amount of education tax credit taken prior quarter(s) (line 11d) of the same year.

11c. Subtract line 11b from line 11a.

11d. Enter the lesser of line 10 or line 11c, but not less than zero.

Instructions for Forms OS-3105G / OS-3105AF / OS-3105MW (Rev. 4/2009)

NOTE: This revision is effective 1st Quarter 2009.

1

1 2

2 3

3 4

4