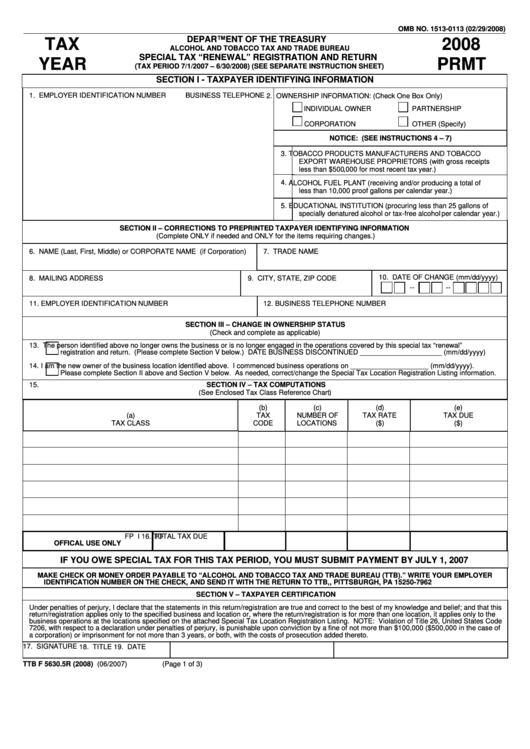

OMB NO. 1513-0113 (02/29/2008)

DEPARTMENT OF THE TREASURY

TAX

2008

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU

SPECIAL TAX “RENEWAL” REGISTRATION AND RETURN

YEAR

PRMT

(TAX PERIOD 7/1/2007 – 6/30/2008) (SEE SEPARATE INSTRUCTION SHEET)

SECTION I - TAXPAYER IDENTIFYING INFORMATION

1. EMPLOYER IDENTIFICATION NUMBER

BUSINESS TELEPHONE

2. OWNERSHIP INFORMATION: (Check One Box Only)

INDIVIDUAL OWNER

PARTNERSHIP

CORPORATION

OTHER (Specify)

NOTICE: (SEE INSTRUCTIONS 4 – 7)

3.

TOBACCO PRODUCTS MANUFACTURERS AND TOBACCO

EXPORT WAREHOUSE PROPRIETORS (with gross receipts

less than $500,000 for most recent tax year.)

4.

ALCOHOL FUEL PLANT (receiving and/or producing a total of

less than 10,000 proof gallons per calendar year.)

5.

EDUCATIONAL INSTITUTION (procuring less than 25 gallons of

specially denatured alcohol or tax-free alcohol per calendar year.)

SECTION II – CORRECTIONS TO PREPRINTED TAXPAYER IDENTIFYING INFORMATION

(Complete ONLY if needed and ONLY for the items requiring changes.)

6. NAME (Last, First, Middle) or CORPORATE NAME (if Corporation)

7. TRADE NAME

10. DATE OF CHANGE (mm/dd/yyyy)

8. MAILING ADDRESS

9. CITY, STATE, ZIP CODE

--

--

11. EMPLOYER IDENTIFICATION NUMBER

12. BUSINESS TELEPHONE NUMBER

SECTION III – CHANGE IN OWNERSHIP STATUS

(Check and complete as applicable)

13.

The person identified above no longer owns the business or is no longer engaged in the operations covered by this special tax “renewal”

registration and return. (Please complete Section V below.) DATE BUSINESS DISCONTINUED _____________________ (mm/dd/yyyy)

14.

I am the new owner of the business location identified above. I commenced business operations on ____________________ (mm/dd/yyyy).

Please complete Section II above and Section V below. As needed, correct/change the Special Tax Location Registration Listing information.

15.

SECTION IV – TAX COMPUTATIONS

(See Enclosed Tax Class Reference Chart)

(b)

(c)

(d)

(e)

(a)

TAX

NUMBER OF

TAX RATE

TAX DUE

TAX CLASS

CODE

LOCATIONS

($)

($)

FF

FP

I

16. TOTAL TAX DUE

OFFICAL USE ONLY

IF YOU OWE SPECIAL TAX FOR THIS TAX PERIOD, YOU MUST SUBMIT PAYMENT BY JULY 1, 2007

MAKE CHECK OR MONEY ORDER PAYABLE TO “ALCOHOL AND TOBACCO TAX AND TRADE BUREAU (TTB).” WRITE YOUR EMPLOYER

IDENTIFICATION NUMBER ON THE CHECK, AND SEND IT WITH THE RETURN TO TTB, P.O. BOX 371962, PITTSBURGH, PA 15250-7962

SECTION V – TAXPAYER CERTIFICATION

Under penalties of perjury, I declare that the statements in this return/registration are true and correct to the best of my knowledge and belief; and that this

return/registration applies only to the specified business and location or, where the return/registration is for more than one location, it applies only to the

business operations at the locations specified on the attached Special Tax Location Registration Listing. NOTE: Violation of Title 26, United States Code

7206, with respect to a declaration under penalties of perjury, is punishable upon conviction by a fine of not more than $100,000 ($500,000 in the case of

a corporation) or imprisonment for not more than 3 years, or both, with the costs of prosecution added thereto.

17. SIGNATURE

18. TITLE

19. DATE

TTB F 5630.5R (2008) (06/2007)

(Page 1 of 3)

1

1 2

2 3

3