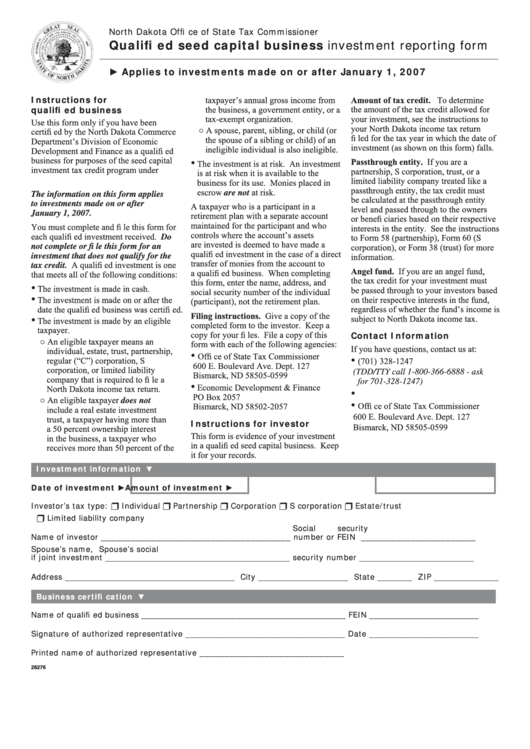

North Dakota Offi ce of State Tax Commissioner

Qualifi ed seed capital business investment reporting form

► Applies to investments made on or after January 1, 2007

Instructions for

taxpayer’s annual gross income from

Amount of tax credit. To determine

qualifi ed business

the business, a government entity, or a

the amount of the tax credit allowed for

your investment, see the instructions to

tax-exempt organization.

Use this form only if you have been

your North Dakota income tax return

○ A spouse, parent, sibling, or child (or

certifi ed by the North Dakota Commerce

fi led for the tax year in which the date of

the spouse of a sibling or child) of an

Department’s Division of Economic

investment (as shown on this form) falls.

ineligible individual is also ineligible.

Development and Finance as a qualifi ed

business for purposes of the seed capital

•

Passthrough entity. If you are a

The investment is at risk. An investment

investment tax credit program under

partnership, S corporation, trust, or a

is at risk when it is available to the

N.D.C.C. ch. 57-38.5.

limited liability company treated like a

business for its use. Monies placed in

passthrough entity, the tax credit must

escrow are not at risk.

The information on this form applies

be calculated at the passthrough entity

to investments made on or after

A taxpayer who is a participant in a

level and passed through to the owners

January 1, 2007.

retirement plan with a separate account

or benefi ciaries based on their respective

maintained for the participant and who

You must complete and fi le this form for

interests in the entity. See the instructions

controls where the account’s assets

each qualifi ed investment received. Do

to Form 58 (partnership), Form 60 (S

are invested is deemed to have made a

not complete or fi le this form for an

corporation), or Form 38 (trust) for more

qualifi ed investment in the case of a direct

information.

investment that does not qualify for the

transfer of monies from the account to

tax credit. A qualifi ed investment is one

Angel fund. If you are an angel fund,

a qualifi ed business. When completing

that meets all of the following conditions:

the tax credit for your investment must

this form, enter the name, address, and

•

The investment is made in cash.

be passed through to your investors based

social security number of the individual

•

on their respective interests in the fund,

The investment is made on or after the

(participant), not the retirement plan.

regardless of whether the fund’s income is

date the qualifi ed business was certifi ed.

Filing instructions. Give a copy of the

•

subject to North Dakota income tax.

The investment is made by an eligible

completed form to the investor. Keep a

taxpayer.

copy for your fi les. File a copy of this

Contact Information

○ An eligible taxpayer means an

form with each of the following agencies:

If you have questions, contact us at:

individual, estate, trust, partnership,

•

Offi ce of State Tax Commissioner

•

regular (“C”) corporation, S

(701) 328-1247

600 E. Boulevard Ave. Dept. 127

corporation, or limited liability

(TDD/TTY call 1-800-366-6888 - ask

Bismarck, ND 58505-0599

company that is required to fi le a

for 701-328-1247)

•

Economic Development & Finance

North Dakota income tax return.

•

individualtax@nd.gov

PO Box 2057

○ An eligible taxpayer does not

•

Offi ce of State Tax Commissioner

Bismarck, ND 58502-2057

include a real estate investment

600 E. Boulevard Ave. Dept. 127

trust, a taxpayer having more than

Instructions for investor

Bismarck, ND 58505-0599

a 50 percent ownership interest

This form is evidence of your investment

in the business, a taxpayer who

in a qualifi ed seed capital business. Keep

receives more than 50 percent of the

it for your records.

Investment information

▼

Date of investment ►

Amount of investment ►

Investor’s tax type:

Individual

Partnership

Corporation

S corporation

Estate/trust

Limited liability company

Social security

Name of investor ______________________________________

number or FEIN _______________________

Spouse’s name,

Spouse’s social

if joint investment _____________________________________

security number _______________________

Address __________________________________ City __________________ State _______ ZIP _____________

Business certifi cation

▼

Name of qualifi ed business _________________________________________

FEIN ______________________

Signature of authorized representative ________________________________

Date ______________________

Printed name of authorized representative _____________________________

28276

1

1