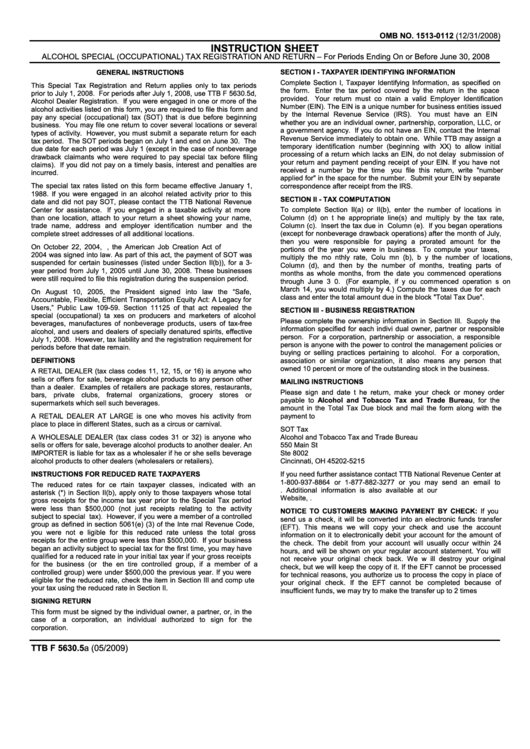

Form Ttb F 5630.5a Instructions - Alcohol Special (Occupational) Tax Registration And Return

ADVERTISEMENT

OMB NO. 1513-0112 (12/31/2008)

INSTRUCTION SHEET

ALCOHOL SPECIAL (OCCUPATIONAL) TAX REGISTRATION AND RETURN – For Periods Ending On or Before June 30, 2008

SECTION I - TAXPAYER IDENTIFYING INFORMATION

GENERAL INSTRUCTIONS

Complete Sectio n I, Taxpayer I dentifying Info rmation, as specified on

This Special Tax Registration a nd Retur n applies only to ta x p eriods

the form. Enter the tax period covered b

y the return in the space

prior to July 1, 2008. For periods after July 1, 2008, use TTB F 5630.5d,

provided.

Your retu rn must co ntain a valid E mployer Identification

Alcohol Dealer R egistration. If y ou were engaged in one or more of the

Number (EIN). The EIN is a unique number for business entities issued

alcohol activities listed on this form, you are required to file this form and

by th e Inte rnal Revenue Se rvice (IRS ).

You must have an

EIN

pay an y special (occupational) ta x (SOT) t hat is due before b eginning

whether you are an individual owner, par tnership, corporation, LL C, or

business. Y ou may file one re turn to cover sever al locations or several

a government agency. If you do not have an EIN, contact the Inte rnal

types of activity. However, you mu st submit a separate return for each

Revenue Service immediately to obt ain one. While TTB ma y assign a

tax period. The SOT periods began on July 1 and end on June 30. The

temporary identi fication number (beginning w ith XX) to allow

initial

due date for eac h period was July 1 (except in the case of nonbeverage

processing of a r eturn which lacks an EIN, do not delay submission of

drawback claimants who were requir ed to pay special tax before filing

your return and payment pending receipt of your EIN. If you hav e not

claims). If y ou did not pa y on a ti mely basis, interest and penalties are

received a number b y the time y ou file this re turn, write "num ber

incurred.

applied for" in the space for the number. Submit your EIN by separate

The special tax rates listed on t his form became effective January 1,

correspondence after receipt from the IRS.

1988. If you were engaged in an alcohol related activity prior to t his

SECTION II - TAX COMPUTATION

date and did not pa y SOT, pleas e contact the TTB National Revenue

Center for assistance. If y ou en gaged in a taxable activity at more

To complete Section II(a) or II(b),

enter th e nu mber of locations in

than one location, attach to your retur n a she et showing your n ame,

Column (d ) on t he appro priate line(s) and multiply by the ta x r ate,

trade name, a ddress and emplo yer identification number and

the

Column (c). Insert the tax due in Column (e). If you began operati ons

complete street addresses of all additional locations.

(except for nonbeverage drawback operations) after the month of July ,

then you were responsible for pa ying a p rorated amount fo r th e

On Octobe r 22, 2004, H.R. 4520 , the American Job Creation Act of

portions of the year you were in business. To compute your ta xes,

2004 was signed into law . As part of this a ct, the payment of SOT w as

multiply the mo nthly rate, Colu mn (b), b y the number of locations,

suspended for certain businesses (listed under S ection II(b)), for a 3-

Column (d), an d then b y the number of mont

hs, treating parts of

year pe riod from July 1, 2005 un til June 30, 2008 . These businesses

months as whole months, from the date you co mmenced oper ations

were still required to file this registration during the suspension period.

through June 3 0. (For e xample, if y ou commenced operation s on

March 14, you would multiply b y 4.) Compute the taxes due for e ach

On August 10,

2005, the Pr

esident signed into law

the

“Safe,

class and enter the total amount due in the block "Total Tax Due".

Accountable, Flexible, Efficient Transportation Equity Act: A Legacy for

Users,” Public Law 1 09-59. Section 11125 of th at act repealed the

SECTION III - BUSINESS REGISTRATION

special (occupational) ta xes on producers a nd marketers of alcohol

Please complete the o wnership information in Se ction III. Supply the

beverages, man ufactures of non beverage pr oducts, users of tax-f ree

information specified for each indivi dual owner, partner or responsible

alcohol, and use rs and dealers of specially denatured spirits, effe ctive

person. Fo r a c orporation, partnership or association, a responsible

July 1, 2008. However, tax liability and the registration requirement for

person is anyone with the power to control the management policies or

periods before that date remain.

buying o r selling practices pertaining to alcohol.

For a corpo ration,

DEFINITIONS

association or similar organization,

it also mea ns an y person that

owned 10 percent or more of the outstanding stock in the business.

A RETAIL DEAL ER (tax class codes 11, 12, 15, or 16) is an yone who

sells or offers for sale, beverage al cohol products to an y person other

MAILING INSTRUCTIONS

than a dealer. Examples of ret ailers are packa ge stores, restaurants,

Please sign and date t he return, make your ch eck or mon ey o rder

bars, private clubs, fraternal

or ganizations, grocer y sto res or

payable to Alcohol a nd T obacco Tax and Trade B ureau, fo r the

supermarkets which sell such beverages.

amount in the Total Tax Due bl ock and mail the form along w ith the

A RETAIL DEALER AT LARGE

is one w ho mo ves his act ivity from

payment to

place to place in different States, such as a circus or carnival.

SOT Tax

A WHOLESALE DEALER (ta x class codes 31 or 32) is an

yone who

Alcohol and Tobacco Tax and Trade Bureau

sells or offers for sale, beverage alcohol products to another dealer. An

550 Main St

IMPORTER is liable for tax as a wholesaler if he or she sells beve rage

Ste 8002

alcohol products to other dealers (wholesalers or retailers).

Cincinnati, OH 45202-5215

INSTRUCTIONS FOR REDUCED RATE TAXPAYERS

If you need further assistance contact TTB National Revenue Center at

1-800-937-8864 or 1 -877-882-3277 or you ma y send a n ema il to

The reduced rates for ce rtain t axpayer classes, indicated

with an

ttbtaxstamp@ttb.gov. Additional information is also availab le at our

asterisk (*) in Section II(b), appl y onl y to those ta xpayers whose t otal

Website,

gross receipts fo r the income ta x year p rior to th e Special Ta x p eriod

were less than $500,000 (not just receipts r elating to the a ctivity

NOTICE T O CUSTOMERS M AKING P AYMENT BY CHEC K: If you

subject to special tax). However, if you were a member of a controlled

send us a check, it w ill be convert ed into an elec tronic funds tran sfer

group as defined in se ction 5061(e) (3) of the Inte rnal Revenue Co de,

(EFT). This me ans w e will copy your check and use the account

you were not e ligible for this reduced rate

unl ess the total gr oss

information on it to electronically debit your account for t he amount of

receipts for the entire group were less than $500,000. If your business

the check. The debit from

your account w ill usually occur within 24

began an activity subject to special ta x for the first time, you may have

hours, and will be sho wn on your regular account statement. You will

qualified for a reduced rate in your initial tax year if your gross receipts

not r eceive y our or iginal check back. We w ill d estroy your or iginal

for the business (or the en tire controlled group , if a membe r of a

check, but w e will keep the copy of it. If the EFT cannot be proces sed

controlled group) were under $50 0,000 the previous y ear. If you were

for technical reasons, y ou authorize us to process the copy in place of

eligible for the re duced rate, chec k the item in Section III and comp ute

your original check. If the

EFT cannot

be completed because of

your tax using the reduced rate in Section II.

insufficient funds, we may try to make the transfer up to 2 times

SIGNING RETURN

This form m ust be signed b y the individual owner, a partner, or, in t he

case of a

corporation, an indi vidual authorized to sign for the

corporation.

TTB F 5630.5a (05/2009)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1