Form Eft-1 - Authorization Agreement For Electronic Funds Transfer - 2000

ADVERTISEMENT

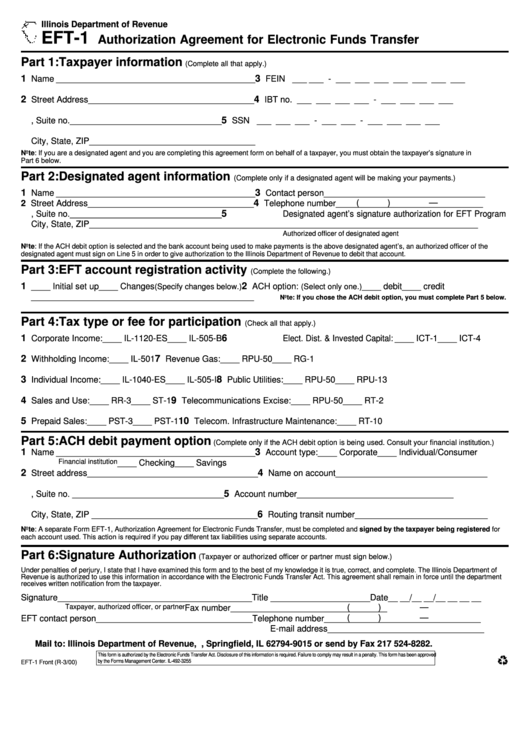

Illinois Department of Revenue

EFT-1

Authorization Agreement for Electronic Funds Transfer

Part 1: Taxpayer information

(Complete all that apply.)

1

3

Name __________________________________________

FEIN ___ ___ - ___ ___ ___ ___ ___ ___ ___

2

4

Street Address ___________________________________

IBT no. ___ ___ ___ ___ - ___ ___ ___ ___

5

P.O. Box, Suite no.________________________________

SSN ___ ___ ___ - ___ ___ - ___ ___ ___ ___

City, State, ZIP___________________________________

Note: If you are a designated agent and you are completing this agreement form on behalf of a taxpayer, you must obtain the taxpayer’s signature in

Part 6 below.

Part 2: Designated agent information

(Complete only if a designated agent will be making your payments.)

1

3

Name __________________________________________

Contact person __________________________________

4

(

)

—

2 Street Address ___________________________________

Telephone number _______________________________

5

P.O. Box, Suite no.________________________________

Designated agent’s signature authorization for EFT Program

City, State, ZIP___________________________________

_______________________________________________

Authorized officer of designated agent

Note: If the ACH debit option is selected and the bank account being used to make payments is the above designated agent’s, an authorized officer of the

designated agent must sign on Line 5 in order to give authorization to the Illinois Department of Revenue to debit that account.

Part 3: EFT account registration activity

(Complete the following.)

1

2

____ Initial set up

____ Changes

ACH option:

____ debit

____ credit

(Specify changes below.)

(Select only one.)

_______________________________________________

Note: If you chose the ACH debit option, you must complete Part 5 below.

Part 4: Tax type or fee for participation

(Check all that apply.)

1

6

Corporate Income:

____ IL-1120-ES

____ IL-505-B

Elect. Dist. & Invested Capital: ____ ICT-1

____ ICT-4

2

7

Withholding Income: ____ IL-501

Revenue Gas:

____ RPU-50 ____ RG-1

3

8

Individual Income:

____ IL-1040-ES

____ IL-505-I

Public Utilities:

____ RPU-50 ____ RPU-13

4

9

Sales and Use:

____ RR-3

____ ST-1

Telecommunications Excise: ____ RPU-50 ____ RT-2

5

10

Prepaid Sales:

____ PST-3

____ PST-1

Telecom. Infrastructure Maintenance:

____ RT-10

Part 5: ACH debit payment option

(Complete only if the ACH debit option is being used. Consult your financial institution.)

1

3

Name __________________________________________

Account type: ____ Corporate ____ Individual/Consumer

Financial institution

____ Checking ____ Savings

2

4

Street address____________________________________

Name on account________________________________

5

P.O. Box, Suite no. ________________________________

Account number_________________________________

6

City, State, ZIP ___________________________________

Routing transit number____________________________

Note: A separate Form EFT-1, Authorization Agreement for Electronic Funds Transfer, must be completed and signed by the taxpayer being registered for

each account used. This action is required if you pay different tax liabilities using separate accounts.

Part 6: Signature Authorization

(Taxpayer or authorized officer or partner must sign below.)

Under penalties of perjury, I state that I have examined this form and to the best of my knowledge it is true, correct, and complete. The Illinois Department of

Revenue is authorized to use this information in accordance with the Electronic Funds Transfer Act. This agreement shall remain in force until the department

receives written notification from the taxpayer.

Signature _________________________________________

Title _____________________ Date__ __/__ __/__ __ __ __

(

)

—

Taxpayer, authorized officer, or partner

Fax number

_________________________________

(

)

—

EFT contact person _________________________________

Telephone number _________________________________

E-mail address

_________________________________

Mail to: Illinois Department of Revenue, P.O. Box 19015, Springfield, IL 62794-9015 or send by Fax 217 524-8282.

This form is authorized by the Electronic Funds Transfer Act. Disclosure of this information is required. Failure to comply may result in a penalty. This form has been approved

by the Forms Management Center.

IL-492-3255

EFT-1 Front (R-3/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1