22.

23.

24.

25.

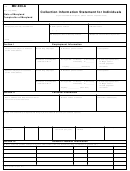

Number in Household

# Cars

# Car Loans

County

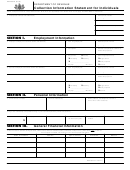

Section 10.

Monthly Income and Expense Analysis

INCOME

Source

Net

26. Wages/ Salaries ( Taxpayer) * Attach copy of most recent pay stub

27. Wages/Salaries (Spouse) * Attach copy of most recent pay stub

28. Rent paid to taxpayer

29. Other members of household

30. Pension(s)

31. Social Security

32. Profit from Business

33. Commissions

34. Other Income

35. Total Income

NECESSARY LIVING EXPENSES

Source

Amount

Source

Amount

36. Mortgage/Rent

42. Auto loans

37. Utilities

43. Health/Life Insurance

A. Telephone/Cell

44. Medical

B. Electricity

45. IRS Tax Payments

C. Heating

46. Miscellaneous Payments

D. Water/Garbage

A. Child Support

38. Homeowner/renter insurance

B. Alimony

39. Groceries

C. Daycare

40. Gas/Maintenance, etc.

D. Estimated tax

47. Total Expenses

41. Auto Insurance

Calculated Disposable Income (total income less total expenses)

Expenses not generally allowed: We generally do not allow tuition for private schools, public or private college expenses, charitable

contributions, voluntary retirement contributions, payments on unsecured debts such as credit card bills, cable television and other similar

expenses. However, we may allow these expenses if it is proven that they are necessary for the health and welfare of the individual or family

or for the production of income.

Under penalties of perjury, I declare that to the best of my knowledge and belief this

statement of assets, liabilities, and other information is true, correct and complete.

Certification

Your signature

Spouse's signature (if joint return was filed)

Date

Attachments Required for Wage Earners and Self-Employed Individuals:

Copies of the following items for the last 3 months from the date this form is submitted. (check all the attached items)

Income- Earnings statements, pay stubs, etc. from each employer, pension/social security/other income, self employment income

(commissions, invoices, sales, records, etc. and business financial statement if self-employed.)

Banks, Investments, and Life Insurance - Statements for all money market, brokerage, checking and savings accounts, certificates

of deposit, IRA, stocks/bonds, and life insurance policies with a cash value.

Assets - Statements from lenders on loans, monthly payments, payoffs, and balances for all personal and business assets. Include

copies of UCC financing statements and accountant's depreciation schedules.

Expenses - Bills or statements for monthly recurring expenses of utilities, rent, insurance, property taxes, phone and cell phone,

insurance premiums, court orders requiring payments (child support, alimony, etc.), other out of pocket expenses.

Other - credit card statements, profit and loss statements, all loan payoffs, etc.

A copy of last year's Form 1040 with all attachments. Include all Schedules K-1 from Form 1120S or Form 1065, as applicable.

Form RO-1062 page 4 (Rev. 4-10)

1

1 2

2 3

3 4

4 5

5 6

6