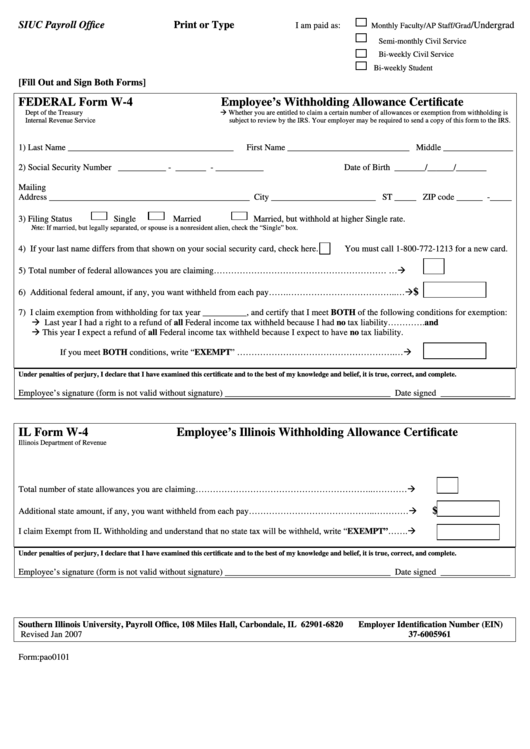

SIUC Payroll Office

Print or Type

/Undergrad

I am paid as:

Monthly Faculty/AP Staff/Grad

Semi-monthly Civil Service

Bi-weekly Civil Service

Bi-weekly Student

[Fill Out and Sign Both Forms]

FEDERAL Form W-4

Employee’s Withholding Allowance Certificate

Dept of the Treasury

Whether you are entitled to claim a certain number of allowances or exemption from withholding is

Internal Revenue Service

subject to review by the IRS. Your employer may be required to send a copy of this form to the IRS.

1) Last Name ______________________________________

First Name ____________________________ Middle ________________

2) Social Security Number ___________ - _______ - ___________

Date of Birth _______/______/_______

Mailing

Address ______________________________________________ City ________________________ ST _____ ZIP code ______ -_____

3) Filing Status

Single

Married

Married, but withhold at higher Single rate.

Note: If married, but legally separated, or spouse is a nonresident alien, check the “Single” box.

4) If your last name differs from that shown on your social security card, check here.

You must call 1-800-772-1213 for a new card.

5) Total number of federal allowances you are claiming……………………………………………………....…

$

6) Additional federal amount, if any, you want withheld from each pay…….………………………………..…

7) I claim exemption from withholding for tax year __________, and certify that I meet BOTH of the following conditions for exemption:

Last year I had a right to a refund of all Federal income tax withheld because I had no tax liability………….and

This year I expect a refund of all Federal income tax withheld because I expect to have no tax liability.

If you meet BOTH conditions, write “EXEMPT” ……………………………………………….…

Under penalties of perjury, I declare that I have examined this certificate and to the best of my knowledge and belief, it is true, correct, and complete.

Employee’s signature (form is not valid without signature) ______________________________________ Date signed ________________

IL Form W-4

Employee’s Illinois Withholding Allowance Certificate

Illinois Department of Revenue

Total number of state allowances you are claiming……………………………………………………..…………

$

Additional state amount, if any, you want withheld from each pay……………………………………..…………

I claim Exempt from IL Withholding and understand that no state tax will be withheld, write “EXEMPT”…….

Under penalties of perjury, I declare that I have examined this certificate and to the best of my knowledge and belief, it is true, correct, and complete.

Employee’s signature (form is not valid without signature) ______________________________________ Date signed ________________

Southern Illinois University, Payroll Office, 108 Miles Hall, Carbondale, IL 62901-6820

Employer Identification Number (EIN)

Revised Jan 2007

37-6005961

Form:pao0101

1

1