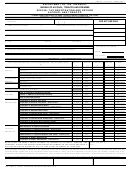

OMB NO. 1513-0113 (02/29/2008)

DEPARTMENT OF THE TREASURY

TAX

2008

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU

SPECIAL TAX LOCATION REGISTRATION LISTING

YEAR

PRMT

(RENEWAL BUSINESS - TAX PERIOD 7/1/2007– 6/30/2008)

INSTRUCTIONS

1. Review and verify that all preprinted business location information is correct.

2. A full street address or rural route description for the actual physical location of the business is required. A post office box number is unacceptable,

and if left uncorrected, may delay or prevent registration of the location as required by law.

3. If any preprinted business location information is incorrect, line through the incorrect business location information and clearly print or type the correct

business location information.

4. If a business location is no longer in business, line through all preprinted business location information pertaining to that business location; print or type

the words “OUT OF BUSINESS”; and show the date business activities ceased at the business location.

5. Enter business location information for new business locations in the space provided below. Please print or type all business location information

entered for each new business location.

EMPLOYER IDENTIFICATION NUMBER:

TTB

TAX

BUSINESS

CITY,

LOCATION

CLASS

TRADE NAME

LOCATION ADDRESS

TELEPHONE

STATE, ZIP CODE

NUMBER

CODE

NUMBER

DO NOT WRITE IN THE SPACE BELOW EXCEPT TO ADD A NEW BUSINESS LOCATION

TRADE NAME

BUSINESS TELEPHONE NUMBER

(

)

LOCATION ADDRESS

CITY, STATE, ZIP CODE

TAX CODE

TAX CLASS

DATE NEW LOCATION STARTED BUSINESS (mm/dd/yyyy)

PAPERWORK REDUCTION ACT

This information is used to ensure compliance by taxpayers with P.L. 100-203, Revenue Act of 1987, P.L. 100-647,

Technical Corrections Act of 1988, and the Internal Revenue laws of the United States. The Alcohol and Tobacco

Tax and Trade Bureau (TTB) uses the information to determine and collect the right amount of tax.

The estimated average burden associated with this collection is 15 minutes per respondent or recordkeeper,

depending on individual circumstances. Comments concerning the accuracy of this burden estimate and

suggestions for reducing this burden should be directed to Reports Management Officer, Regulations and Rulings

Division, Alcohol and Tobacco Tax and Trade Bureau, Washington, DC 20220.

An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information

unless it displays a current, valid OMB control number.

TTB F 5630.5R (2008)

(06/2007)

(Page 2 of 3)

1

1 2

2 3

3