Refund Request Form Page 2

Download a blank fillable Refund Request Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Refund Request Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

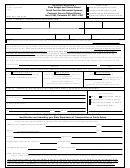

REFUND REQUEST FORM

Tax Year __________________

City/Village _______________________

DEPARTMENT OF TAXATION

A SEPARATE FORM

106 E. SPRING STREET

MUST BE FILED FOR

ST. MARYS, OHIO 45885

EACH EMPLOYER AND

419-394-3303, ext. 107

FOR EACH YEAR.

PART A: (To be completed by Taxpayer)

NAME OF APPLICANT_____________________________

SOCIAL SECURITY NO.___________________

CURRENT ADDRESS_________________________________________________________________________

STREET ADDRESS DURING CLAIM PERIOD____________________________________________________

Beginning and ending dates of residency at above address:

From:__________________

To:_____________________

:______________

NAME OF CITY OF WHERE YOU ACTUALLY PERFORMED SERVICES FOR YOUR EMPLOYER

EMPLOYER'S NAME____________________

EMPLOYER'S MAILING ADDRESS_____________________

COMPUTATION OF AMOUNT CLAIMED:

A)

Total gross wages as reported on W-2 (W-2 must be attached)

$

B)

Subtract nontaxable wages (From Line B computation above)

( $

)

C)

Total taxable income (Line A minus Line B)

$

D)

Tax due, Line C multiplied by _____% (See tax rates above)

$

E)

Subtract tax withheld as shown on attached W-2

( $

)

F)

Amount of refund claimed

$

EXPLANATION OF REFUND:__________________________________________________________________

________________________________________________________________________________________

________________________________________________________________________________________

I AUTHORIZE THE DEPARTMENT OF TAXATION TO FURNISH THE TAX DEPARTMENT FOR MY CITY OF

RESIDENCE OR EMPLOYMENT, A COPY OF THIS REFUND REQUEST. THE UNDERSIGNED DECLARES THAT ALL

INFORMATION GIVEN IS TRUE AND COMPLETE TO THE BEST OF HIS/HER KNOWLEDGE AND BELIEF, AND THAT A

REFUND HAS NOT BEEN CLAIMED OR RECEIVED BY HIM/HER FOR THE PERIOD COVERED BY THIS CLAIM.

Signed_________________________________

D

ate______________________

PART B: CERTIFICATION OF EMPLOYER: (Must be completed by employer only)

I verify that during the tax year ______, my company withheld $____________ City tax in excess of his/her liability. The statements

made above and any log attached has been reviewed by myself and found to be in keeping with my company's records. I also verify

that no portion of said tax has been or will be refunded directly to the employee from my company and that no adjustments have been

or will be made to my company's city tax withholding account for said tax.

Signed____________________________

Title______________________________

Date____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2