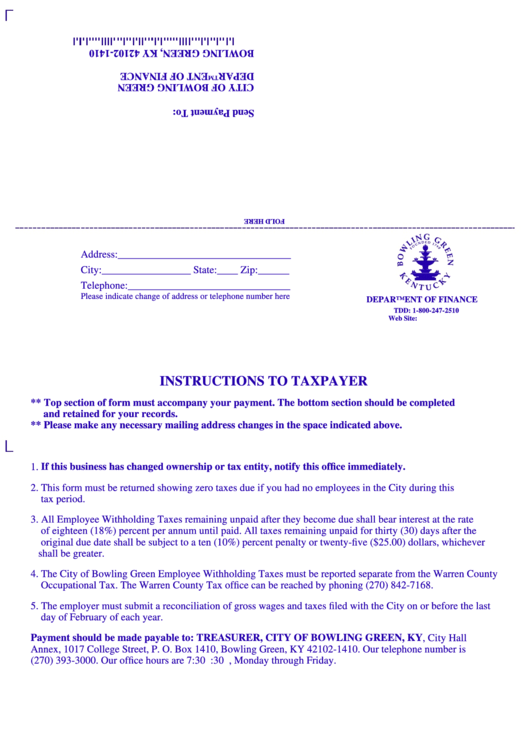

Address:_________________________________

City:_________________ State:____ Zip:______

Telephone:_______________________________

Please indicate change of address or telephone number here

DEPARTMENT OF FINANCE

TDD: 1-800-247-2510

Web Site:

INSTRUCTIONS TO TAXPAYER

** Top section of form must accompany your payment. The bottom section should be completed

and retained for your records.

** Please make any necessary mailing address changes in the space indicated above.

1. If this business has changed ownership or tax entity, notify this office immediately.

2. This form must be returned showing zero taxes due if you had no employees in the City during this

tax period.

3. All Employee Withholding Taxes remaining unpaid after they become due shall bear interest at the rate

of eighteen (18%) percent per annum until paid. All taxes remaining unpaid for thirty (30) days after the

original due date shall be subject to a ten (10%) percent penalty or twenty-five ($25.00) dollars, whichever

shall be greater.

4. The City of Bowling Green Employee Withholding Taxes must be reported separate from the Warren County

Occupational Tax. The Warren County Tax office can be reached by phoning (270) 842-7168.

5. The employer must submit a reconciliation of gross wages and taxes filed with the City on or before the last

day of February of each year.

Payment should be made payable to: TREASURER, CITY OF BOWLING GREEN, KY, City Hall

Annex, 1017 College Street, P. O. Box 1410, Bowling Green, KY 42102-1410. Our telephone number is

(270) 393-3000. Our office hours are 7:30 a.m. to 4:30 p.m., Monday through Friday.

1

1