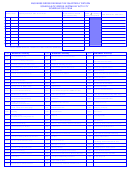

12. Subtract line 11 from line 10. This is the tax before payment credits.

13a. Enter the total overpayment credit you elected from Form 1120CM, 1120F, or 1040CM and 4th quarter BGRT of the preceding

year, if any. Note: Do not include any amount claimed in previous quarters. This amount is subject to final adjustment by the

Division of Revenue and Taxation.

13b. Enter the tax overpayment from the preceding quarter’s (line 21).

14. Enter any amount paid this quarter from Form 500 BGRT-BWH (Business Gross Revenue Tax and Backup Withholding Deposit

Slip).

15. If this return is amended return of a previously filed original and/or amendments for this quarter, enter the total tax paid on

such original and/or amended returns applicable to this quarter. (Do not include penalty and interest).

16. Total credits. Add lines 13a thru 15.

17. Subtract line 16 from line 12. If less than zero, enter zero and go to line 21.

IF YOU FILE AND OR PAY AFTER THE DEADLINE, COMPLETE LINES 18a THRU 19.

18a. Failure to File Return on Time. Except when an extension is granted, a penalty of 5% of the tax (line 16) shall be added

for every month or fraction thereof elapsing between the due date of this return and the date it is actually filed; not exceed

ing 25% in the aggregate. If the failure to pay penalty becomes applicable, the 5% failure to file penalty shall be reduced by

1/2 of 1%. Enter the penalty on this line.

18b. Failure to Pay Taxes on Time. For taxes which are not paid when due, a penalty of 0.5% of the tax (line 16) shall be

added for every month or fraction thereof, elapsing between the due date and the date the tax is actually paid. Enter the total

penalty on this line.

19. INTEREST. If you pay the tax after the deadline, there is an interest charge as provided under Public Law 14-35 of the

amount of the tax due (line 16) and penalty charges (line 17a and 17b) from the date the tax is due until it is actually paid.

Enter the total interest charge on this line. The interest rate is subject to change on a quarterly basis. The applicable interest

table is available at the Division of Revenue and Taxation. The Division of Revenue and Taxation can compute the interest

charges and bill you on it.

20. TOTAL AMOUNT DUE THIS QUARTER. Add lines 17 thru 19. PAY THIS AMOUNT.

21. If line 16 is greater than line 12, subtract line 12 from line 16. Otherwise, enter zero. Unless this is a 4th quarter return, this

amount can be carried forward (line 13b) to the succeeding quarter.

22. FOR 4TH QUARTER RETURN ONLY. Enter the amount of overpayment from line 16 you want credited to the 1st quarter

return of the following year. You may credit any amount but not more than the amount shown as overpayment on line 16. To

request a refund of the overpayment, use Form OP-3105 and attach to this return.

K.

DECLARATION AND SIGNATURE.

All returns must be signed by a natural person. No return shall be complete unless and until it is signed by the taxpayer. Tax returns shall be

signed by the following:

The return of: (a) an individual taxpayer shall be signed by the individual;

(b) a corporation shall be signed by the president, vice-president, treasurer, assistant treasurer, chief accounting officer of the

corporation, or any other officer duly authorized so to act;

(c) a partnership shall be signed by any one of the partners; and

(d) all other entities shall be signed by a natural person as specified by the NMTIT.

DEADLINE AND FILING

The original copy of this return must be filed at the Division of Revenue and Taxation on or before the last day of the month following the end of each

quarter, that is, on or before April 30, July 31, October 31 and January 31. If filing by mail send to:

DIVISION OF REVENUE AND TAXATION

P.O. BOX 5234 CHRB

SAIPAN, MP 96950

PAYMENTS

Any tax due must be paid to the Division of Revenue and Taxation. Make your check or money order payable to: “CNMI TREASURER”.

If you are making single payment for multiple tax returns, please make sure that the total of all taxes and charges are correct. Also,

indicate how you want the payment to be applied.

NOTE: Please be advised that if a check is remitted for payment of taxes is returned by your bank unpaid, the taxes will be deemed

unpaid and subject to all applicable late payment penalty and interest charges.

Instructions for Form OS-3105G / OS-3105AF / OS-3105MW (Rev. 4/2009)

NOTE: This revision is effective 1st Quarter 2009.

1

1 2

2 3

3 4

4