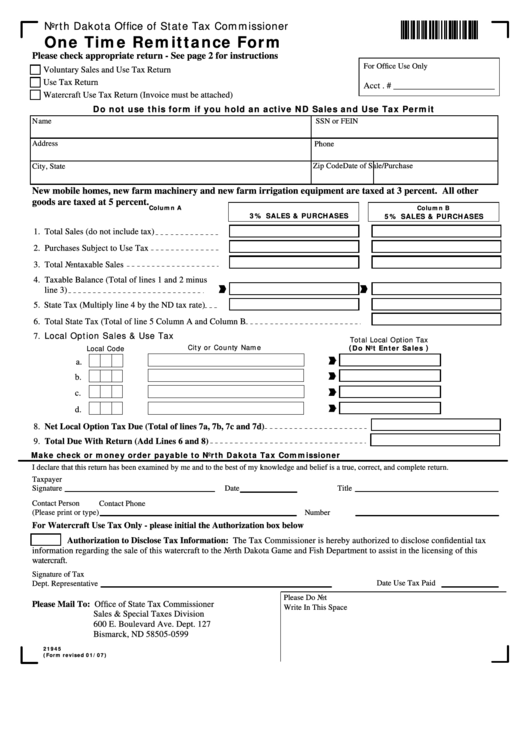

North Dakota Office of State Tax Commissioner

One Time Remittance Form

Please check appropriate return - See page 2 for instructions

For Office Use Only

Voluntary Sales and Use Tax Return

Use Tax Return

Acct . # _______________________

Watercraft Use Tax Return (Invoice must be attached)

Do not use this form if you hold an active ND Sales and Use Tax Permit

Name

SSN or FEIN

Address

Phone

Zip Code

Date of Sale/Purchase

City, State

New mobile homes, new farm machinery and new farm irrigation equipment are taxed at 3 percent. All other

goods are taxed at 5 percent.

Column A

Column B

3% SALES & PURCHASES

5% SALES & PURCHASES

1. Total Sales (do not include tax)

2. Purchases Subject to Use Tax

3. Total Nontaxable Sales

4. Taxable Balance (Total of lines 1 and 2 minus

line 3)

5. State Tax (Multiply line 4 by the ND tax rate)

6. Total State Tax (Total of line 5 Column A and Column B

7. Local Option Sales & Use Tax

Total Local Option Tax

City or County Name

(Do Not Enter Sales)

Local Code

a.

b.

c.

d.

8. Net Local Option Tax Due (Total of lines 7a, 7b, 7c and 7d)

9. Total Due With Return (Add Lines 6 and 8)

Make check or money order payable to North Dakota Tax Commissioner

I declare that this return has been examined by me and to the best of my knowledge and belief is a true, correct, and complete return.

Taxpayer

Signature

Date

Title

Contact Person

Contact Phone

(Please print or type)

Number

For Watercraft Use Tax Only - please initial the Authorization box below

Authorization to Disclose Tax Information: The Tax Commissioner is hereby authorized to disclose confidential tax

information regarding the sale of this watercraft to the North Dakota Game and Fish Department to assist in the licensing of this

watercraft.

Signature of Tax

Date Use Tax Paid

Dept. Representative

Please Do Not

Please Mail To: Office of State Tax Commissioner

Write In This Space

Sales & Special Taxes Division

600 E. Boulevard Ave. Dept. 127

Bismarck, ND 58505-0599

21945

(Form revised 01/07)

1

1