Foreign Trade Zone Personal Property Tax Credit Application Form - Office Of Finance - Anne Arundel County Maryland Page 2

ADVERTISEMENT

§ 4-3-101. Credit – Foreign trade zones.

(a)

Definition. In this section, "foreign trade zone" means a foreign trade

zone or subzone established under federal law.

(b)

Scope. This section does not apply to operating personal property of a

public utility.

(c)

Creation. There is a tax credit against County personal property taxes

levied on personal property that is located in a foreign trade zone within the

County.

(d)

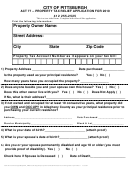

Time for filing application. Application for the tax credit created by this

section shall be filed on or before June 1 immediately before the first taxable year

for which the tax credit is sought. If the application is filed after June 1, the credit

shall be disallowed that year but shall be treated as an application for a tax credit

for the next succeeding taxable year.

(e)

Form of application. An application for the tax credit shall be submitted

to the Controller on forms that the Office of Finance requires; be under oath,

containing a declaration preceding the signature of the applicant to the effect that

it is made under the penalties of perjury provided for by the Tax-Property

Article, § 1-201, of the State Code; and be accompanied by proof that the

personal property satisfies the requirements of this section.

(f)

Calculation. The tax credit shall be calculated and credited based on the

total personal property tax levied by the County on personal property satisfying

the requirements of this section.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2