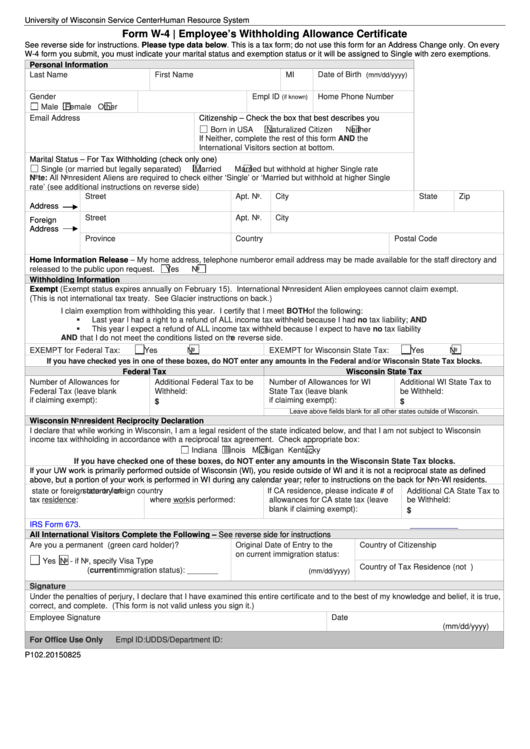

University of Wisconsin Service Center

Human Resource System

Form W-4 | Employee’s Withholding Allowance Certificate

See reverse side for instructions. Please type data below. This is a tax form; do not use this form for an Address Change only. On every

W-4 form you submit, you must indicate your marital status and exemption status or it will be assigned to Single with zero exemptions.

Personal Information

Last Name

First Name

MI

Date of Birth

(mm/dd/yyyy)

Gender

U.S. Social Security Number

Empl ID

Home Phone Number

(if known)

Male

Female

Other

Email Address

Citizenship – Check the box that best describes you

Born in USA

Naturalized Citizen

Neither

If Neither, complete the rest of this form AND the

International Visitors section at bottom.

Marital Status – For Tax Withholding (check only one)

Single (or married but legally separated)

Married

Married but withhold at higher Single rate

Note: All Nonresident Aliens are required to check either ‘Single’ or ‘Married but withhold at higher Single

rate’ (see additional instructions on reverse side)

Street

Apt. No.

City

State

Zip

U.S.

Address

Street

Apt. No.

City

Foreign

Address

Province

Country

Postal Code

Home Information Release

– My home address, telephone number or email address may be made available for the staff directory and

released to the public upon request.

Yes

No

Withholding Information

Exempt

(Exempt status expires annually on February 15). International Nonresident Alien employees cannot claim exempt.

(This is not international tax treaty. See Glacier instructions on back.)

I claim exemption from withholding this year. I certify that I meet BOTH of the following:

Last year I had a right to a refund of ALL income tax withheld because I had no tax liability; AND

This year I expect a refund of ALL income tax withheld because I expect to have no tax liability

AND that I do not meet the conditions listed on the reverse side.

EXEMPT for Federal Tax:

Yes

No

EXEMPT for Wisconsin State Tax:

Yes

No

If you have checked yes in one of these boxes, do NOT enter any amounts in the Federal and/or Wisconsin State Tax blocks.

Federal Tax

Wisconsin State Tax

Number of Allowances for

Additional Federal Tax to be

Number of Allowances for WI

Additional WI State Tax to

Federal Tax (leave blank

Withheld:

State Tax (leave blank

be Withheld:

if claiming exempt):

if claiming exempt):

$

$

Leave above fields blank for all other states outside of Wisconsin.

Wisconsin Nonresident Reciprocity Declaration

I declare that while working in Wisconsin, I am a legal resident of the state indicated below, and that I am not subject to Wisconsin

income tax withholding in accordance with a reciprocal tax agreement. Check appropriate box:

Indiana

Illinois

Michigan

Kentucky

If you have checked one of these boxes, do NOT enter any amounts in the Wisconsin State Tax blocks.

If your UW work is primarily performed outside of Wisconsin (WI), you reside outside of WI and it is not a reciprocal state as defined

above, but a portion of your work is performed in WI during any calendar year; refer to instructions on the back for Non-WI residents.

U.S. state or foreign country of

U.S. state or foreign country

If CA residence, please indicate # of

Additional CA State Tax to

tax residence:

where work is performed:

allowances for CA state tax (leave

be Withheld:

blank if claiming exempt):

$

U.S. Citizens working outside of the U.S. may qualify for exemption from state and federal income tax by filing

IRS Form

673.

All International Visitors Complete the Following – See reverse side for instructions

Are you a permanent U.S. resident (green card holder)?

Original Date of Entry to the U.S.

Country of Citizenship

on current immigration status:

Yes

No - if No, specify Visa Type

Country of Tax Residence (not U.S.)

(current immigration status): _______

(mm/dd/yyyy)

Signature

Under the penalties of perjury, I declare that I have examined this entire certificate and to the best of my knowledge and belief, it is true,

correct, and complete. (This form is not valid unless you sign it.)

Employee Signature

Date

(mm/dd/yyyy)

For Office Use Only

Empl ID:

UDDS/Department ID:

P102.20150825

1

1 2

2